How to Identify and Trade Order Blocks

Summary

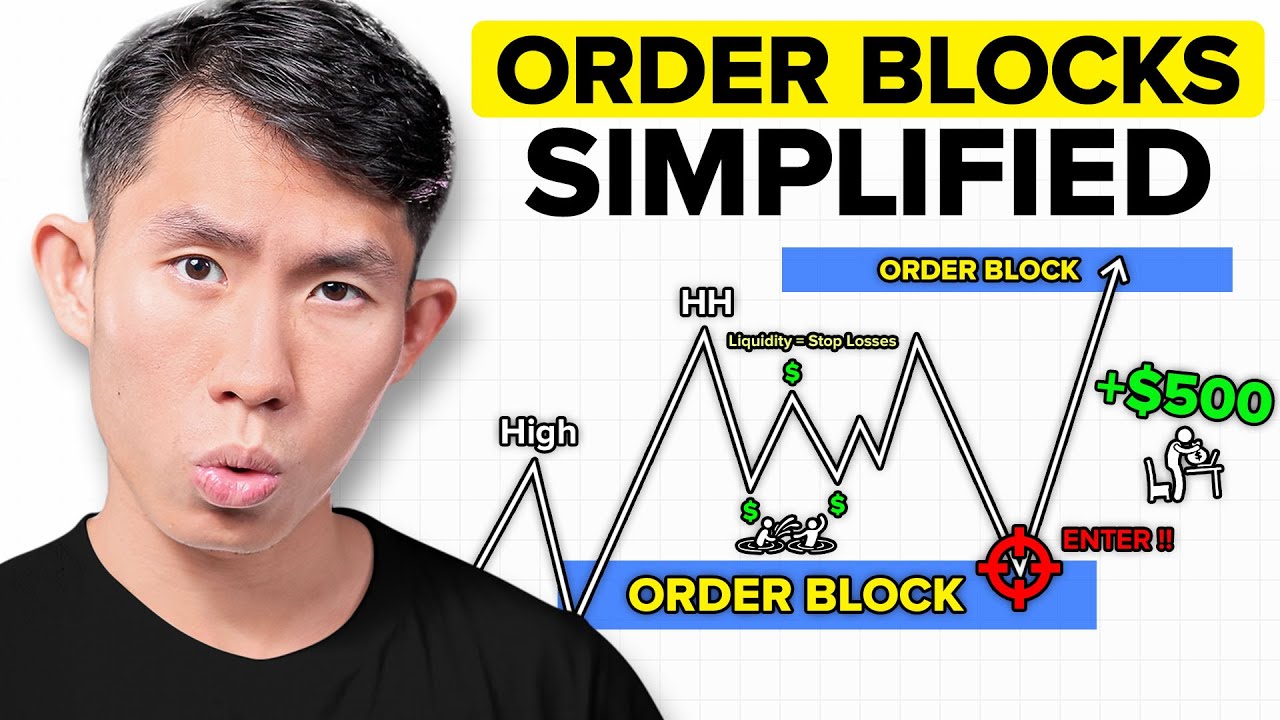

TLDRThis video dives into the concept of order blocks, explaining their importance in trading. The presenter details how to identify and use order blocks in combination with market structure and imbalances, across various timeframes from weekly to lower timeframes. Key techniques include recognizing breaks of structure, understanding imbalances, and pinpointing the last candles before significant price movements. The video offers step-by-step guidance on how to practice, refine, and apply these strategies to real charts, with emphasis on precision, adaptability, and proper risk management to enhance trading accuracy.

Takeaways

- 😀 Order blocks are key areas where significant market moves start, and traders should focus on these zones for entry opportunities.

- 😀 A structure break (market movement that breaks key price levels) combined with an imbalance is a strong indicator of potential trade setups.

- 😀 It is essential to identify whether the imbalance is bullish or bearish, as it helps determine the direction of the trade.

- 😀 Using a higher timeframe (e.g., weekly) to find order blocks and structure breaks is crucial before zooming into lower timeframes for more precise entries.

- 😀 The last bullish or bearish candle before a big market move (break of structure) is considered the order block, and these levels are often tapped for potential entries.

- 😀 Not all order blocks work perfectly. Some fail to hold as price moves away, highlighting the importance of using stop losses and risk management.

- 😀 Lower timeframes (like the 4-hour or 1-hour charts) help refine the order blocks, providing more detailed setups for entering the market.

- 😀 A bearish or bullish imbalance that is followed by a break in structure can signal an order block, making these areas important for entries.

- 😀 Order blocks should not be drawn too tightly or over-refined, as this may lead to inaccurate predictions; focus on broader zones for better accuracy.

- 😀 Entry models should align with the higher timeframes' trend. The use of imbalances and order blocks across different timeframes enhances accuracy and reliability in trading.

Q & A

What is an order block in trading?

-An order block is the last candle before a strong move that breaks market structure, often accompanied by an imbalance. It represents areas where significant buying or selling pressure occurred before a large price movement.

How do you identify a valid order block?

-A valid order block is identified by finding the last relevant buy or sell candle before a significant price move that breaks market structure and creates an imbalance. It is crucial not to mistake extreme price levels for order blocks.

Why is the imbalance important in identifying order blocks?

-The imbalance is crucial because it highlights areas where price moved too quickly, often leaving gaps. These areas are typically where the market is likely to react, and identifying imbalances helps confirm the validity of an order block.

How does market structure influence order block analysis?

-Market structure, such as breaks of structure (like fractal highs or lows), helps define the market's trend direction. Identifying structure breaks alongside order blocks and imbalances ensures that the order block aligns with the prevailing market momentum.

Why should you consider multiple timeframes when analyzing order blocks?

-Considering multiple timeframes helps identify the broader market trend and refine the precision of your entry points. Higher timeframes, such as weekly or daily, give you the overall market direction, while lower timeframes offer more specific areas for entry.

What role does intuition play in order block analysis?

-Intuition comes into play when analyzing areas where the market might react but doesn't perfectly align with strict mechanical rules. For example, in some cases, you might choose to consider the bodies of candles or slightly adjust the order block area based on market behavior.

What is the process of checking an order block across different timeframes?

-The process starts by identifying major order blocks on higher timeframes (like weekly or daily), checking for imbalances, and marking significant structure breaks. Then, you drop to lower timeframes to refine the order block and find a precise entry point.

Can order blocks fail to hold and how do you deal with it?

-Yes, order blocks can fail if the market doesn't react as expected. It's important to recognize that order blocks are just areas where the market could react, but there's no guarantee. In case of failure, traders must adjust their strategy or move to a new level that aligns better with the current market conditions.

How do you determine entry points after identifying an order block?

-After identifying an order block and confirming it with an imbalance, you refine your entry by dropping to even lower timeframes, such as the 15-minute or 5-minute chart. The goal is to pinpoint the most precise level where the market will react and enter with a stop-loss set above or below the order block.

What is the importance of the fractal low in order block analysis?

-The fractal low is significant because it represents a swing low that, when broken, confirms a shift in market structure. Identifying fractal lows in conjunction with imbalances and order blocks helps to validate the strength of the move and improve the accuracy of your analysis.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)