What is Accounting?

Summary

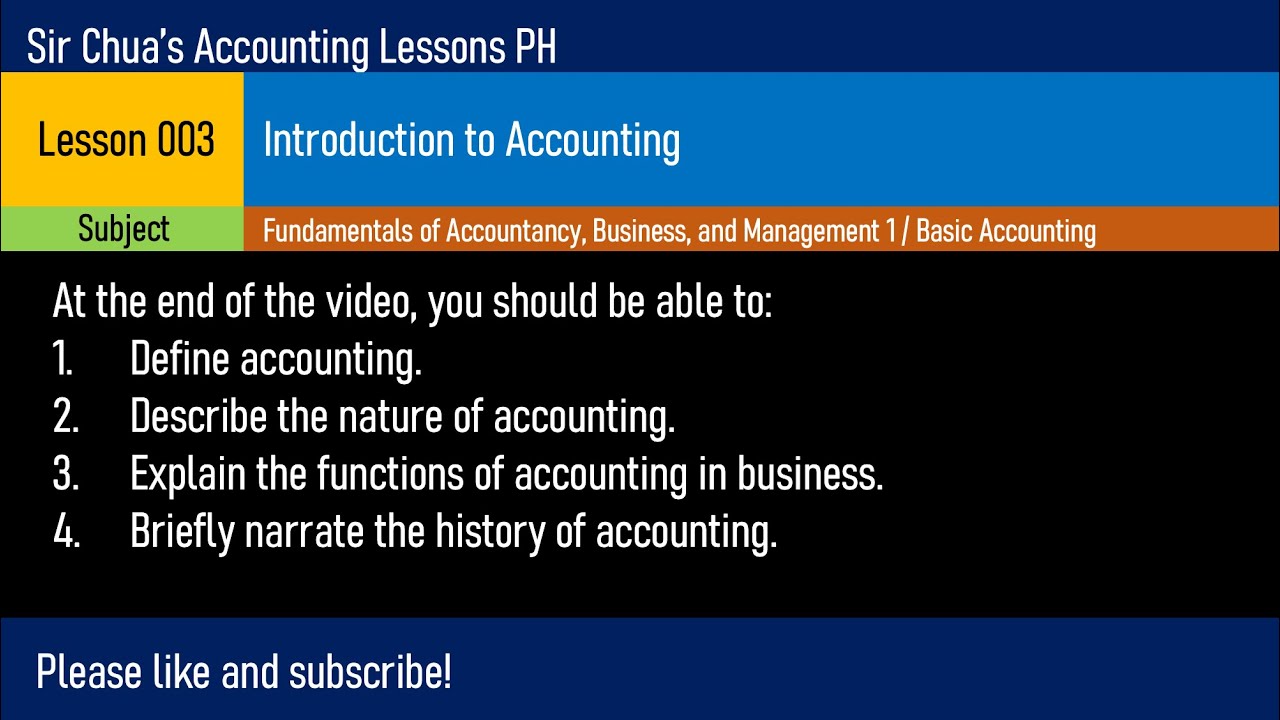

TLDRThis introductory lesson explains the fundamentals of accounting by addressing three main questions: What is accounting? Why is it important? And what types of accounting are there? Accounting is defined as an information science that organizes financial data for businesses and individuals. It helps with decision-making by analyzing financial transactions. The lesson also covers four types of accounting: bookkeeping, financial accounting, managerial accounting, and tax accounting. Emphasis is placed on bookkeeping and financial accounting, which form the foundation for understanding financial transactions and guiding future decisions.

Takeaways

- 😀 Accounting is an information science focused on organizing financial data for organizations and individuals.

- 😀 Accounting helps to analyze, collect, and organize financial information, which is quantitative and money-related.

- 😀 It is a practical field that provides insights into financial health, making it essential for both businesses and individuals.

- 😀 Businesses need accounting to track sales, production costs, and financial status, while individuals need it to manage their personal finances.

- 😀 Accounting uses past financial data to make informed decisions for the future, helping to plan and take action.

- 😀 The four main types of accounting are bookkeeping, financial accounting, managerial accounting, and tax accounting.

- 😀 Bookkeeping is the foundational task of collecting and organizing financial data, ensuring all other accounting functions can be performed.

- 😀 Financial accounting focuses on preparing standardized financial statements (income statement, balance sheet, cash flow) for external stakeholders like investors and lenders.

- 😀 Financial accounting is regulated and follows a uniform set of accounting principles, making it comparable across different organizations.

- 😀 Managerial accounting provides detailed financial data for internal decision-making and is not shared with competitors.

- 😀 Tax accounting is highly technical and focuses on calculating the amount of taxes a company needs to pay, with varying rules depending on local legislation.

Q & A

What is the main focus of accounting?

-Accounting is primarily focused on collecting and organizing financial data to help organizations and individuals make informed decisions about their finances.

Why is accounting considered an information science?

-Accounting is classified as an information science because it involves analyzing, collecting, and organizing financial data to provide meaningful insights into an organization's or individual's financial situation.

How is accounting different from other types of sciences?

-Unlike abstract sciences, accounting is a practical discipline that deals with quantitative financial data, which is directly applicable to real-world financial decision-making.

What is the main purpose of financial accounting?

-The primary purpose of financial accounting is to create standardized financial statements (income statement, balance sheet, and cash flow) for external stakeholders, such as investors, creditors, and financial analysts, to assess a company's financial health.

Why is financial accounting highly regulated?

-Financial accounting is highly regulated to ensure that the financial information presented in statements is consistent, comparable across companies, and transparent for third-party users, such as investors and banks.

What are the four main types of accounting?

-The four main types of accounting are bookkeeping, financial accounting, managerial accounting, and tax accounting.

What role does bookkeeping play in accounting?

-Bookkeeping is the foundational activity in accounting, responsible for systematically gathering and recording financial information that other areas of accounting rely on.

What is the difference between financial and managerial accounting?

-Financial accounting focuses on providing standardized financial information for external users, while managerial accounting is aimed at providing detailed internal financial data for business managers to make strategic decisions.

Why is managerial accounting not governed by accounting principles?

-Managerial accounting is not governed by formal accounting principles because it is intended for internal use, providing business managers with detailed, strategic information that may not be shared with external parties.

What is the focus of tax accounting?

-Tax accounting is concerned with determining the amount of taxes a company needs to pay, and it is highly technical, varying depending on the legal tax regulations of each jurisdiction.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)