How to apply for GST Cancellation| Surrender| Final return- Tamil #gst

Summary

TLDRThis video provides a detailed guide on how to cancel GST registration, including step-by-step instructions for filling out the cancellation application on the GST portal. The speaker explains the various reasons for cancellation, such as business closure or structural changes, and emphasizes the importance of filing a final GST return to avoid a ₹10,000 penalty. The process involves confirming address details, selecting appropriate cancellation reasons, stock declaration (if applicable), and verifying the application. The video highlights the critical need to submit the final return for successful cancellation and outlines the potential consequences for failing to comply.

Takeaways

- 😀 To apply for GST registration cancellation, go to the GST service section and click on the registration cancellation option.

- 😀 The process is straightforward, with three options: address details, reason for cancellation, and verification.

- 😀 For the reason of cancellation, you may need to select options like change in PAN card, business closure, or GST transfer due to mergers or acquisitions.

- 😀 If your business is closed, ensure to select the appropriate option and provide the closure date.

- 😀 You are asked if you have any remaining stock; if none, the cancellation process can proceed.

- 😀 The system will also ask for your verification and authorized person details, including the place of business.

- 😀 Once the GST cancellation request is submitted, keep track of its status to confirm if the department has accepted the request.

- 😀 After acceptance, a final return will be issued, which must be filed to avoid a ₹10,000 penalty.

- 😀 If the final return is missed, the penalty will be applied. Ensure to file it promptly.

- 😀 Filing the final return is mandatory for the cancellation to be complete and to avoid any future penalties.

- 😀 If you intend to register for GST again in the future, you will need to file the final return and then reapply for a new GST registration.

Q & A

What is the first step in applying for GST registration cancellation?

-The first step is to go to the service section and click on the 'GST Registration Cancellation' option.

What options are available when applying for GST registration cancellation?

-There are three main options: the first one is related to address details, the second asks for the reason for cancellation, and the third involves confirmation and submission.

Why is the second option asking for the reason for cancellation important?

-The second option is important because it requires you to specify why you are applying for GST registration cancellation, such as business closure or a change in business structure.

What reason might someone select for GST cancellation if their business has closed?

-If the business has closed, the user should select the 'Business Closed' option from the reasons for cancellation.

What should you do if you have any stock remaining when applying for GST cancellation?

-You should check whether you have any remaining stock. If there is none, the process is simpler. If there is stock, you need to report it.

What happens if you miss the final GST return after registration cancellation?

-If the final GST return is missed after cancellation, there will be a penalty of ₹10,000, which you will need to pay.

What happens after the GST cancellation request is submitted?

-After submitting the cancellation request, you should check the status to ensure it is accepted by the department. Once accepted, a final return will be issued.

How should you handle a situation where you have filed a return after GST cancellation?

-If you have filed a return after cancellation, make sure it is properly filed and you avoid any penalties. The final return must also be filed to avoid additional charges.

What is required to complete the GST cancellation process successfully?

-You must ensure that all necessary returns, including the final return, are filed properly. Failure to do so may result in a penalty.

What does the system require after submitting the GST cancellation request?

-After submitting the cancellation request, you need to verify and select the authorized person and provide the business place details before proceeding.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

How to apply GST Registration as TDS deductor | GST TDS Registration | GST TDS number apply | TDS

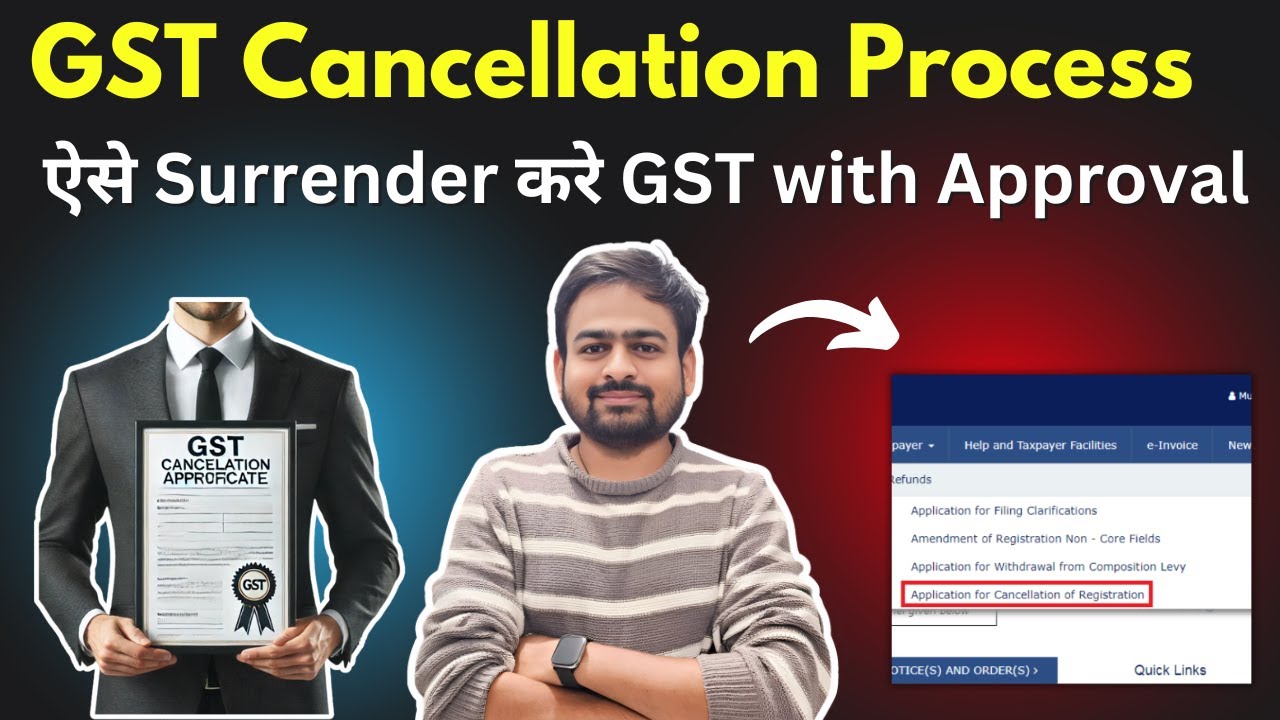

GST Cancellation Process | How to Cancel GST Registration | How to Close Surrender GST Number

GSTR-9/9C Filing with payment of tax | How to pay Tax with GSTR 9 and 9C

How to File GSTR-3B Return | 5 min me easily | GSTology

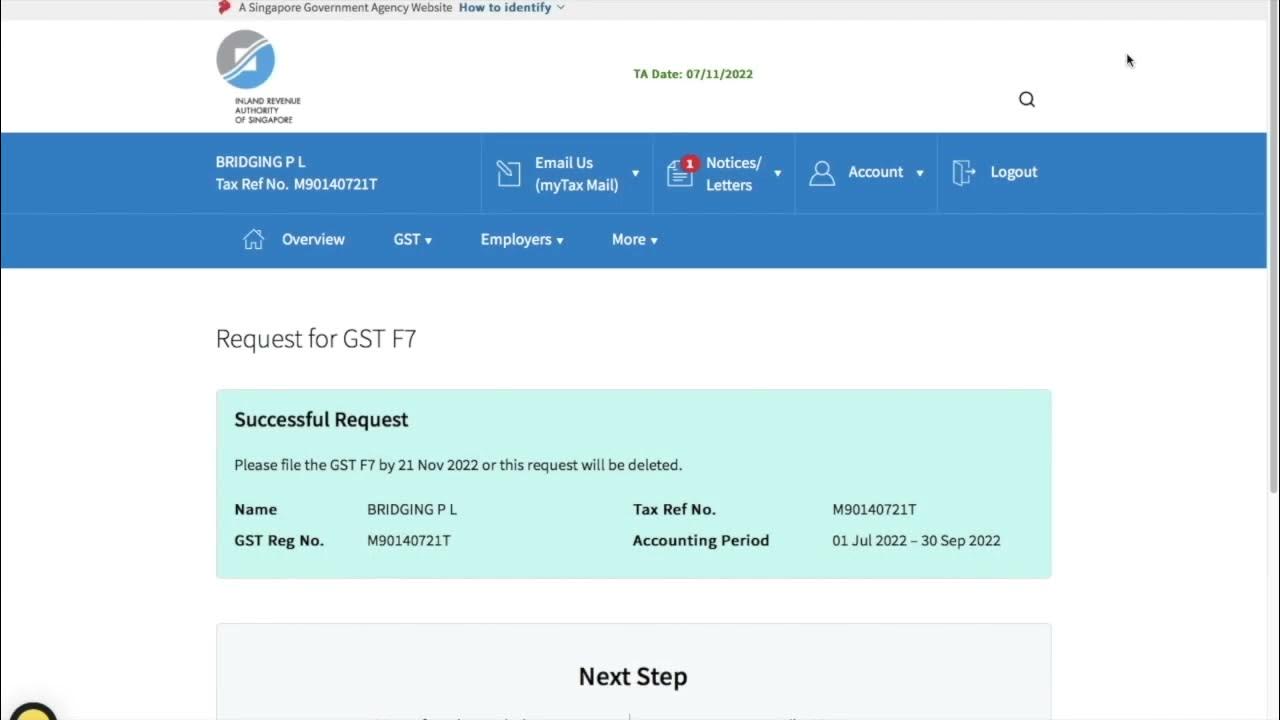

Filing of GST Return (Video Guide)

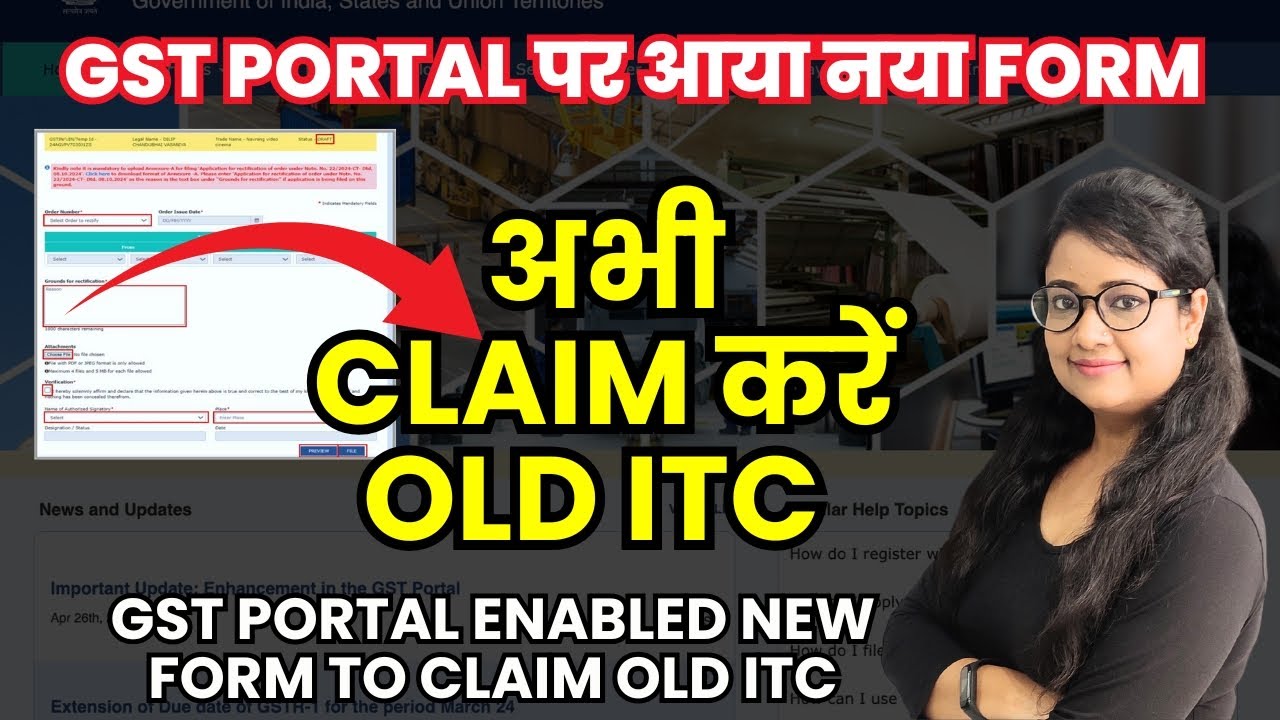

GST ITC big update - Claim your Old ITC | File Application to claim Old Input Tax Credit under GST

5.0 / 5 (0 votes)