Hukum tukar uang dengan uang | ustadz ammi nur baits @kajianfiqihsalafiyah9203

Summary

TLDRThe script discusses the Islamic principles of exchanging money, focusing on the prohibition of riba (usury) in transactions involving currency exchange. It emphasizes that for an exchange to be valid, it must be conducted hand-to-hand (tunic) and without any discrepancy in quantity or nominal value. If the money being exchanged is of the same kind (e.g., IDR to IDR), both quantity and value must match. Differences in currency types, such as IDR and USD, are permissible as long as the exchange occurs immediately and at the current rates, ensuring no riba is involved.

Takeaways

- 😀 The Prophet Muhammad (PBUH) emphasized that exchanging gold for gold involves riba (interest) unless done hand-to-hand without any delay or difference in quantity.

- 😀 The concept of riba applies when exchanging money for money if the transaction involves a difference in quantity or is not immediate.

- 😀 Currency exchange must be conducted on a spot or cash basis for it to be halal (permissible in Islam).

- 😀 When exchanging the same currency (e.g., IDR for IDR or Rupiah for Rupiah), the transaction must involve identical amounts and be conducted in cash.

- 😀 If there is a difference in quantity between the exchanged currencies, it falls under riba fadhl (difference in value), which is prohibited.

- 😀 If the exchange is not immediate (i.e., there is a delay in the transaction), it falls under riba nasi'ah (delayed exchange), which is also prohibited.

- 😀 If the currencies are different (e.g., exchanging IDR for USD or IDR for Riyal), the exchange is permissible if done immediately, despite the difference in quantity or value.

- 😀 An example of permissible exchange is swapping $1 for IDR 14,000, as long as it is done hand-to-hand and immediately.

- 😀 The main principle of Islamic currency exchange is that it should be done instantly and with equivalent quantities to avoid riba.

- 😀 The transaction's validity is primarily determined by whether it is conducted immediately and with equivalent amounts, regardless of the currency type.

Q & A

What is the main topic discussed in the transcript?

-The transcript discusses the concept of exchanging money and the Islamic perspective on it, focusing on the conditions for transactions such as the prohibition of riba (usury), the requirement for cash transactions, and the rules for exchanging currencies or money of the same type.

What does 'riba' refer to in the context of this transcript?

-'Riba' refers to usury or interest, which is prohibited in Islamic finance. In the context of the transcript, it specifically addresses the exchange of money and the conditions under which riba occurs.

What are the main conditions for exchanging money according to the transcript?

-The main conditions for exchanging money are that the exchange must be 'tuna' (immediate), and if the money is of the same type (e.g., IDR with IDR), the amounts must be the same in quantity and nominal value to avoid riba.

What happens if the quantities or nominal values differ in a money exchange?

-If the quantities or nominal values differ in a money exchange, it becomes riba fadhl (the excess exchange of the same kind) or riba nasi'ah (the delay in the exchange), both of which are prohibited in Islam.

Can money be exchanged if the currencies are different? If so, what is the requirement?

-Yes, money can be exchanged if the currencies are different (e.g., IDR to USD or IDR to SAR), but the requirement is that the exchange must be 'tuna' (immediate), and the transaction should be conducted without a delay.

What is the significance of 'tuna' in money exchanges?

-'Tuna' refers to an immediate exchange, meaning both parties must complete the transaction without delay. This condition is crucial to prevent riba nasi'ah, which is riba caused by deferred transactions.

What is the rule when exchanging money of the same type, such as IDR with IDR?

-When exchanging money of the same type, such as IDR with IDR, the transaction must meet the following conditions: the quantities must be the same, the nominal values must match, and the exchange must occur immediately (tuna).

What does the term 'riba nasi'ah' mean?

-'Riba nasi'ah' refers to usury that results from delaying or deferring a financial transaction. This is prohibited in Islam as it involves a delay in payment or exchange.

Is it permissible to exchange different amounts of money, like exchanging $1 for IDR 14,000?

-Yes, it is permissible to exchange different amounts of money, such as exchanging $1 for IDR 14,000, as long as the exchange is conducted immediately and there is no delay in the transaction.

What is the general ruling on exchanging currencies like IDR and USD?

-The general ruling on exchanging currencies such as IDR and USD is that it is allowed as long as the exchange is 'tuna' (immediate), even if the nominal values or quantities are different. The primary concern is that there should be no delay in the transaction.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Time Value of Money in Islam & Shariah Concepts, Rules & Examples | AIMS Education

Belajar Syariah bersama Muamalat: Apa itu Riba?

Media Pembelajaran PAI Kelas 8 Bab 9 Tema Praktek Jual Beli dan Utang Piutang serta Menghindari Riba

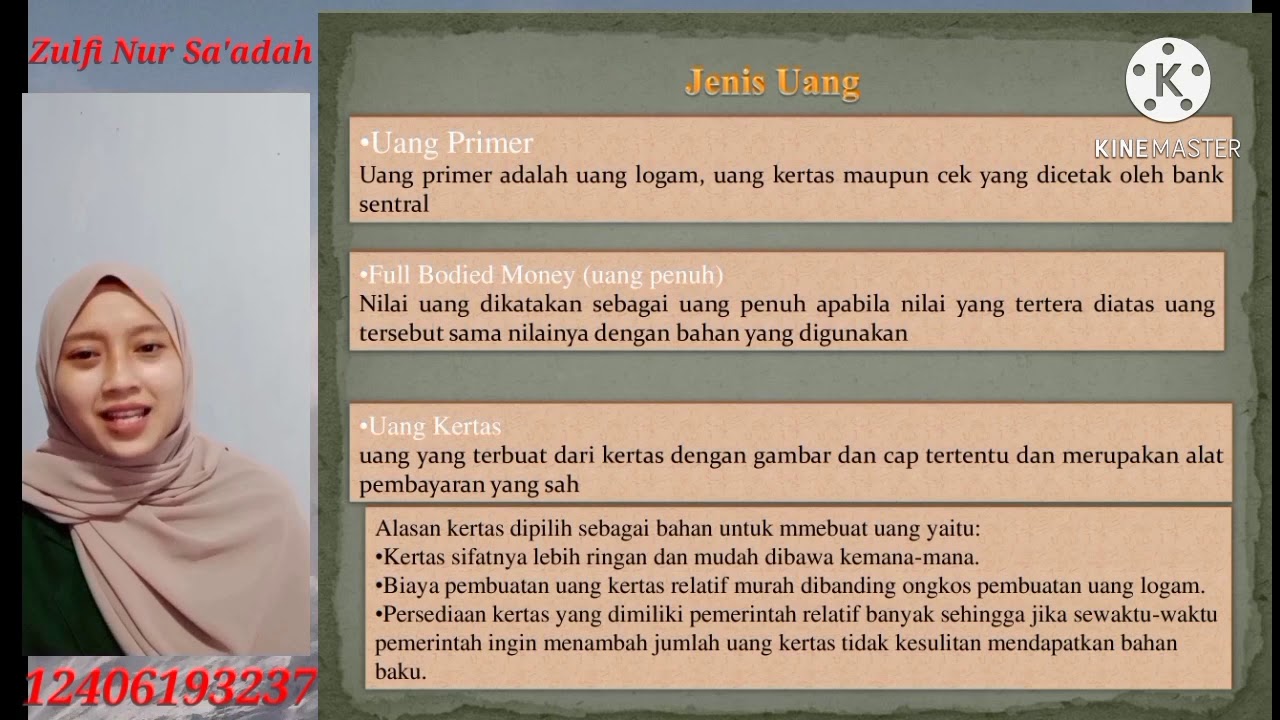

KONSEP UANG DALAM PERSPEKTIF ISLAM || TUGAS UTS || MANAJEMEN KEUANGAN SYARIAH 3F || IAIN TULUNGAGUNG

THE MAIN PROHIBITION In Islamic Economic - Islamic Economic Couse By Mr.Ahmad Syaiful Affa

Fikih kelas 9 Tentang Riba

5.0 / 5 (0 votes)