THE BIGGEST 2 WEEKS OF THE ENTIRE YEAR

Summary

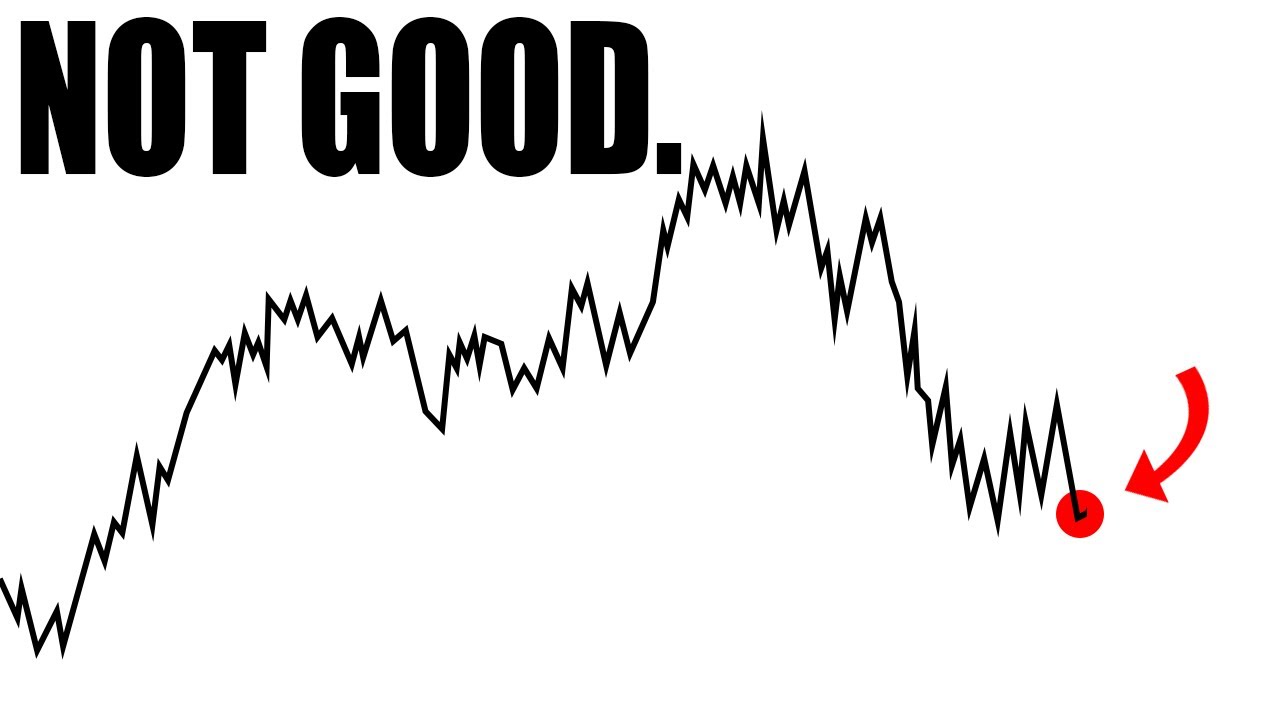

TLDRIn this stock market analysis, Tom from Stocked Up discusses the mixed performance of the S&P 500, noting the downturn of major tech stocks like Google, Meta, Microsoft, Apple, and Nvidia despite some sectors showing gains. He highlights July's historical strength in the market, especially the first half, and shares key levels to watch for the S&P 500 index, including the resistance at 550. Tom also covers specific stocks like Chewy, Tesla, and Nvidia, and discusses the potential impact of election-year dynamics on the market. He wraps up with big money plays and upcoming economic events, including Jerome Powell's speech.

Takeaways

- 📈 On Friday, 54% of the S&P 500 stocks were in the green, but big tech stocks like Google, Meta, Microsoft, Apple, and Nvidia were in the red.

- 🔍 There was a significant presence of gray on the heat map, indicating stability or minor changes across various sectors, with oil, bank, and financial stocks performing well.

- 📉 The S&P 500 ETF (SPY) closed down 0.39% on Friday, despite some sectors showing gains.

- 🌟 Historical data suggests that July is the best month for the stock market over the past 20 years, especially the first half of the month.

- 📊 SPY showed a double top pattern around the key resistance level of 550, which will be crucial to watch in the coming week.

- 📈 The first two weeks of July have been the best two weeks for the stock market since 1950, based on historical data.

- 📉 Concerns are raised as tech stocks like Nvidia are starting to fall, with a potential rough start to July if the downturn continues.

- 📊 Nvidia's daily chart shows recovery during the week followed by a downturn on Friday, with key support levels around $118-$120 to watch.

- 📈 The script also highlights the performance of other tech stocks like Apple and Microsoft, which were doing well until the Friday selloff.

- 🔑 The importance of watching the upcoming week for potential market movements, especially considering the historical strength of July.

- 🎯 The video also discusses specific stocks to watch, like Chewy (CHW), which had significant price movement due to recent news and events.

Q & A

What percentage of the S&P 500 was in the green on the mentioned Friday?

-On the mentioned Friday, 54% of the S&P 500 was in the green.

Which big tech stocks were mentioned to be deep in the red?

-The big tech stocks mentioned to be deep in the red were Google, Meta, Microsoft, Apple, and Nvidia.

What was the overall performance of the SPY on Friday?

-The SPY closed down in the red, with a decrease of 0.39% on Friday.

What is historically the best month for the stock market in the past 20 years?

-Historically, July is the best month for the stock market in the past 20 years.

What is special about the first half of July in terms of stock market performance since 1950?

-The first half of July is historically the best two weeks in the stock market since 1950.

What is the key resistance level for the SPY that is being watched?

-The key resistance level for the SPY being watched is 550.

What is the major support level for Nvidia that should be watched?

-The major support level for Nvidia to watch is around 122 to 123.

What is the significance of the $200 mark for Tesla stock?

-The $200 mark for Tesla stock is significant as it acts as a psychological level and is a key resistance level to watch.

What is the ticker symbol for the big money play mentioned in the script?

-The ticker symbol for the big money play mentioned is PTEEN (Patterson UTI Energy).

What is the significance of the $10 level for PTEEN stock?

-The $10 level for PTEEN stock is significant as it is a key support level and a psychological level, similar to how $200 is for Tesla.

What are some of the key events and economic indicators to watch for in the upcoming week according to the script?

-Some key events and economic indicators to watch for include ISM Manufacturing PMI, JOLTS job openings, ISM Services PMI, FOMC minutes, non-farm payrolls, and unemployment rate. Additionally, Jerome Powell's speech at the European Central Bank Forum is also significant.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

This Week Will Be HISTORIC For The Stock Market

How a Chinese AI Disrupted America’s Tech Titans Overnight| Vantage with Palki Sharma | N18G

WARNING: Brace for a Flood of Stock Market Crash Videos

Japón templa gaitas Crónica de cierre 7 8 2024 bolsas, economía y mercados

Stock Market Index | by Wall Street Survivor

Did the Stock Market Crash Just get STARTED? Know This First

5.0 / 5 (0 votes)