We Are Entering a Recession Unemployment, Jobs, JOLTS, CEO Report 06 Sep Economic Update

Summary

TLDRThis U.S. economic update for September 6, 2025, explains why the economy and stock market often diverge, highlighting layoffs boosting corporate profits despite rising unemployment. August jobs data showed weak growth, unemployment ticked up to 4.3%, and labor market indicators suggest a potential slowdown. Housing shows unusual trends, with new homes costing less than existing ones and rising delinquencies, while inflation remains slightly above target. GDP shows mixed growth across sectors. The Fed may cut rates soon, and a recession could begin in late 2025. Practical advice includes maintaining an emergency fund, cautious investing, and staying prepared without panic.

Takeaways

- 😀 The economy is not the same as the stock market. Stock prices can rise even if the economy is struggling, as companies can reduce costs (e.g., layoffs) and increase profits.

- 😀 Recent job data shows concerning trends. August 2025 added only 22,000 jobs, far below the 80,000 needed to maintain stable unemployment.

- 😀 The U.S. unemployment rate rose to 4.3% in September 2025, which is higher than the range of 4.0-4.2% seen since May 2024.

- 😀 There are 7.4 million unemployed people competing for 7.2 million open jobs, indicating a lack of job opportunities for every unemployed person.

- 😀 CEO surveys show that 34% of CEOs plan to reduce their workforce, a 6% increase from the second quarter, signaling growing uncertainty in the labor market.

- 😀 Economic indicators point to a potential recession. Leading indicators have been negative for the last 4 months, and coincident indicators are starting to level off.

- 😀 Housing market struggles: New homes now cost less than existing homes, with 9.2 months of inventory for new homes versus 4.6 months for existing ones.

- 😀 15% of homebuyers are cancelling their purchases, and regional housing markets are reacting differently, with the South and West seeing price declines, while the Northeast and Midwest are stable or slightly rising.

- 😀 Rising delinquencies are a concern, with a 10-20% overall increase across credit tiers. However, compared to 2008, people today are in a better financial position.

- 😀 Inflation remains a concern, with core inflation (excluding food and energy) at 2.9%. The Federal Reserve is expected to reduce interest rates by 0.25-0.50% in September 2025 to support the economy.

- 😀 Predictions for a potential recession in Q4 2025: Economic contraction in the first quarter, recovery in Q2, and a possible slowdown leading to a recession in the fourth quarter.

Q & A

How does the economy differ from the stock market?

-The economy is a broad system involving all economic activities, while the stock market is a financial platform where companies' stocks are bought and sold. A company could lay off workers to reduce costs and increase profits, which could lead to higher stock prices, even while the broader economy may be suffering with higher unemployment rates.

Why do stock prices go up even when a company lays off employees?

-When a company reduces its workforce, it lowers operational costs, which could increase its profit margins. Even though layoffs negatively affect the economy and the employees, lower costs can boost profits, making the company's stock more attractive to investors, causing stock prices to rise.

What is the relationship between job growth and the unemployment rate?

-To maintain a stable unemployment rate, the U.S. economy needs to add around 80,000 jobs per month. In August 2025, only 22,000 jobs were added, which is far below the required threshold, resulting in an uptick in the unemployment rate.

What does the JOLTS report indicate about the job market?

-The JOLTS report revealed that there are 7.2 million job openings, but only 7.4 million unemployed people actively seeking jobs. This suggests that the job market is struggling to match the number of job seekers with available opportunities.

What does an increase in layoffs indicate about the economy?

-An increase in layoffs, as noted in a CEO survey showing 34% of CEOs plan to reduce their workforce, signals that companies are anticipating economic uncertainty. While layoffs are higher than in the previous year, many businesses are still holding onto their employees due to past challenges in recruitment.

What are leading and coincident economic indicators, and how do they predict a recession?

-Leading economic indicators, such as manufacturing orders and housing permits, signal future economic trends, often predicting a recession before it occurs. Coincident indicators, like unemployment rates, show the current state of the economy. As leading indicators turn negative, it’s a sign a recession could be approaching.

Why is the housing market showing signs of distress?

-The housing market is facing issues like declining prices for new homes, an increase in homebuyer cancellations, and a drop in housing permits. Builders are reluctant to start new projects due to oversupply and unsold homes. Additionally, high-interest rates make housing more expensive, and many homeowners are holding off on selling.

What is happening with credit delinquencies, and why is it a concern?

-Credit delinquencies have increased across all credit tiers, with a notable rise in car loans and home loans. This is a concern because it signals that people may be struggling to meet their financial obligations. While these numbers are small, they represent a growing issue that could spread further if the economy worsens.

How do tariffs affect inflation and the economy?

-Tariffs on goods can drive up prices, leading to inflation. The removal of tariffs could ease inflationary pressure, as it would reduce costs for businesses importing goods. However, other factors like government spending and monetary policy may still drive inflation.

What is the expected outcome of the Fed's FOMC meeting in September 2025?

-The Federal Reserve is expected to reduce interest rates by about 0.25% to 0.50% to help stimulate the economy. This is in response to declining jobs data and potential easing of tariffs, which would reduce inflationary pressures while also supporting job growth.

How is the potential recession expected to affect job losses?

-During a recession, job losses are typically higher, but over 90% of people usually keep their jobs. Even during the severe recession of 2020, 85% of job seekers were still employed. Recessions generally last about 10 months, and while economic downturns are stressful, the majority of workers maintain their positions.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Embedded Linux | Introduction To U-Boot | Beginners

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

Complements of Sets

TIMNAS INDONESIA U17 KALAH SEGALANYA DARI KORUT DAN TERSINGKIR DARI PIALA ASIA!

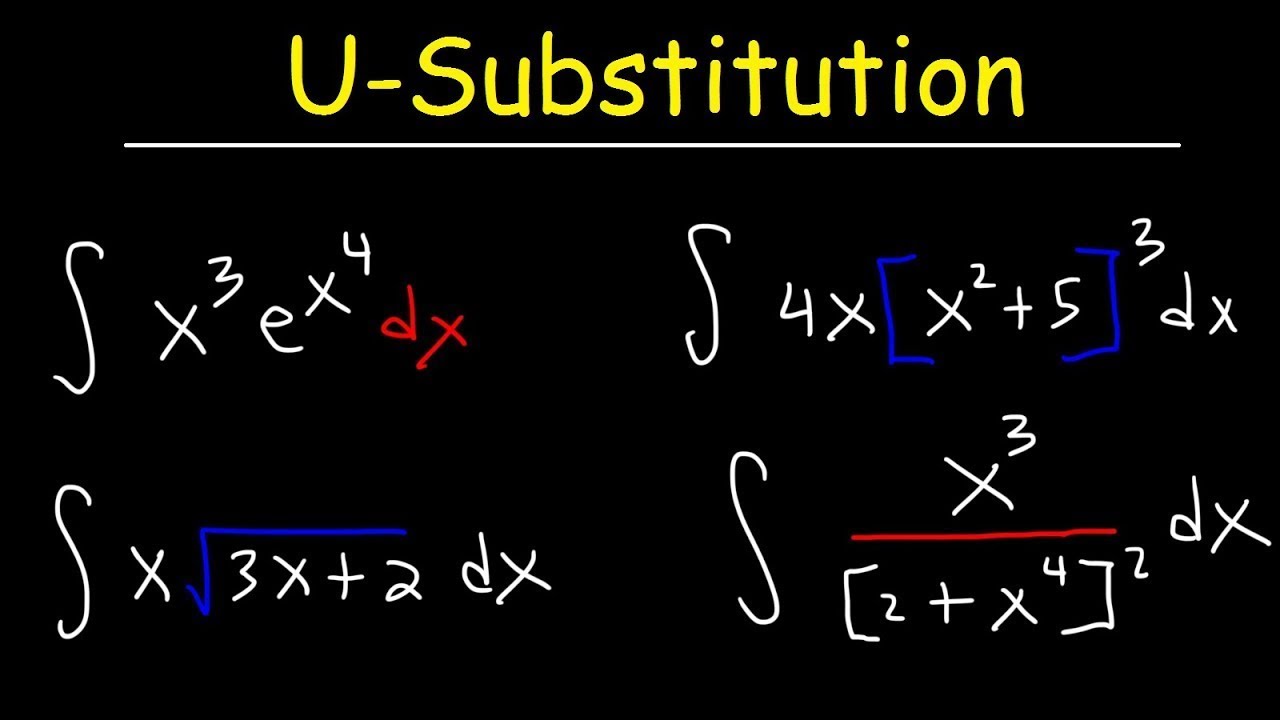

How To Integrate Using U-Substitution

5.0 / 5 (0 votes)