#LEARN TALLY PRIME |GULF ACCOUNTING | IMPORT PURCHASE WITH CUSTOM DUTY | ടാലി പ്രൈമിൽ! മലയാളത്തിൽ |

Summary

TLDRThis video guides viewers through the process of handling import tax entries in an accounting system, specifically within the context of GCC import purchases. It demonstrates how to select appropriate vouchers, debit input tax, and adjust amounts by percentages. The process includes making journal entries for duties and taxes, crediting tax amounts when needed, and updating the balance sheet. The video also explains the steps for claiming taxes on future transactions, offering valuable insights into managing tax-related accounting tasks.

Takeaways

- 😀 The process involves selecting a voucher and adjusting the input tax amount for imports.

- 😀 Input tax amounts are increased by 5% as part of the adjustment process.

- 😀 The input tax value is set to 5500, which is reflected in the accounting entries.

- 😀 Debit entries for taxes on imports are initially recorded in the system.

- 😀 Reversal or crediting of previously debited amounts is necessary to correct the tax entry.

- 😀 The new value for the input tax is now reflected in the system after the credit entry is made.

- 😀 The updated tax amount is refundable, and this will be considered in the next period.

- 😀 The balance sheet is updated to show the new value of duties and taxes (5500).

- 😀 The video explains how to adjust taxes related to GCC import purchases in an accounting system.

- 😀 This tutorial ensures that tax adjustments are correctly reflected in financial records for accurate reporting.

Q & A

What is the first step in processing import purchases in the ERP system?

-The first step is to select the voucher for the import purchase and make necessary adjustments, such as updating the amount for input tax.

Why do you need to increase the input tax amount by 5%?

-The input tax amount needs to be increased by 5% to reflect the correct tax calculation for the imported goods or services.

How is the input value (5500) entered in the system?

-The input value of 5500 is entered into the system by selecting the appropriate field and updating the amount as required.

What happens after debiting the input tax on import purchases?

-Once the input tax is debited, it may be necessary to reverse or credit the amount if adjustments are needed, ensuring accurate financial records.

What is the purpose of crediting the input tax entry in the system?

-Crediting the input tax entry serves to correct or reverse previous debits, particularly when adjustments or refunds are involved.

How can you verify that the amount has been correctly updated in the system?

-By reviewing the balance sheet or relevant reports, you can verify that the amounts, including duties and taxes, have been correctly updated.

What is the significance of the amount appearing as 'Refundable' in the system?

-The amount marked as 'Refundable' indicates that the tax or duties paid can be claimed back, either partially or fully, in a future transaction.

What is the role of the balance sheet in this process?

-The balance sheet is used to review the updated amounts for duties and taxes, ensuring that all financial entries are accurate and properly recorded.

How does the system handle the tax on import of purchases entry?

-The system processes the tax on import of purchases entry by updating the relevant accounts and reflecting changes in the tax amount based on the latest transaction details.

What should be done after making changes to the tax entries in the system?

-After making changes to the tax entries, it's important to save the updates and ensure that the balance sheet and other reports reflect the latest adjustments.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

How to Import Bank Statement in Tally Prime | Auto Bank Reconciliation | Excel to Tally Prime |

CARA INPUT DOKUMEN PENYESUAIAN || MYOB UD ABADI PART 7 UKK AKUNTANSI TAHUN 2024

Estágio Prática Contábil: MPM

Filing Your First Professional Business Tax Return: Everything You Need to Know (Part 1)

Cara Lapor SPT PPh 21 Desember Tahun 2024

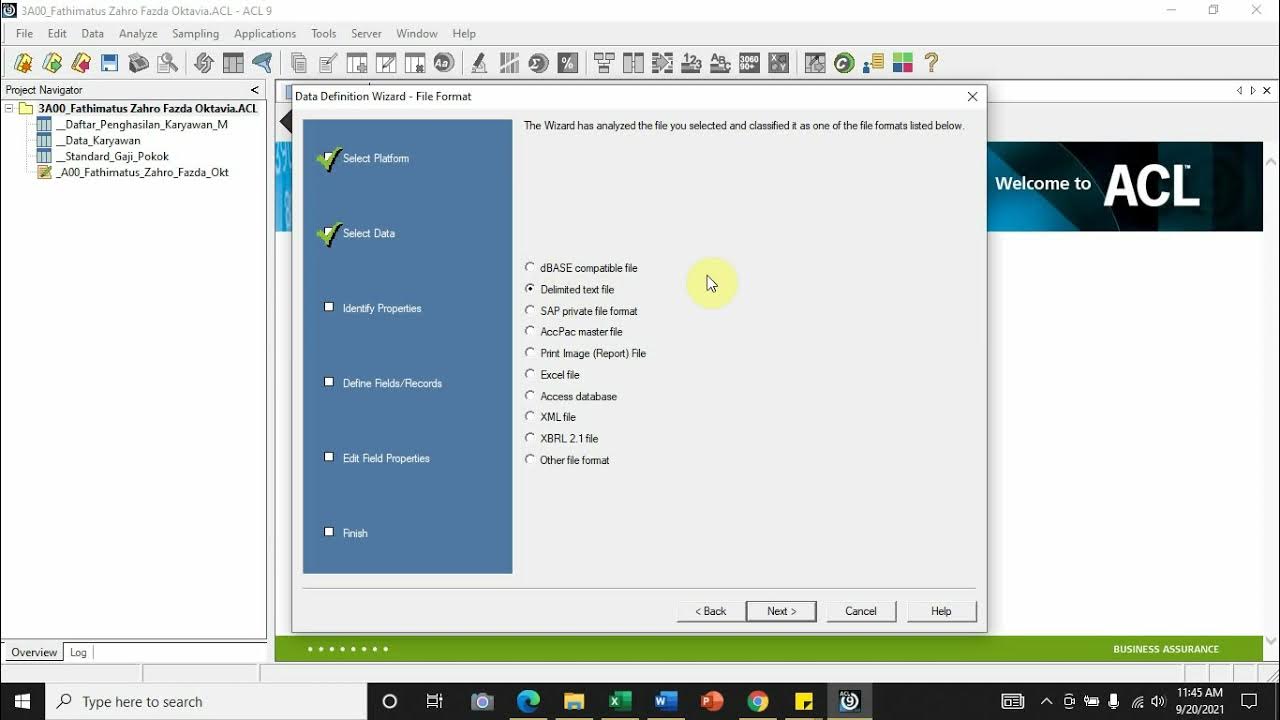

[Import File] - Comma Separated Values (.csv) ke Dalam Aplikasi Audit Command Language (ACL)

5.0 / 5 (0 votes)