JENIS-JENIS BUKTI TRANSAKSI INTERNAL & EKSTERNAL 99% LENGKAP I MUDAH DIPAHAMI

Summary

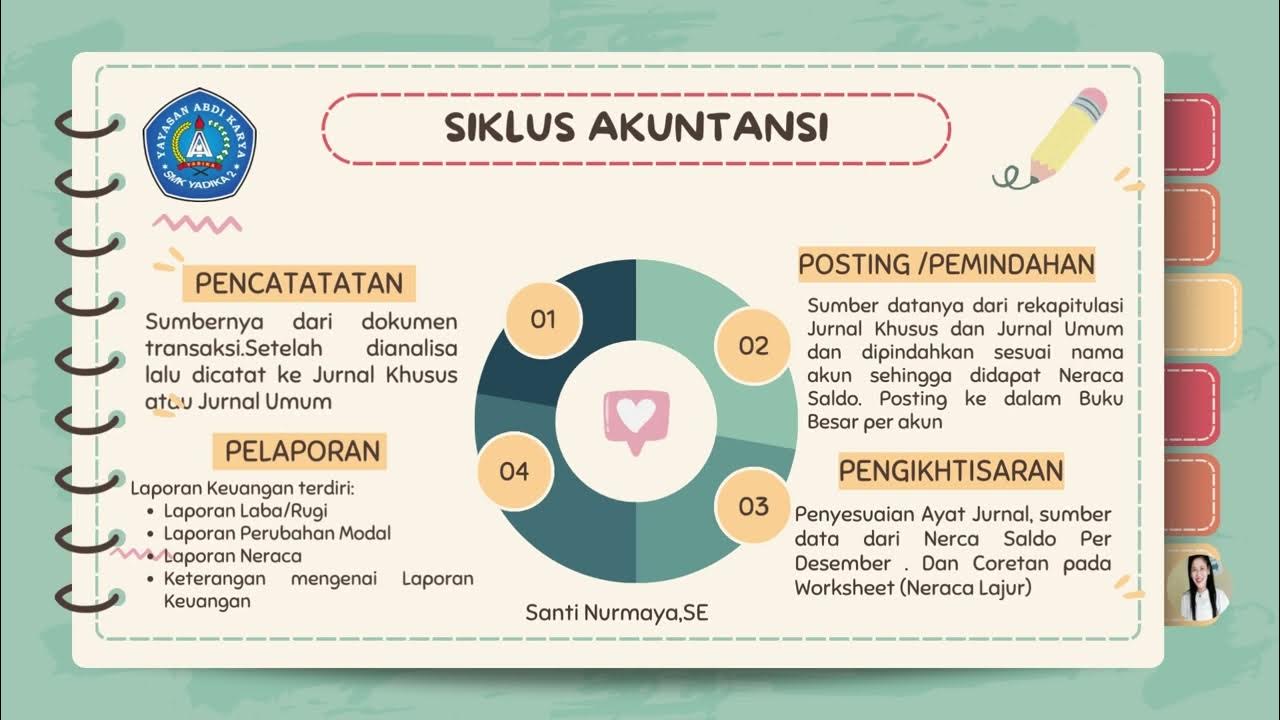

TLDRThis educational video covers the types of transaction evidence used in business, differentiating between internal and external transactions. It explains key documents such as internal memos, cash receipts, and payments, as well as external documents like receipts, invoices, bank statements, cheques, and giro transfers. The video also clarifies the role of credit and debit notes in return transactions. By understanding these various forms of evidence, businesses can ensure accurate record-keeping and financial transparency in both internal and external operations.

Takeaways

- 😀 Internal transaction evidence includes documents such as memos, cash receipts, and cash disbursements, which record actions within the company.

- 😀 External transaction evidence refers to documentation of transactions with outside parties, including receipts, invoices, and bank statements.

- 😀 A memo is a common internal document, used to convey instructions from company leadership to appointed individuals for specific tasks.

- 😀 Cash receipts are used to document when the company receives cash payments, such as from sales or rental income.

- 😀 Cash disbursement receipts track when cash leaves the company, for example, when paying salaries, utility bills, or when the owner withdraws funds.

- 😀 Receipts serve as proof of cash payments made by customers to the company, marking the exchange of goods or services for money.

- 😀 Invoices are issued when goods or services are sold on credit, providing the buyer with a record of the transaction and the amount owed.

- 😀 Bank statements show the financial relationship between the company and its bank, tracking cash movements and ensuring proper financial reconciliation.

- 😀 Cheques are used for large transactions, where a bank is instructed to pay a specific sum of money from one account to another.

- 😀 Credit and debit notes are used for returns: the seller issues a credit note to reduce the buyer’s debt, and the buyer issues a debit note to adjust the seller’s records.

- 😀 Bilyet giro is a financial instrument used to transfer funds between bank accounts, acting as a form of bank-to-bank payment transfer.

Q & A

What is the difference between internal and external transaction evidence?

-Internal transaction evidence refers to documentation of events occurring within the company, like memos from managers to specific departments. External transaction evidence involves documents that record transactions between the company and outside entities, such as receipts, invoices, or checks.

What is an internal transaction memo, and how is it used?

-An internal transaction memo is a document used to record internal company instructions, such as directives from department heads to other internal teams. It serves as evidence for the action or request made within the company.

What is a cash receipt, and what does it signify?

-A cash receipt is a document that shows the company has received money, typically through cash transactions. It signifies the company's intake of cash, such as from sales or rent payments.

What is a cash disbursement document?

-A cash disbursement document records when the company pays out cash. This could include paying employee salaries, utility bills, or when the owner takes personal funds from the company, known as 'prive'.

What is the purpose of a receipt (kwitansi) in external transactions?

-A receipt (kwitansi) serves as proof of a cash transaction, indicating that a company has received payment for goods or services. It is issued to the payer when they make a payment.

How does an invoice (faktur) differ from a receipt?

-An invoice (faktur) is used in credit sales, indicating that goods were sold on credit. It is a record of a transaction that does not involve immediate payment. In contrast, a receipt confirms payment, often in cash.

What is a bank statement (rekening koran), and how does it relate to the company’s financial records?

-A bank statement (rekening koran) is a document that shows the movement of money between the company's bank account and external parties. It is essential for reconciling cash records and ensures accurate financial tracking.

How is a check used in transactions, and what is its purpose?

-A check is a written order to a bank to pay a specific amount of money to the check's holder. It is typically used in larger transactions when the buyer does not wish to pay in cash. The check serves as a form of payment authorization.

What is the difference between a credit note and a debit note?

-A credit note is issued by the seller when goods are returned or services are not as expected, leading to a reduction in the seller’s receivables. A debit note is issued by the buyer in a similar situation, reflecting a reduction in payables.

What is a giro transfer (bilyet giro), and how does it work?

-A giro transfer (bilyet giro) is a bank instruction to transfer a specified amount of money from one account to another. It is commonly used for transferring funds between accounts without the need for physical money.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenant5.0 / 5 (0 votes)