Session 10: Estimating Hurdle Rates - Bottom up Betas

Summary

TLDRIn this corporate finance session, the concept of bottom-up betas is introduced as an alternative to regression betas for estimating the cost of equity. The approach begins with estimating betas for individual businesses within a company, then weights them based on their respective values to compute an overall unlevered beta for the company. The process offers greater precision and flexibility, especially for multi-business companies like Disney, enabling more accurate cost of equity estimates for distinct business units. The session emphasizes the importance of using business-specific hurdle rates to prevent riskier businesses from subsidizing safer ones.

Takeaways

- 😀 Betas are weighted averages: The beta of a company can be calculated as a weighted average of the betas of the individual businesses it operates in.

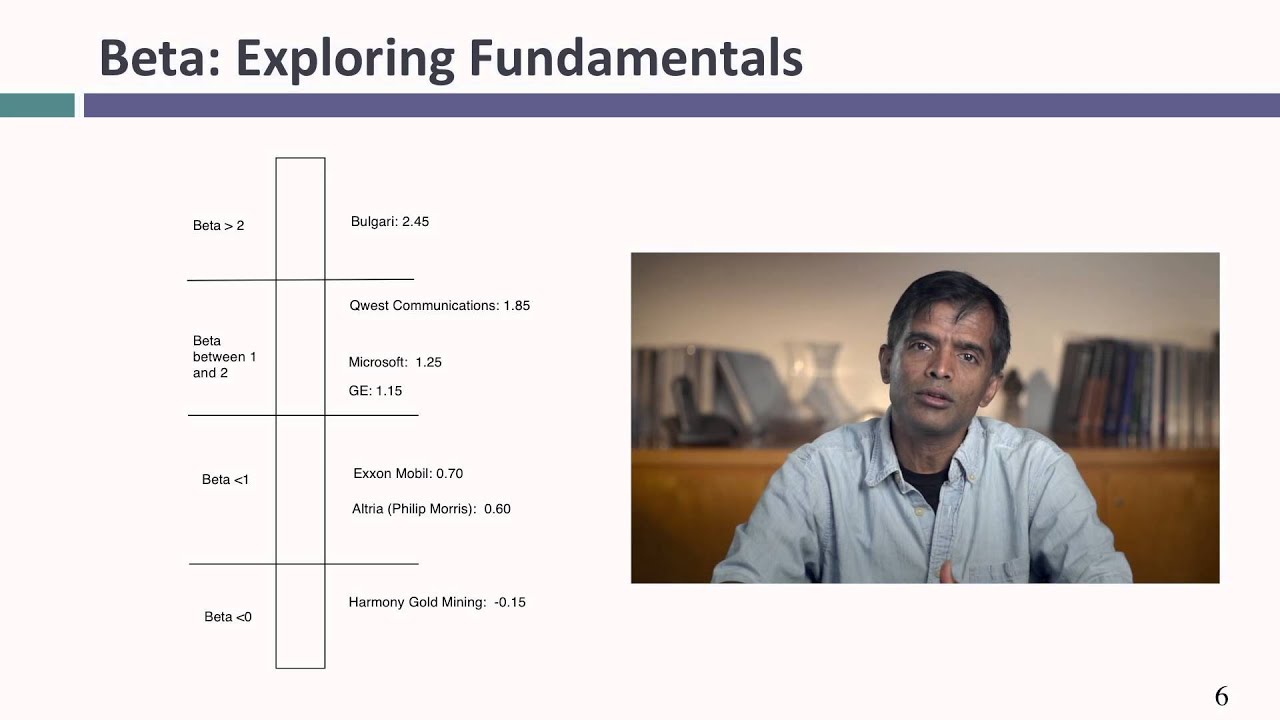

- 😀 Bottom-up beta approach: This method builds a more accurate beta by breaking down a company into its businesses and using publicly traded companies in the same industries for comparison.

- 😀 Regression betas can be problematic: The speaker suggests that regression betas might be inaccurate or imprecise, and a bottom-up approach can address this by averaging multiple regression betas.

- 😀 Using unlevered betas: To isolate the risk of the business itself, the speaker recommends unlevering regression betas, which removes the influence of financial leverage.

- 😀 Weighting betas by business value: The final beta for a company should reflect the proportion of value each business contributes, not just its revenue.

- 😀 Precision through large samples: Averaging regression betas from many companies in the same industry helps to improve the precision of the final business beta.

- 😀 The role of cash in beta calculation: The presence of cash in companies can affect the unlevered beta calculation, as cash has a beta of zero.

- 😀 Levered betas and debt allocation: After calculating unlevered betas, companies must allocate debt to each business unit to calculate the appropriate levered betas.

- 😀 Tailored hurdle rates: For multi-business companies, different business units should have separate cost of equity rates based on their specific risks, rather than using a single company-wide rate.

- 😀 Bottom-up betas offer control: Unlike regression betas that rely on historical data, bottom-up betas allow companies to be proactive and incorporate expected changes in business strategy or industry conditions.

Q & A

What is the bottom-up beta approach discussed in the script?

-The bottom-up beta approach involves estimating a company's beta by first identifying the betas of the individual businesses the company operates in, and then combining them in a weighted average based on the relative value of each business.

Why does the speaker prefer the bottom-up beta approach over regression betas?

-The speaker prefers bottom-up betas because they are more precise and allow for greater control. This method uses averages from multiple companies, which reduces the impact of outliers and gives a more accurate estimate of the beta for a business.

What is the key property of betas that makes them easy to work with?

-Betas are weighted averages, meaning that the beta of a portfolio or a company is simply the weighted average of the betas of the individual assets or businesses in the portfolio.

How does the speaker calculate unlevered betas for individual businesses?

-The speaker first finds publicly traded companies within the same business sector and uses their regression betas. Then, the betas are unlevered using the average debt-to-equity ratio for those companies, providing an unlevered beta that reflects the risk of the business itself, independent of debt.

What is the advantage of using averages from multiple regression betas in estimating a business's beta?

-The advantage is that averaging multiple regression betas helps mitigate the impact of outliers and results in a more stable and accurate estimate of the beta, in contrast to using a single regression beta from a single company.

Why is it important to use a bottom-up approach for a multi-business company like Disney?

-For a multi-business company like Disney, the bottom-up approach allows for estimating different hurdle rates for different businesses, reflecting the distinct risks of each business, rather than using a single company-wide beta that could distort investment decisions.

How does the speaker assign weights to the businesses in a multi-business company like Disney?

-The speaker uses revenue or, preferably, the enterprise value-to-sales ratio of comparable companies to estimate the value of each business. These values are then used to assign weights to each business, ensuring that the beta for each business is appropriately weighted.

What role does the debt-to-equity ratio play in calculating unlevered betas?

-The debt-to-equity ratio is crucial in unlevering betas because it adjusts for the impact of leverage (debt) on the business. The unlevered beta reflects the business's risk without the influence of debt.

How does the speaker handle the issue of small sample sizes when estimating betas for certain businesses?

-To address small sample sizes, the speaker expands the sample by including related businesses from other regions or industries. For example, when there were few US theme park companies, the speaker looked globally to include companies from Europe and Asia.

Why does Disney allocate its debt across businesses rather than using a single company-wide debt-to-equity ratio?

-Disney allocates its debt across businesses based on their identifiable assets because this method more accurately reflects the risk and capital structure of each business, rather than using a single debt-to-equity ratio for the entire company.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Session 11: Estimating Hurdle Rates - More on bottom up betas

Session 5: Betas (Relative Risk Measures)

Session 9: Estimating Hurdle Rates - Betas and Fundamentals

Session 8: Estimating Hurdle Rates - Regression Betas

30. Calculation of Weighted Average Cost Of Capital from Financial Management Subject

Session 6: Estimating Hurdle Rates - Equity Risk Premiums - Historical & Survey

5.0 / 5 (0 votes)