Risk Management & Position Sizing Strategy for Trading

Summary

TLDRIn this crucial video, the channel emphasizes the importance of risk management for day traders, especially for those aiming for profitability. The speaker shares a personal experience with a bad trade on PDD, highlighting the necessity of a risk management strategy to prevent significant losses. The video outlines a three-step approach to risk management, focusing on understanding risk-reward ratios, setting proper stop-loss and take-profit levels based on daily support and resistance, and recognizing personal strengths and weaknesses to establish trading rules. The speaker encourages traders to practice discipline, track trades in a journal, and follow a set of personal rules to maintain profits, offering a free risk management crash course for further insights.

Takeaways

- 😀 Risk management is crucial for becoming a profitable trader, as it helps to preserve profits.

- 📉 The speaker emphasizes the importance of having a risk management strategy, using a personal trade on PDD stock as an example.

- 💰 The key to risk management is understanding and applying the power of risk-reward ratio, which should be considered in relation to account size.

- 🔢 For a $10,000 account, the speaker suggests risking about 1% per trade, which equates to $100 per trade.

- 🚫 Risking the same amount as you are making can lead to a break-even scenario or losses, especially with a 50% win rate.

- 📈 A better approach is to aim for a risk-reward ratio of at least 1:2, meaning you risk $100 to make $200.

- 🏆 For substantial growth, especially with a small account, aim for a risk-reward ratio of 1:3 or higher.

- 📊 Use daily support and resistance levels to set stop-loss and take-profit levels, ensuring a favorable risk-reward setup.

- 📝 It's essential to know your strengths and weaknesses as a trader and set rules for yourself to maintain discipline.

- 📉 The speaker shares personal rules like stopping trading after a certain time or after giving back a certain percentage of profits to avoid emotional trading.

- 📚 Keeping a trading journal and tracking all trades can help traders understand their actual risk-reward ratio and improve their strategy.

Q & A

What is the main focus of the video?

-The main focus of the video is on risk management strategies for day trading, emphasizing its importance for becoming a profitable trader.

Why is risk management considered crucial in day trading?

-Risk management is crucial in day trading because it helps traders control their losses, which is essential for maintaining profitability, especially with a small account.

What was the trader's experience with the stock PDD?

-The trader had a bad trade with PDD, which quickly dropped to daily support and resulted in a significant loss. However, the trader managed the risk and stopped out for a loss, which was about 1% of their account size.

What is the recommended maximum percentage of account size to risk per trade?

-The recommended maximum percentage to risk per trade is about 1% of the account size.

How does the trader suggest managing risk if you have a more conservative approach?

-For a more conservative approach, the trader suggests risking a fixed amount per day, such as $100, and adjusting the risk per trade based on the number of trades planned for the day.

What is the significance of the risk-reward ratio in trading?

-The risk-reward ratio is significant because it helps traders manage their potential losses and gains. A proper risk-reward ratio ensures that the potential profit is greater than the potential loss, which is key to long-term profitability.

What is the minimum risk-reward ratio a new trader should aim for?

-A new trader should aim for a minimum risk-reward ratio of 1:2, meaning they should risk $1 to make $2.

How does the trader calculate the risk for a trade?

-The trader calculates the risk for a trade by determining the entry point and the stop-loss level, and then assessing the potential profit target based on the risk-reward ratio.

What is the importance of having a trading journal?

-A trading journal is important for tracking trades, analyzing risk-reward ratios, and understanding a trader's strengths and weaknesses. It helps in maintaining discipline and improving trading strategies.

What are some personal rules the trader suggests setting for oneself?

-The trader suggests setting personal rules based on one's strengths and weaknesses, such as stopping trading after a certain time of day or after giving back a certain percentage of profits, to maintain discipline and prevent overtrading.

How can traders improve their win rate and profitability?

-Traders can improve their win rate and profitability by working on their risk-reward ratio, aiming for at least 1:2, and ideally 1:3 or more. Additionally, they should focus on managing their risk effectively and maintaining discipline in their trading.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

How I manage position size, money, and risk management (Class 15)

The Market is Changing, Don’t Get Left Behind

8 Rules That Changed my Trading Forever

How To Start DAY TRADING - Becoming A Trader IN 30 DAYS

ICT Mentorship Core Content - Month 02 - No Fear Of Losing

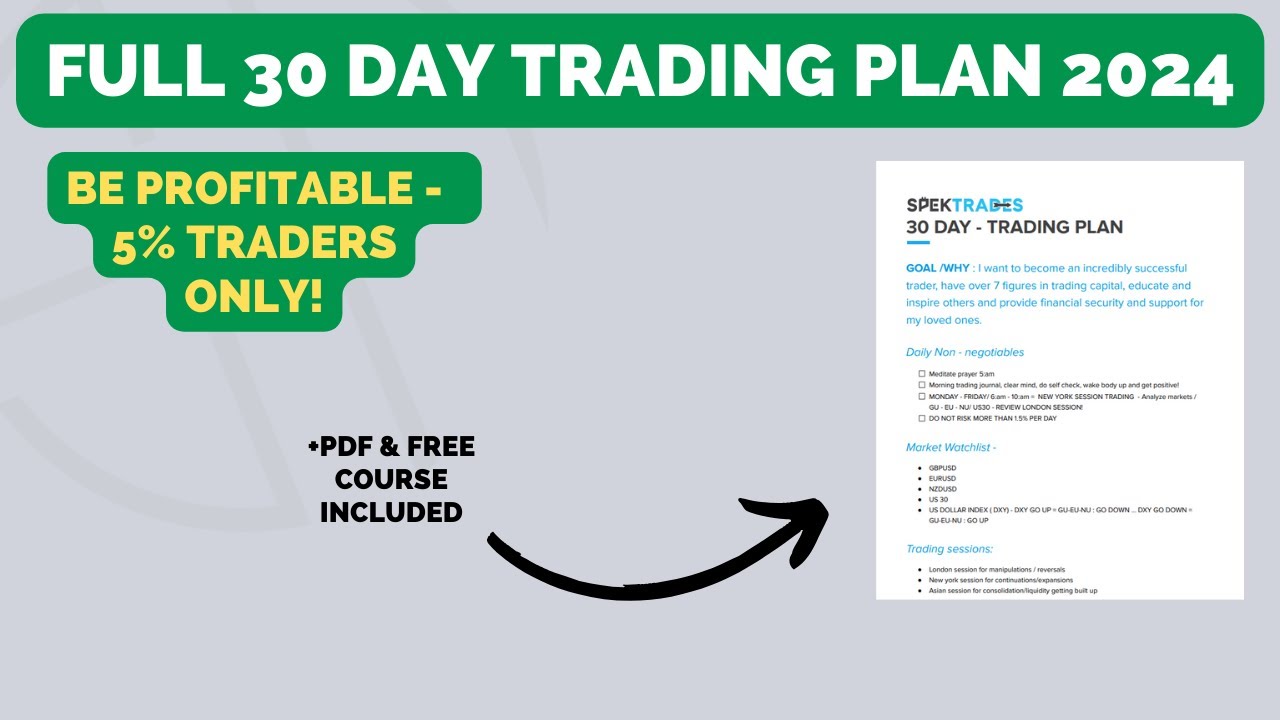

Full 30 Day Trading Plan: Become Profitable In 2024 (5% Traders only!)

5.0 / 5 (0 votes)