Session 11: Estimating Hurdle Rates - More on bottom up betas

Summary

TLDRThis session in the corporate finance class explores the concept of bottom-up betas, focusing on estimating betas for global companies like Vale, Tata Motors, and Baidu, and how to apply this method to private businesses. The instructor demonstrates how to estimate a company's cost of equity by breaking down businesses, using global comparables, and adjusting for different currencies. The session emphasizes the challenges of estimating betas for private companies and introduces an approach to account for the additional risk exposure of private business owners, ultimately helping them set more accurate cost of equity estimates.

Takeaways

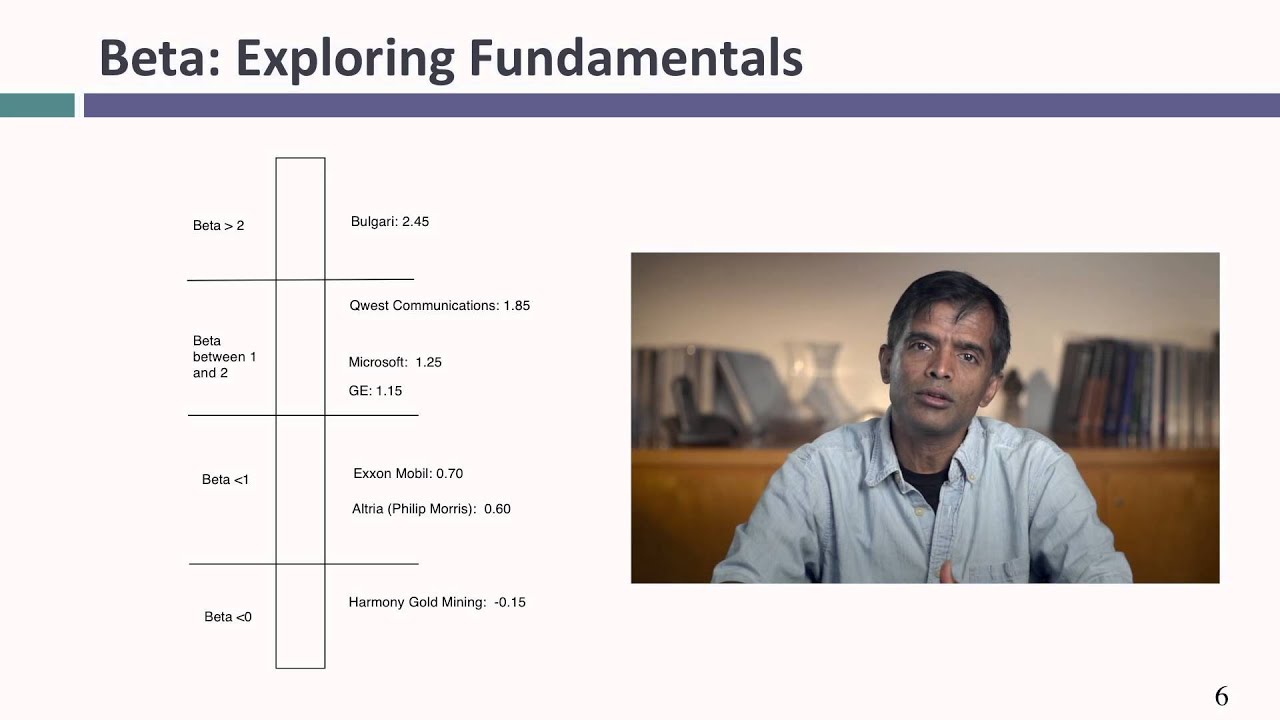

- 😀 The concept of bottom-up betas is introduced, where individual business operations are analyzed to estimate a company’s overall beta.

- 😀 To estimate betas for global companies, identify comparable publicly traded firms in relevant industries, then unlever and calculate the weighted average to find the company's beta.

- 😀 A specific example of applying the bottom-up beta approach is given for Vale, a global mining company with operations in Brazil and abroad, including China.

- 😀 The unlevered beta of a company is calculated by breaking the company down into its individual businesses and using comparable firms for each business unit.

- 😀 For companies with mixed business operations, like Vale, the same debt-to-equity ratio can be used across all business units if their debt needs are similar.

- 😀 The cost of equity is calculated by combining the company’s unlevered beta with the equity risk premium and the risk-free rate in the relevant currency (e.g., USD for Vale).

- 😀 To convert a US dollar cost of equity into a local currency (e.g., nominal Reais), the inflation rate in the local currency and in USD must be taken into account, using a simple scaling method.

- 😀 It is recommended to work in US dollars when computing a company’s cost of equity, especially for countries with high inflation rates, to ensure accurate risk premiums.

- 😀 The process of calculating bottom-up betas is applied to other companies such as Tata Motors and Baidu, where different market conditions (e.g., rupees, yuan) and business models are considered.

- 😀 For financial services companies like Deutsche Bank, it’s advised to use the levered beta directly rather than unlevering, as their debt-to-equity ratios are difficult to estimate.

- 😀 The bottom-up beta method can be extended to private companies by assuming appropriate debt-to-equity ratios based on industry averages and adjusting for the lack of diversification in the business owner’s risk exposure.

Q & A

What is the concept of bottom-up betas?

-The concept of bottom-up betas involves estimating a company's beta by breaking it down into individual businesses and calculating the unlevered beta for each segment. This approach contrasts with traditional regression methods, as it considers the specific characteristics of each business unit rather than the company as a whole.

Why is the unlevered beta important in the bottom-up approach?

-The unlevered beta is important because it isolates the risk of the business itself, excluding the effects of leverage. This allows for a clearer understanding of the business's inherent risk, which is then adjusted for the company's debt structure to compute the levered beta.

How did the instructor estimate the beta for Vale, a global mining company?

-The instructor estimated Vale's beta by breaking it down into its four business segments, identifying comparable publicly traded firms for each segment, calculating the unlevered beta for each segment, and then combining these values using a weighted average based on revenue contributions.

What approach was used to estimate Vale's cost of equity?

-Vale's cost of equity was estimated using its unlevered beta, the US dollar risk-free rate, and a weighted average equity risk premium specific to Vale's markets. The instructor also demonstrated how to convert the cost of equity into Brazilian real terms using expected inflation rates in both US dollars and Brazil.

Why did the instructor use a risk-free rate in US dollars when assessing Vale, despite it being a Brazilian company?

-The instructor used the US dollar risk-free rate because Vale reports its financials in US dollars, and its revenues come from global markets, particularly China. This makes it more practical to assess the company's cost of equity in US dollar terms rather than in Brazilian reais.

How does inflation play a role in adjusting the cost of equity across currencies?

-Inflation affects the cost of equity when converting between currencies. The instructor explained that to adjust a US dollar-based cost of equity to a different currency (e.g., Brazilian reais), one must factor in the inflation rate differences between the two currencies. This adjustment ensures the cost of equity reflects the local economic conditions.

What challenges are associated with estimating betas for financial companies like Deutsche Bank?

-Estimating betas for financial companies like Deutsche Bank can be difficult because determining an appropriate debt-to-equity ratio for banks is challenging. Instead of unlevering and relevering betas, the instructor suggested using levered betas directly for each business unit, assuming that the debt levels across the segments are similar.

How does the bottom-up beta approach apply to private companies?

-The bottom-up beta approach can also be used for private businesses by analyzing publicly traded companies in similar industries and calculating their unlevered betas. For private companies, the instructor suggested using market averages for debt-to-equity ratios and adjusting for the extra risk private owners face due to lack of diversification.

What is total beta, and how is it calculated for a private business?

-Total beta is a measure that accounts for both market risk and the additional risk a private business owner faces due to lack of diversification. It is calculated by dividing the market beta by the correlation between the company and the market (derived from the R-squared of the regression analysis). This adjusted beta provides a more accurate cost of equity for private companies.

Why is using a market beta potentially problematic for private businesses?

-Using a market beta for private businesses can underestimate the cost of equity because it only considers market risk and ignores the additional risks that the owner, who is not diversified, faces. To address this, the instructor suggested adjusting the market beta by incorporating the total risk, leading to a higher and more accurate cost of equity.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Session 10: Estimating Hurdle Rates - Bottom up Betas

Session 5: Betas (Relative Risk Measures)

Session 9: Estimating Hurdle Rates - Betas and Fundamentals

Risk and Return: Capital Asset Pricing Model (CAPM) 【Dr. Deric】

Session 6: Estimating Hurdle Rates - Equity Risk Premiums - Historical & Survey

Session 12: Estimating Hurdle Rates - Debt & its Cost

5.0 / 5 (0 votes)