STDV + SMT Theory

Summary

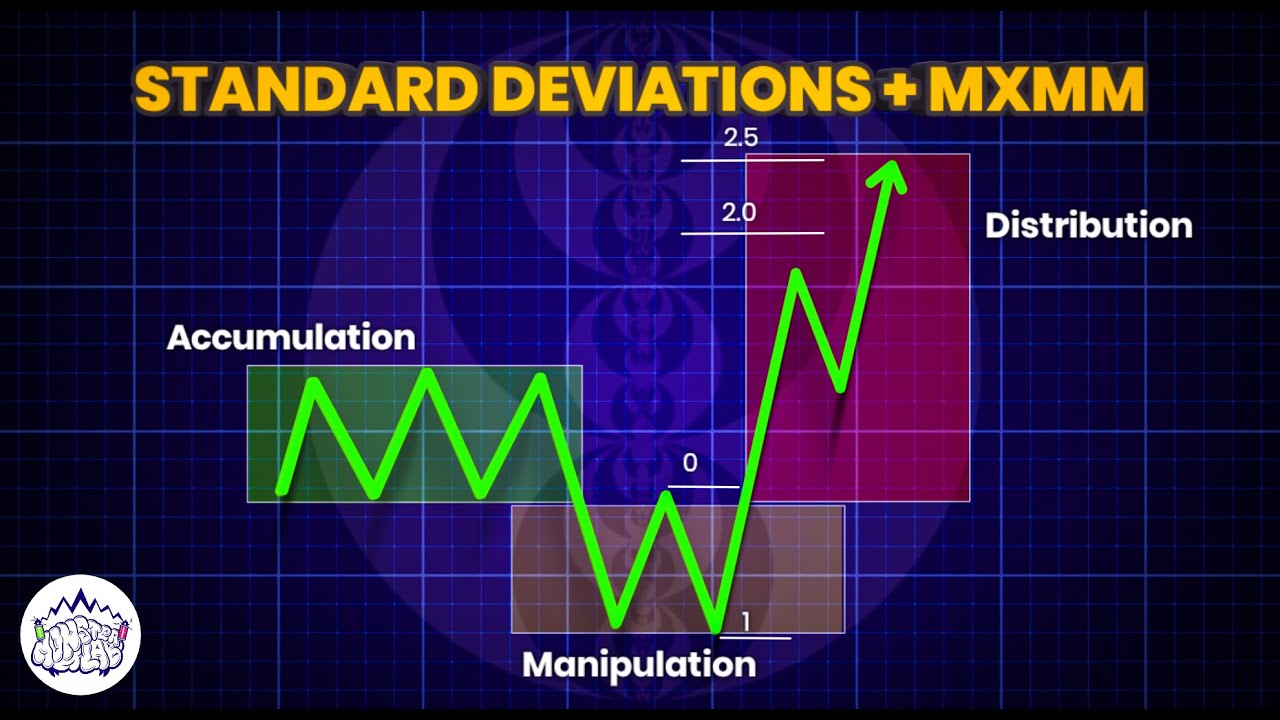

TLDRThis video explains how to effectively use market maker models, focusing on the manipulation of price, standard deviations, and key levels like the 4-hour open. The speaker outlines strategies for identifying explosive moves and distribution in price, stressing the algorithmic nature of the market. Through examples of the 'power of three' and other techniques, traders can learn to anticipate price movements and make precise decisions. The speaker encourages active participation, offering deeper insights through additional videos and a paid group for further learning.

Takeaways

- 😀 The market operates on a precise algorithm, with price movements often following standard deviation levels like 2-2.5 and 3.5-4, not random fluctuations.

- 😀 Timing is crucial in trading, especially around specific time intervals like the 4-hour candle openings, where significant price action may occur.

- 😀 A market maker model can reveal the pattern of price accumulation and distribution, which is key to understanding market movements.

- 😀 Breakers (specific price levels) help identify areas where explosive moves and distributions can occur, aiding in better trade execution.

- 😀 Understanding the concept of the 'Power of Three' allows traders to spot the critical points in price action and anticipate moves within the market structure.

- 😀 Standard deviation levels are essential tools for identifying price targets and understanding potential market manipulation.

- 😀 The market does not always follow the same pattern; some candles represent accumulation or distribution, and not every 4-hour candle will show a distribution move.

- 😀 Reaccumulation phases in price indicate potential moves lower, and these should be closely watched for upcoming opportunities.

- 😀 The importance of tracking the relationship between different indices (e.g., ES and NASDAQ) for SMT (Symmetry) helps identify valid trading setups and manipulation.

- 😀 The speaker encourages viewers to engage with their trading progress by sharing examples and tagging them on social media, fostering community interaction.

- 😀 For those interested in a deeper dive, the speaker offers a paid group that provides more in-depth analysis and trading theory.

Q & A

What is the significance of standard deviations in the trading strategy discussed?

-Standard deviations are used as a measure of price movement and volatility. The speaker emphasizes that price typically moves in predictable patterns within specific ranges of standard deviations (such as two to two and a half, and three and a half to four), allowing traders to anticipate price movements based on these patterns.

What does the speaker mean by 'power of three' in the context of the market?

-The 'power of three' refers to a market cycle where price manipulations occur in three distinct phases. These phases help traders predict the final price movement. The speaker highlights that understanding the power of three helps traders anticipate when a market move is likely to end, allowing for precise entries and exits.

How does the concept of reaccumulation play a role in the trading strategy?

-Reaccumulation refers to a period where price gathers momentum before making a final move. In the context of the script, the speaker describes how price reaccumulates after moving into certain standard deviation ranges, signaling a continuation of the trend. This phase is key for predicting when a move to a specific price level will happen.

What is the importance of time-related price actions in the strategy?

-Time-related price actions are crucial because they help identify when market makers might manipulate price movements. The speaker mentions how specific timeframes, such as the four-hour candle, are strategically used to set up price manipulation or 'wicks,' creating the conditions for a price move in the desired direction.

What does the speaker mean by a 'breaker' in the trading strategy?

-A breaker is a significant price level or event that marks a potential turning point or reversal in the market. The speaker uses breakers to identify key points where price is likely to break out or distribute, offering potential entry points for trades.

Why does the speaker focus on the four-hour (4H) candle in their analysis?

-The four-hour candle is important because it provides a clear view of price movements over a significant time period. The speaker uses it to identify moments of distribution and accumulation, helping to predict when market moves will expand or contract. The 4H candle is a tool for determining when significant market shifts are likely to occur.

How does the speaker use the concept of 'distribution' in the market?

-Distribution refers to the phase when smart money (market makers) is selling off or pushing the price in one direction before a reversal. The speaker uses distribution to identify when price is likely to reverse after reaching a key level, based on the behavior of price and the underlying market conditions.

What role does the market maker model play in this trading strategy?

-The market maker model plays a central role as it helps traders understand how price is manipulated by market makers through various phases. By identifying these phases, traders can predict the likelihood of price moving within specific standard deviation ranges and the potential direction of the next move.

What does the speaker mean by 'market ran on an algorithm'?

-When the speaker says the market is 'ran on an algorithm,' they mean that market movements follow patterns that are not random but driven by structured algorithms or models. These models govern how price behaves and can be predicted based on historical data and established trading theories.

How does the speaker's strategy differ from traditional trading methods?

-The speaker's strategy differs by relying on precise patterns and algorithms, such as standard deviations and market maker models, to predict price movements. Unlike traditional methods that may focus more on fundamentals or broad market trends, this strategy focuses on the manipulation of price and market structure within defined parameters.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

How To Use ICT Standard Deviations

How To PREDICT Market Reversals - ICT Standard Deviations

Episode 12: Using Standard Deviation Projections - ICT Concepts

Standard Deviations + MMXM | ICT Concepts | DexterLab

Standard Deviation Projections & MMXM - (Simple Strategy)

Why you STILL don't UNDERSTAND ICT Market Maker Models

5.0 / 5 (0 votes)