Kasus Materialitas dan Resiko Audit PPAk UGM | Kelompok E

Summary

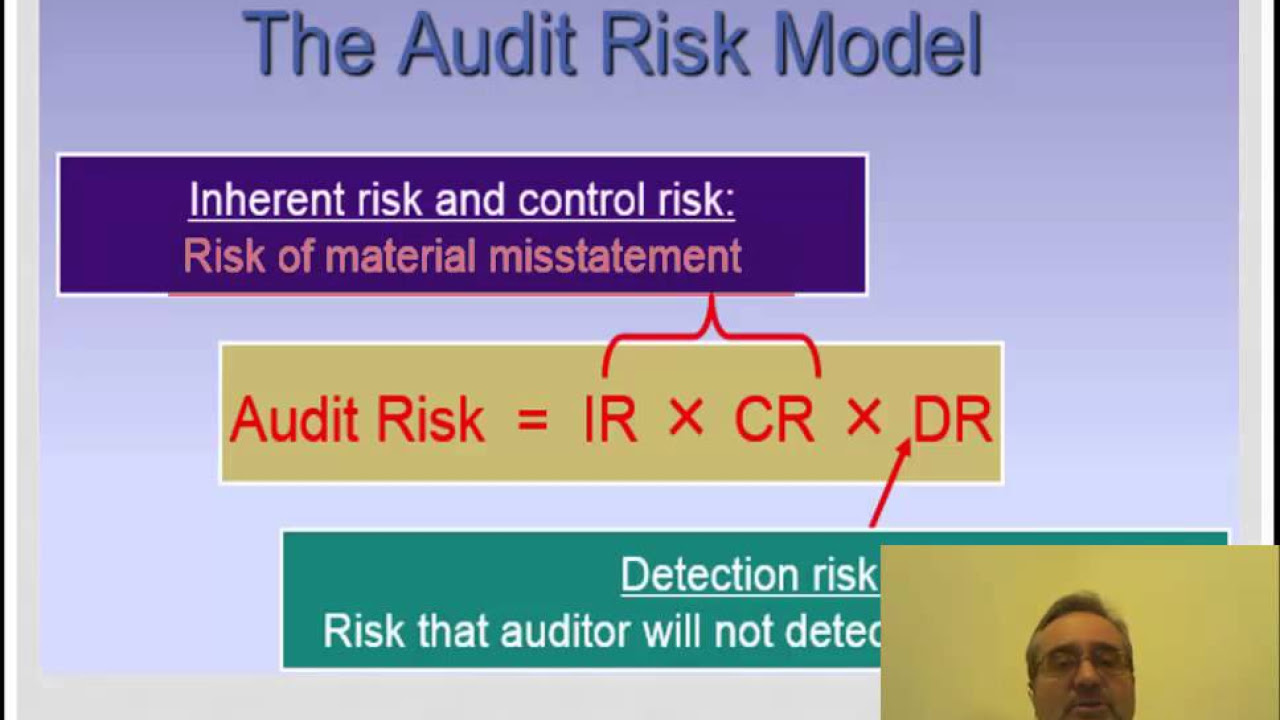

TLDRThis video transcript details the process of assessing materiality and audit risks for various companies. Through interviews with management and auditors, it explores how different companies manage financial transactions, internal controls, and documentations. Each case—Cilembu, Neraka, Lumpia, and Induk—highlights unique challenges and methods for calculating materiality based on income, assets, and gross profit. The risk assessments also vary, from low to high control risks, with detection risks impacting audit outcomes. Overall, the video provides insight into the intricacies of financial reporting and audit risk evaluation in diverse business environments.

Takeaways

- 😀 Cilembu is a trading company with solid internal controls and good transaction documentation, but faces challenges in inventory valuation due to recent policy changes.

- 😀 Cilembu's materiality calculation for audit was based on 5% of pre-tax income, resulting in a threshold of IDR 5,000,000, which was used to evaluate audit risks.

- 😀 Cilembu has a moderate control risk, but a high detection risk due to changes in inventory policy, leading to an overall high audit risk for the company.

- 😀 The company Neraka has no internal control systems and performs minimal bookkeeping, relying on external accountants to produce financial statements.

- 😀 Neraka's audit risk is high, as they lack proper internal control, resulting in high inherent risk and detection risk, but they managed to receive a WTP (Unqualified Opinion) due to external audit support.

- 😀 Neraka calculated materiality based on 5% of pre-tax income, resulting in an IDR 8,007,000 threshold for financial statement misstatements.

- 😀 Lumpia is a company with moderately developed internal controls, using industry 4.0 systems for production and accounting, but still in the process of improving internal control procedures.

- 😀 Lumpia’s audit risk is moderate, with medium control risk and high detection risk, reflecting an ongoing effort to enhance internal control systems.

- 😀 Mimpi is a startup with unclear business focus and minimal accounting systems, but has maintained neat financial records. This lack of clarity increases the inherent and control risks significantly.

- 😀 Mimpi's audit risk is high due to weak internal controls and uncertainty regarding its business focus, which leads to a high detection risk and low overall audit risk.

Q & A

What is the primary focus of the first case company, Cilembu?

-Cilembu is a company involved in the trading of cassava. They emphasize maintaining proper internal controls and documentation for their transactions and have been implementing a new inventory valuation method.

How does Cilembu handle its internal controls?

-Cilembu has well-documented internal controls with segregated duties. They have a good history of recording all transactions and maintaining proper documentation to support their financial processes.

What challenges did Cilembu face in the audit process?

-Cilembu faced difficulties due to changes in their inventory valuation method, which made it harder to ensure the accuracy of reported balances. Despite this, they have consistently received a 'WTP' (Unqualified Opinion) in audits.

How is materiality calculated in Cilembu’s case?

-Materiality is calculated using profit before tax (PBT) as the benchmark, with a materiality rate of 5%. This results in a calculated materiality of 5 million. For account balances, materiality is calculated based on total assets.

What is the risk assessment for Cilembu?

-Cilembu’s control risk is assessed as low to moderate due to their good internal controls, but changes in their inventory policy introduce some uncertainty. The detection risk is high, reflecting potential issues in detecting errors due to manual processes and new policies.

What is the audit opinion given to Cilembu and why?

-Cilembu has received a consistent 'WTP' (Unqualified Opinion) in previous audits due to their good recordkeeping and the company’s willingness to address recommendations. However, they faced difficulties with the new inventory valuation method.

What is the main issue faced by Neraka, the second company?

-Neraka faces significant challenges in internal controls, as they have no proper documentation or internal control systems. Their financial records are poorly organized, and they rely on external auditors to prepare their financial statements.

How did Neraka's audit process differ from Cilembu’s?

-Unlike Cilembu, Neraka struggled with the absence of internal controls and documentation. Despite these issues, Neraka eventually received a 'WTP' opinion after overcoming challenges related to disorganized financial records and external audit assistance.

What is the risk assessment for Neraka?

-Neraka has a high control risk due to the lack of internal controls and proper financial records. The inherent risk is high, and the detection risk is also high due to the difficulties in identifying errors in such an unorganized environment. Overall, audit risk is high.

What challenges did Mimpi face, and how does it differ from Cilembu and Neraka?

-Mimpi, a company involved in manufacturing, operates with a modern accounting system and has a relatively organized structure. However, it still faces challenges with the integration of new technologies and systems, unlike Cilembu, which faces inventory policy issues, and Neraka, which lacks basic internal controls.

How is materiality calculated in Mimpi's case?

-In Mimpi's case, materiality is calculated based on profit before tax (PBT) with a rate of 5%, resulting in a materiality of 7.5 million. The materiality for account balances like cash is also calculated based on the total assets of the company.

How does the internal control environment in Mimpi affect its audit risk?

-Mimpi has a modern accounting system, but the integration of these systems still poses a risk to detecting errors. Their internal controls are moderate, and the audit risk is also moderate due to these challenges with system integration.

What challenges does Induk face as a new company?

-Induk, a newly established company, faces significant challenges due to the lack of focus and ineffective internal controls. The company’s financial records are unorganized, and they do not have a clear business focus, increasing the audit risk.

What is the audit opinion for Induk?

-Induk faces high audit risk due to its lack of credible internal controls, unclear business focus, and poorly managed financial records. The company’s audit risk is high, and there are concerns over the validity and completeness of its financial statements.

How is materiality calculated in Induk’s case?

-In Induk’s case, materiality is calculated using profit before tax (PBT) as the benchmark, with a 5% materiality rate, resulting in a materiality of 2 million. Account balance materiality is also calculated based on total assets.

What is the overall risk assessment for Induk?

-Induk's control risk and inherent risk are both assessed as high due to the lack of internal controls, poor financial management, and unclear business focus. Detection risk is also high, resulting in a high overall audit risk.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

2.3 Overview of the Audit Process Audit Planning Risk Assessment

4 Fase Audit (AKSK)

Risk of Material Misstatement

2.2 Overview of the Audit Process Auditing Planning Knowledge, Analytics, Materiality

Materialitas dan Resiko Audit

Mengupas Konsep Audit! Apa itu Audit? | Buku Wajib Mahasiswa Akuntansi Series

5.0 / 5 (0 votes)