2025 economic forecasts for Turkey | Atilla Yeşilada

Summary

TLDRIn this video, the speaker discusses Turkey's economic outlook for 2025, offering forecasts on GDP growth, employment, inflation, and fiscal policies. They predict modest GDP growth of around 2.5% due to low consumption and limited business investment, while inflation is forecasted to remain high at 30-35%. The speaker critiques Turkey's monetary and fiscal policies, noting risks like potential early elections and political instability. However, they highlight some upside risks, such as improved relations with Trump and lower energy prices, which could boost investor sentiment. Overall, the speaker believes Turkey will avoid a major crisis in 2025 but faces ongoing economic challenges.

Takeaways

- 😀 Turkey's GDP growth for 2025 is forecasted to be around 2.5%, which is below the 10-year average, largely due to sluggish household consumption and low capital investment.

- 😀 Employment growth in Turkey is expected to decline from over 1 million new jobs in 2024 to around 500,000 in 2025, with challenges in labor-intensive sectors like retail and textiles.

- 😀 The Turkish economy faces structural issues, with many businesses avoiding new investments due to cronyism and corruption, leading to limited business expansion.

- 😀 Minimum wage and pension hikes have been low in 2025, contributing to reduced purchasing power for many workers and retirees.

- 😀 Inflation in Turkey is expected to decelerate in 2025 but will remain high, with an estimated range of 30-35%, despite fiscal restraints and a stronger local currency.

- 😀 The Central Bank of Turkey has started an easing cycle, lowering interest rates in December 2024 and expected to cut further in 2025, but the policy risks destabilizing the Turkish Lira.

- 😀 Turkey's fiscal policy aims to reduce the budget deficit from 5% in 2024 to 3% in 2025, but additional taxes and ongoing inflation pressures will challenge this goal.

- 😀 Turkey's current account deficit is expected to shrink to around 1% of GDP in 2025, but it may rise again later in the year due to increased imports and a strong Lira.

- 😀 There are risks of early elections or constitutional referendums, which could lead to a surge in government spending and an increase in inflation.

- 😀 Upside risks include improved relations between Turkey and the U.S., potentially boosting investor sentiment, and a potential drop in energy prices, which could help control inflation.

Q & A

What is the expected GDP growth for Turkey in 2025?

-The consensus GDP growth for Turkey in 2025 is expected to be around 3%. However, the speaker is more cautious and forecasts a growth of 2.5%, which is below the average of the past decade.

Why is the speaker pessimistic about Turkey's fixed income investments and business expansion?

-The speaker is pessimistic because of the cronyism and mafia-like state environment in Turkey, where businesses may face pressure to share profits with political entities, or even have their assets acquired below market value by party-affiliated groups.

How does Turkey’s minimum wage hike in 2025 compare to inflation, and what impact does it have?

-In 2025, Turkey’s minimum wage hike is set at 30%. However, considering the official CPI for the previous year was 45%, this increase means that many workers, especially blue-collar workers, will feel poorer in real terms.

What does the speaker predict for Turkey's employment growth in 2025?

-The speaker forecasts a decline in employment growth in Turkey, with 500,000 new jobs expected in 2025, down from over 1 million the previous year. This decline is due to factors like the shift from brick-and-mortar retail to e-commerce.

What is the expected inflation rate in Turkey for 2025, according to the speaker?

-The speaker expects inflation to be between 30% and 35% in 2025. This range reflects their uncertainty, but they consider the 30% side more likely, due to fiscal restraint, a strong lira, and moderate wage increases.

What role does Turkey's external deficit play in the economic forecast for 2025?

-Turkey's external deficit is expected to shrink to around 1% of GDP in 2025, which is seen as manageable. However, with a strong lira, consumer imports may increase, leading to a potential rise in the current account deficit to 2% of GDP.

What are the key risks to Turkey’s economy in 2025, as identified by the speaker?

-The key downside risk is the possibility of early elections or a constitutional referendum, which could lead to increased government spending and inflation. The upside risk is the potential for improved investor sentiment due to the strong relationship between Erdogan and Trump.

What is the impact of monetary policy in Turkey for 2025?

-Turkey's monetary policy is expansionary, with the central bank cutting interest rates from 50% to 47.5% in December 2024. The speaker believes this could become problematic for the Turkish lira’s stability, especially if fiscal policy does not provide adequate restraint.

What is the outlook for Turkey’s fiscal deficit in 2025?

-The fiscal deficit is expected to decrease from 5% of GDP in 2024 to around 3.8% in 2025. This will be achieved through lower earthquake-related expenditures and increased taxes, although there is skepticism about the effectiveness of the new taxes.

How does the speaker view the Turkish government's approach to taxation in 2025?

-The speaker criticizes the government’s approach to taxation, particularly the taxation of new technologies like e-commerce. They believe this is counterproductive and may stifle growth in emerging sectors.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

SO SÁNH CHÍNH SÁCH TÀI KHÓA VÀ CHÍNH SÁCH TIỀN TỆ

Kebijakan Fiskal - PART 2

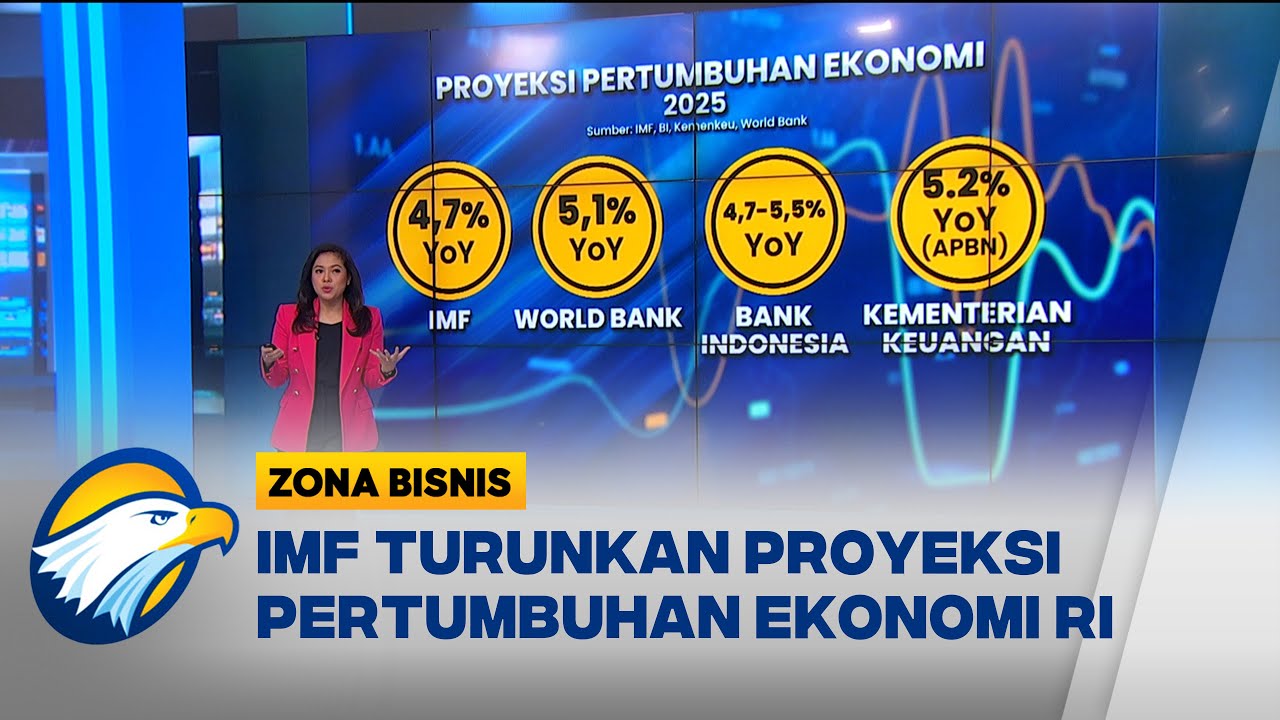

Menkeu Paparkan Kerangka Ekonomi Makro - [Zonas Bisnis]

Macroeconomic Objectives - A Level and IB Economics

IMF Ramal Ekonomi Indonesia 2025-2026 Bakal Anjlok! [Zona Bisnis]

Transisi 2024-2025: Mengarungi Peluang dan Risiko Ekonomi Indonesia

5.0 / 5 (0 votes)