¿Cuánto cuesta un empleado en Panamá?

Summary

TLDRThis video script explains the costs involved in employing a worker in Panama, breaking down both employee deductions and employer expenses. It details how an employee with a monthly salary of 1,000 faces deductions for social security, educational insurance, and income tax, leaving them with a take-home of 866.92. For the employer, additional costs include vacation pay, 13th-month pay, seniority premiums, indemnity (optional), and various employer contributions, such as social security and insurance. The total cost for the employer can rise to 1,400.17, representing a 41.74% increase over the base salary, or 1,300.51 without indemnity.

Takeaways

- 😀 An employee in Panama earning 1000 USD per month pays 9.75% for social security and 1.25% for educational insurance.

- 😀 After deductions for social security and educational insurance, the employee's take-home salary is 866.92 USD.

- 😀 The employer incurs additional costs beyond the employee's salary, including vacation and the 13th month payment.

- 😀 Vacation is a mandatory right, and its calculation is based on the total salary divided by 11.

- 😀 The 13th month is a mandatory payment, calculated by dividing the total salary by 12.

- 😀 Seniority bonuses are mandatory for indefinite contracts, and they are calculated by dividing the total salary by 52.

- 😀 Indemnification is not mandatory but may be paid under certain conditions. Some organizations only reserve a percentage for this.

- 😀 The cost of indemnification is calculated as the seniority bonus multiplied by 3.4.

- 😀 The employer's contributions include 12.25% for social security, 1.50% for educational insurance, and 2.10% for professional risks.

- 😀 The total additional employer cost is 417.36 USD, representing 41.74% of the employee's salary.

- 😀 In total, an employee earning 1000 USD per month costs the employer 1400.17 USD, including all employer contributions.

- 😀 If indemnification is excluded, the additional employer cost is 35.20% of the salary, making the total cost 1300.51 USD.

Q & A

What is the gross salary of the employee in the example?

-The employee's gross salary is 1,000 USD per month.

What are the deductions made from the employee's salary?

-The employee's salary is reduced by 9.75% for social security, 1.25% for educational insurance, and other income tax deductions, leaving the employee with 866.92 USD.

What additional costs must the employer cover beyond the employee's salary?

-The employer must cover additional costs like vacation, 13th month salary, seniority premium, indemnification (optional), social security, educational insurance, and professional risk insurance.

How is the vacation cost calculated?

-The vacation cost is calculated by dividing the total salary by 11.

What is the 13th month salary and how is it calculated?

-The 13th month salary is mandatory and is calculated by dividing the total salary by 12.

How is the seniority premium calculated, and who is eligible for it?

-The seniority premium is calculated by dividing the total salary by 52 and is mandatory for employees with indefinite contracts.

Is indemnification mandatory for employers to pay?

-No, indemnification is not mandatory. It is paid under certain conditions, and some organizations may not make provisions for it.

How is the indemnification calculated if it is applicable?

-If indemnification is applicable, it is calculated as the value of the seniority premium multiplied by 3.4.

What is the employer's contribution to social security and educational insurance?

-The employer must contribute 12.25% for social security and 1.5% for educational insurance, both based on the total salary.

How is the professional risk insurance calculated?

-The professional risk insurance is calculated based on a percentage defined by the social security, which varies for each organization. In this example, it is assumed to be 2.10%.

What is the total cost of the employee to the employer, including all contributions?

-The total cost to the employer, including all contributions, is 1,400.17 USD, which is 41.74% more than the employee's gross salary.

How much does the employee cost the employer if indemnification is excluded?

-Without indemnification, the total cost to the employer would be 1,300.51 USD, which represents 35.2% more than the employee's gross salary.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Biaya Tenaga Kerja Dlm Akuntansi Biaya

Understanding Your Paycheck

PART 10 | TUTORIAL E-BUPOT 21/26 | Perbedaan Perhitungan PPh Pasal 21 Nett, Gross, dan Gross Up

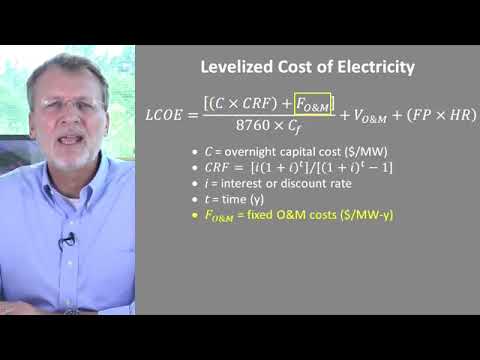

Levelized Cost of Electricity - Energy Consulting #energy #infrastructure #ehicorp

3 CORE AMP, Payroll & ACCTG Portal Part 2

Tax Credits vs Tax Deductions: What is the Difference and Which is Better?

5.0 / 5 (0 votes)