Understand Financial Assets in Less than 13 Minutes!

Summary

TLDRThis video explains the concept of financial assets, including cash, short-term investments, and receivables. It covers their importance in managing a business’s cash flow, ensuring enough funds are available for operations while earning returns on excess cash. The video also discusses cash management, internal controls to prevent fraud, and the process of bank reconciliation. Viewers learn how to adjust bank and book balances and prepare journal entries to maintain accurate financial records. The video provides essential knowledge for businesses to effectively manage their financial assets and safeguard against errors.

Takeaways

- 😀 Financial assets include cash, short-term investments, and receivables, which businesses manage to maintain liquidity and earn returns.

- 😀 Cash management involves balancing enough cash to pay bills while avoiding holding excessive cash that could otherwise be invested for returns.

- 😀 Short-term investments help businesses use excess cash to earn returns until the funds are needed for operational purposes.

- 😀 Cash on the balance sheet is reported at its face amount, while short-term investments are reported at their current market value.

- 😀 Net realizable value refers to the amount a business expects to collect from accounts receivable after deductions for potential losses.

- 😀 Cash equivalents are short-term investments with minimal market risk and a maturity of less than three months, combined with cash on the balance sheet.

- 😀 Restricted cash is money set aside for specific purposes, not available for paying current liabilities, and is classified as an investment on the balance sheet.

- 😀 A line of credit is a pre-arranged borrowing agreement between a bank and a business, disclosed in the notes to financial statements until funds are borrowed.

- 😀 Internal control systems for cash are critical to prevent theft, fraud, and errors, ensuring the accuracy of financial records.

- 😀 Regular bank reconciliations are necessary to identify and correct errors and discrepancies between the bank statement and the company’s ledger.

- 😀 The bank reconciliation process includes adjusting for deposits in transit, outstanding checks, errors, and other reconciling items to match the adjusted balances.

Q & A

What are financial assets, and what are some examples?

-Financial assets include cash, short-term investments, and receivables. These are assets that provide economic value to a business.

How are cash and cash equivalents reported on the balance sheet?

-Cash and cash equivalents are reported at their face amount on the balance sheet. This includes physical currency, deposits, and items such as checks and money orders.

What is the difference between cash and cash equivalents?

-Cash includes physical currency and deposits, while cash equivalents are short-term investments with a maturity of less than three months and minimal risk of value changes.

What is net realizable value, and how is it used in financial accounting?

-Net realizable value is the amount a business expects to collect from its receivables. It is used to report accounts receivable on the balance sheet.

What is the significance of restricted cash on the balance sheet?

-Restricted cash is cash set aside for a specific purpose and is not available for paying current liabilities. It is classified as an investment rather than a current asset.

How does a business use a line of credit, and how is it recorded in the financial statements?

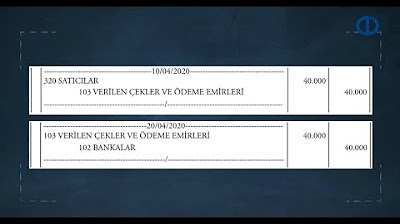

-A line of credit is an agreement between a business and a bank, allowing the business to borrow money up to a certain limit. No transaction is recorded when the line is opened, but when money is borrowed, the cash account is debited, and the line of credit account is credited.

What are the key components of cash management?

-Cash management includes ensuring there is enough cash to meet business obligations while preventing excess idle cash. It helps businesses account for cash accurately, prevent theft or fraud, and ensure the availability of necessary funds.

What are the key internal controls over cash?

-Internal controls for cash include segregation of duties (authorization, custody, recording), preparing cash budgets, requiring daily deposits, using checks or electronic payments for all transactions, verifying expenditures before payment, and reconciling bank statements promptly.

Why is bank reconciliation important for a business?

-Bank reconciliation is important because it helps identify discrepancies between the cash balance on the bank statement and the cash recorded in the company's ledger. It helps correct errors and ensure accurate financial reporting.

How do you perform a bank reconciliation using the Simmons Company example?

-Start with the bank statement balance, then adjust for deposits in transit, outstanding checks, and bank errors. Then, adjust the book balance for collections, interest, NSF checks, and errors. The adjusted bank and book balances should match.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Giải thích BẢNG CÂN ĐỐI KẾ TOÁN - Ví dụ BCĐKT của Vinamilk và Vingroup

CARA MEMAHAMI PENGERTIAN DAN JENIS AKTIVA || AKUNTANSI DASAR | AKTIVA | HARTA | ASET

Aset? Ada yang Lancar, Ada yang Enggak Lho!! | #akuntansi #akuntansidasar

FİNANSAL MUHASEBE - Ünite 3 Konu Anlatımı 1

Konsep Dasar Akuntansi: Cara Memahami Dasar Dasar Akuntansi dengan Mudah

Financial Accounting 1: 13- Sections Of A Classified Statement Of Financial Position (شرح بالعربي)

5.0 / 5 (0 votes)