5 ETFs AMERICANOS para INVESTIR COM A VITÓRIA DE DONALD TRUMP

Summary

TLDRIn this video, the host outlines five ETFs that could thrive if Donald Trump wins the U.S. presidency, emphasizing a pro-capitalist perspective. Key recommendations include the Palladium ETF, which may benefit from Trump's support for fossil fuels, and the Dollar Index ETF as a safe haven during economic turmoil. The speaker also highlights Bitcoin as a portfolio essential and suggests oil and gas and financial services ETFs could profit from Trump’s policies. Ultimately, the host stresses the importance of diversification and preparing for various economic scenarios.

Takeaways

- 📈 Trump’s potential presidency could positively impact certain sectors of the economy.

- 💰 Investing in precious metals, particularly palladium, may be beneficial if Trump wins.

- 📉 The UUP ETF, which tracks the dollar index, is recommended as a risk management tool during economic uncertainty.

- 🔗 Bitcoin's value may not be directly correlated to Trump's presidency but remains a crucial part of a diversified portfolio.

- 🌍 The IYE ETF, focusing on oil and gas companies, is likely to benefit from Trump’s favorable stance on the fossil fuel industry.

- 📊 Diversification is key; investors should avoid making directional bets based solely on economic predictions.

- 🏦 The IXG ETF could thrive under Trump due to deregulation in the banking sector, which can lead to increased profits.

- ⚖️ Historical signs indicate an impending economic recession, making protective investments vital.

- 🔒 Having physical assets like gold can provide a hedge against systemic risks in the banking sector.

- 👥 Engaging with financial advisors and using tools like QR codes for consultations is encouraged for personalized investment strategies.

Q & A

What are the key economic sectors that may perform well if Donald Trump is elected president?

-The script discusses five ETFs that could perform well, particularly in precious metals, the dollar index, Bitcoin, oil and gas, and the banking sector.

Why is the 'PAU' ETF focused on palladium significant in the context of Trump's potential presidency?

-Palladium is used in combustion engine catalysts, and Trump's policies may increase demand for combustion engines, thus boosting palladium prices.

How does the UUP ETF function as a risk management tool?

-The UUP ETF tracks the strength of the dollar, which typically rises in times of economic crisis, making it a good hedge against portfolio downturns.

What is the relationship between Bitcoin and Trump's policies mentioned in the script?

-While there is no direct correlation between Trump's election and Bitcoin, the speaker believes Bitcoin should be part of a balanced portfolio due to its potential as a digital asset.

What are the potential risks of investing in the IYE ETF, which focuses on oil and gas?

-The IYE ETF could be sensitive to economic recessions, as oil prices can be volatile and the sector may suffer during downturns.

What is the significance of diversification in an investment portfolio as discussed in the video?

-Diversification helps manage risk by spreading investments across different sectors and asset classes to navigate various economic conditions.

What does the speaker mean by 'directional bets' in investing?

-Directional bets refer to making investments based solely on predictions about economic downturns, which the speaker advises against to avoid missing other opportunities.

How does the speaker suggest preparing for potential economic crises?

-The speaker recommends maintaining a diversified portfolio that includes cash, precious metals, the dollar index, and sector-specific ETFs to be resilient during downturns.

What insights does the speaker provide about the banking sector under a Trump administration?

-Trump's focus on deregulation could lead to increased profitability for banks, but there are also risks of a banking crisis that could affect even major institutions.

What does the speaker imply about the historical performance of Bitcoin in relation to models like Stock-to-Flow?

-The speaker notes that despite Bitcoin's recent price movements, it remains undervalued according to the Stock-to-Flow model, indicating potential for future growth.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

MSTR Financial Jiu-Jitsu: Saylor’s Savage Capital Market Checkmate! 🔥🔥🔥

Harris, Trump prepare for ABC News debate on Sept. 10

Three Indicators that Trump Will Win

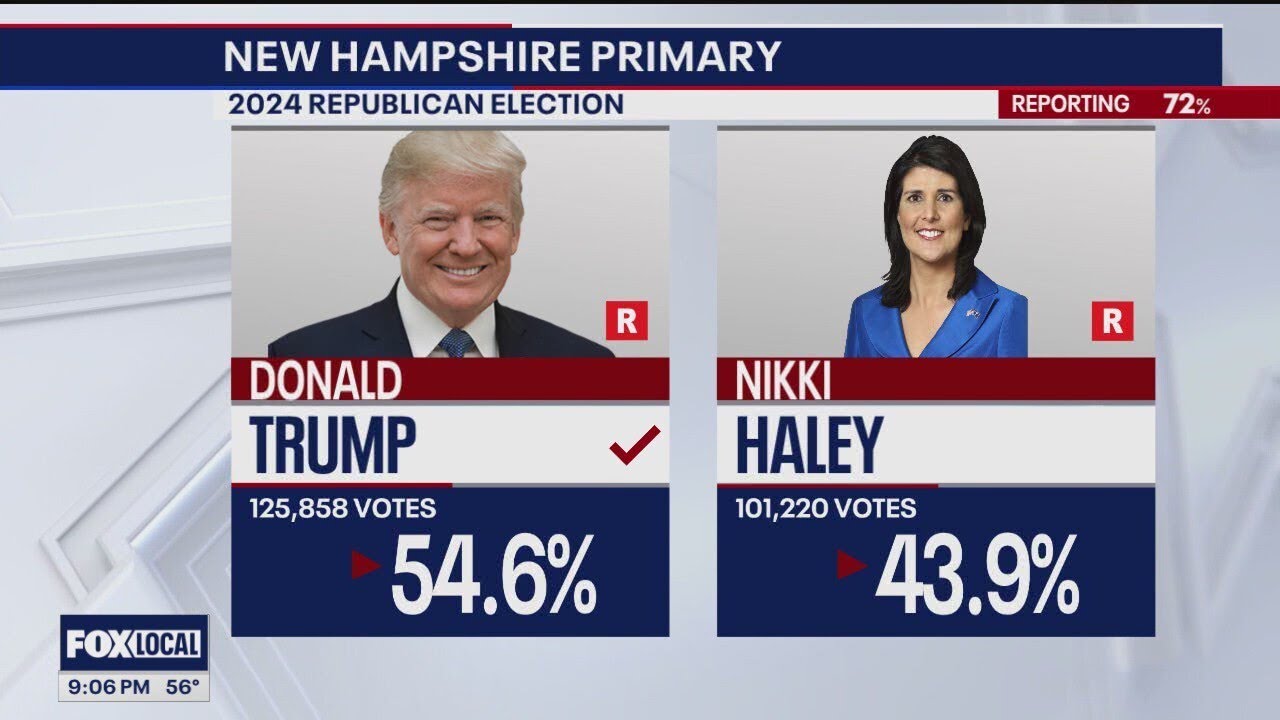

Donald Trump wins New Hampshire primary - Now what?

What can Germany expect with Harris or Trump? | DW News

Trump challenged ‘crooked Joe’ to a golf match: Gutfeld

5.0 / 5 (0 votes)