JURNAL UMUM PERUSAHAAN DAGANG (tips & trik menganalisis Posisi Debit Kredit pada Perusahaan Dagang)

Summary

TLDRIn this accounting lesson, Dewi Norsanie explains the fundamental concepts of debit and credit in journal entries for trading companies. She covers key transactions such as sales, purchases, returns, and payments, showing how they affect accounts. Through clear examples, the tutorial emphasizes how to determine the debit and credit positions for different scenarios, including handling discounts, goods returns, and debt settlements. By the end of the video, viewers will have a solid understanding of journalizing common business transactions and applying them effectively in real-life accounting situations.

Takeaways

- 😀 Understanding Debit and Credit: When inventory increases, it is recorded on the debit side, and when it decreases, it is recorded on the credit side.

- 😀 Sales Transactions: When goods are sold, the 'sales' account is credited, and the 'accounts receivable' account is debited (if the sale is on credit).

- 😀 Return of Goods: When goods sold are returned, the 'sales return' account is debited, and 'accounts receivable' is credited.

- 😀 Purchase Transactions: When inventory is purchased, the 'purchases' account is debited, and the 'accounts payable' account is credited (if purchased on credit).

- 😀 Return of Purchased Goods: When purchased goods are returned, the 'purchase return' account is credited, and 'accounts payable' is debited.

- 😀 Payment Methods in Transactions: Depending on whether the transaction is paid in cash or on credit, the corresponding account (cash or accounts payable) is adjusted.

- 😀 Discount Adjustments: Sales or purchase discounts (e.g., 2/10 N 30) apply when payments are made within a specified period, affecting the final transaction amount.

- 😀 Journal Entries for Specific Transactions: The script provides detailed examples of journal entries for various transactions, including sales, returns, purchases, and payments.

- 😀 Cash and Credit Sales: When goods are sold for cash, the cash account is debited, while the sales account is credited. If on credit, 'accounts receivable' is used.

- 😀 Checking Previous Transactions: It’s important to verify previous transactions, such as returns or discounts, before recording a new payment or receipt to ensure accuracy.

Q & A

What is the main topic of the video script?

-The main topic of the video script is analyzing debit and credit when preparing general journals for trading companies, with a focus on how transactions involving sales, purchases, returns, and payments should be recorded.

What happens when goods are added or reduced in a trading company?

-When goods are added, they are recorded on the debit side of the journal. When goods are reduced, they are recorded on the credit side.

How is the journal entry for a sale of goods recorded?

-When goods are sold, the 'Sales' account is credited and the 'Accounts Receivable' account is debited if sold on credit, or 'Cash' if sold in cash.

What should be done when goods that were sold are returned?

-When goods are returned, the 'Sales Return' account is debited, and 'Accounts Receivable' or 'Cash' is credited depending on the original transaction's payment method.

How do you record a purchase of goods in a trading company?

-When goods are purchased, the 'Purchases' account is debited and the 'Accounts Payable' account is credited.

What happens when goods purchased are returned?

-When purchased goods are returned, the 'Purchase Return' account is debited and 'Accounts Payable' is credited.

How should a payment for outstanding receivables or payables be recorded?

-When payments are made for outstanding receivables or payables, the payment amount should be recorded by debiting 'Cash' and crediting 'Accounts Receivable' or 'Accounts Payable' accordingly.

How does the discount for early payment affect journal entries?

-If an early payment discount applies, the discount amount is recorded by debiting the relevant expense or revenue account and crediting 'Accounts Receivable' or 'Accounts Payable', reducing the amount to be paid or received.

What is the purpose of cross-checking returns and discounts when making payments?

-Cross-checking returns and discounts ensures accurate payment amounts and corrects the accounts before finalizing payments, preventing errors in the journal entries.

How is the journal entry for a purchase from PT Bintang recorded on August 1?

-On August 1, when goods are purchased from PT Bintang on credit, the 'Purchases' account is debited and 'Accounts Payable' is credited.

What steps should be followed when making a payment for goods purchased from Firma Mandala on August 22?

-When making the payment for goods purchased from Firma Mandala, first check if a discount applies. If the purchase qualifies for a discount, apply it to reduce the payment amount. Then, debit 'Accounts Payable' and credit 'Cash' for the final amount paid.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

JURNAL PEMBELIAN - JB - JURNAL KHUSUS

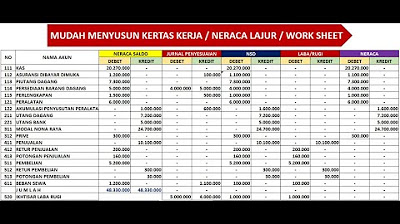

KERTAS KERJA - NERACA LAJUR - WORK SHEET - PERUSAHAAN DAGANG

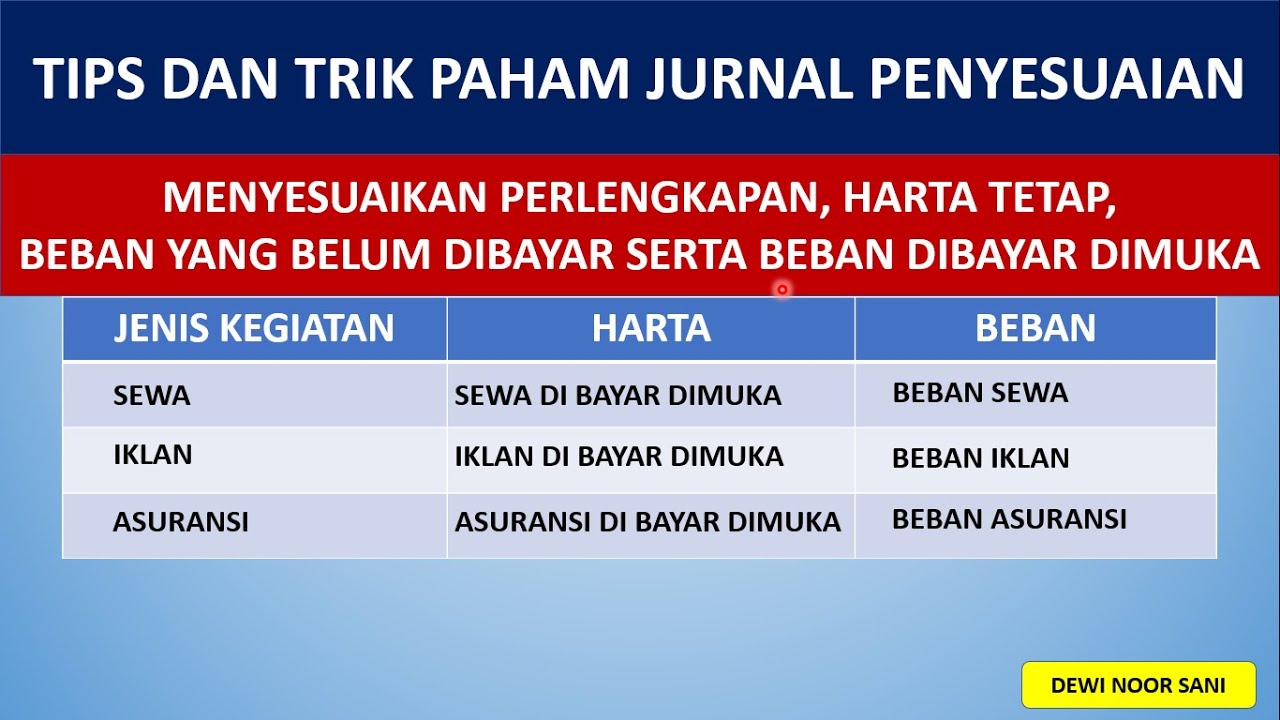

JURNAL PENYESUAIAN -Tips dan Trik Memahami dengan Cepat

Jurnal Umum Perusahaan Jasa

Deskripsi Perusahaan Dagang - Pengertian, Ciri, Akun, Syarat Penyerahan Barang, Syarat Pembayaran

Cara Menyusun Jurnal Penyesuaian

5.0 / 5 (0 votes)