Time Value of Money in Islam & Shariah Concepts, Rules & Examples | AIMS Education

Summary

TLDRThis video explains key principles of Islamic finance, focusing on the time value of money, paper money, and the rules governing loans, debts, and currency exchange according to Sharia law. It highlights the prohibition of interest (Riba) and emphasizes that debts must be settled in the same currency as originally agreed, without fluctuation due to market changes. It also explores how Islamic banks operate on a partnership basis rather than as creditors, with a focus on fairness, equity, and the responsible use of money. Key rules for transactions involving gold, silver, and foreign currencies are also outlined.

Takeaways

- 📉 In Islamic finance, once a sale price is mutually agreed, any increase due to delayed payment is prohibited because it is considered riba (interest).

- 💱 The time value of money is recognized only in asset pricing (e.g., Murabaha or Salam) but not in loans or debts, where any increase is forbidden.

- 🕌 Loans and debts must always be repaid in the same currency and quantity, regardless of changes in purchasing power or currency value.

- 💵 Paper money is treated as real money under Sharia, possessing the same rules as gold and silver for exchange and valuation.

- 🔁 Money is not viewed as a tradable commodity in Sharia; its primary role is as a medium of exchange, not a profit-generating asset.

- 🤝 Islamic banking operates on partnership or investment principles (e.g., Mudaraba, Musharaka) rather than creditor–debtor relationships.

- 🏦 In Islamic finance, money creation is tied to real assets—banks generate money through asset-based transactions rather than interest-based lending.

- 🔄 A fixed debt must be repaid in its original currency, and linking debt obligations to currency fluctuations is not allowed.

- 💶 Currency exchanges must follow Sharia rules: same-currency exchange requires equality and immediate delivery, while different currencies require only immediate delivery.

- ⏳ Deferred sales of currencies are not permitted; currency exchange must be executed on the spot without a future settlement date.

- 🏛️ The OIC Fiqh Academy allows converting a debt into another currency only on the settlement day using the prevailing exchange rate.

- 📊 Bank transfers involving different currencies must follow proper exchange contracts, and delays are acceptable only within normal processing times.

Q & A

What is the Islamic perspective on the time value of money?

-In Islamic finance, the time value of money is acceptable when pricing assets, as long as it does not involve riba (interest). Any increase in the price of a commodity due to deferred payment is seen as a valid sale if it follows Sharia rules, such as in murabaha (cost-plus financing).

Why is adding to the price of a commodity due to delay prohibited in Islamic finance?

-Once a sale is agreed upon, the price of the commodity cannot be altered due to delay because the commodity, once sold, belongs to the purchaser. The seller cannot increase the price, as doing so would be considered riba (interest), which is prohibited in Islamic finance.

What is the difference between murabaha and salam in Islamic finance?

-Murabaha is a sale where the price is agreed upon, and deferred payment may be allowed, but the price cannot increase due to delay. Salam, on the other hand, is a forward contract where payment is made in advance for future delivery of goods, usually at a price lower than the immediate cash-and-carry price.

How does Islamic finance view the use of paper money?

-Paper money in Islamic finance is considered a medium of exchange, not actual capital. It must be used for productive activities and adhere to Sharia rules, especially those governing gold and silver. It represents a value but is not treated as capital unless invested in productive use.

What is the rule regarding currency exchange in Islamic finance?

-Currency exchange in Islamic finance must occur in equal amounts at the time of the transaction. If there is a deferred exchange, the exchange rate must be agreed upon at the settlement time, ensuring there are no outstanding amounts after the exchange.

Can a debtor pay a debt in a currency other than the one originally agreed upon?

-Yes, but only if the debtor and creditor agree at the time of settlement, and the exchange rate applied is the one applicable on that specific settlement date. The transaction must follow Sharia rules, and no part of the amount should remain outstanding.

How does Islamic law treat the creation of money?

-The creation of money in Islamic finance is linked to the mobilization of resources through partnerships or investment (mudaba or sherka system). Islamic banks engage with clients as partners, investors, or traders, not creditors, and money supply is tied to asset creation rather than extending credit to borrowers.

Is it permissible in Islamic finance to sell gold for gold with a deferred delivery?

-No, according to Islamic rules, if gold is exchanged for gold, the delivery must be simultaneous. If gold is sold for silver or vice versa, there is no requirement for equality in the bargain, but delivery must still occur at the time of the transaction.

What does the OIC Fiqh Academy say about fixed debts and currency fluctuation?

-The OIC Fiqh Academy has ruled that fixed debts must be repaid in the same currency and should not be subject to currency fluctuations. If the currency becomes extinct or unavailable, its counter value should be used, but the debt amount remains the same as agreed.

How are debts settled in Islamic finance when involving multiple currencies?

-Debtors and creditors may agree to settle debts in different currencies, but only at the time of settlement. The exchange rate applied must be the prevailing one on the settlement date, and the agreed debt amount should be fully settled, with no outstanding balance.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

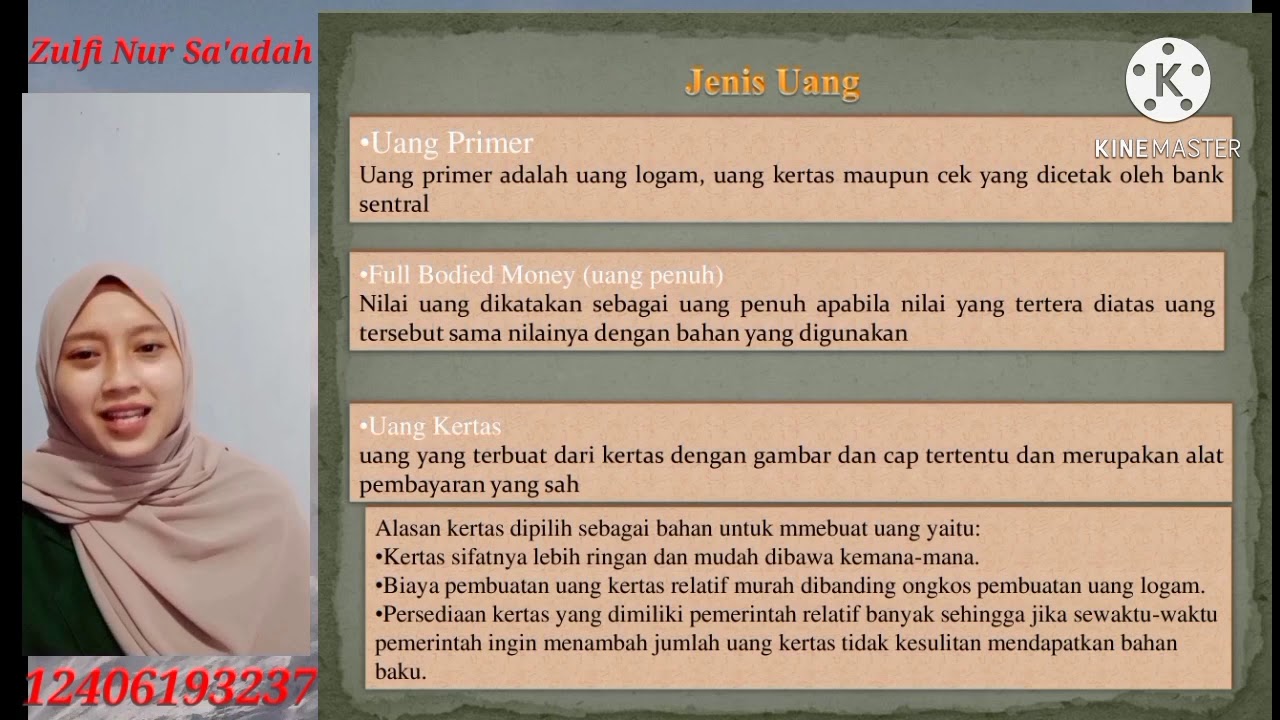

KONSEP UANG DALAM PERSPEKTIF ISLAM || TUGAS UTS || MANAJEMEN KEUANGAN SYARIAH 3F || IAIN TULUNGAGUNG

Hukum tukar uang dengan uang | ustadz ammi nur baits @kajianfiqihsalafiyah9203

Pengertian, Sejarah, Fungsi, dan Jenis Uang

Materi PAI 8: Menjadi Pribadi yang Dapat Dipercaya serta Terhindar dari Riba dalam Jual Beli @Part 1

History of Philippine Currency and Monetary Standards | Business Finance

How to have infinite money (in less than 10 minutes)

5.0 / 5 (0 votes)