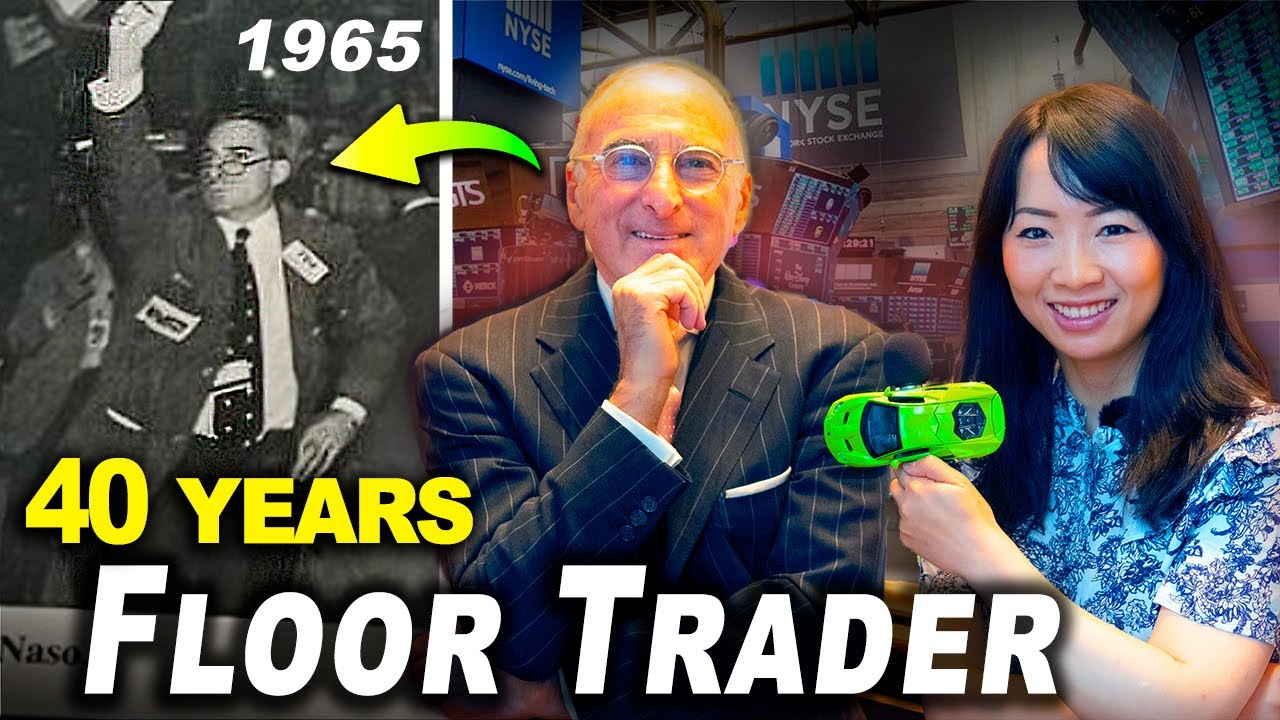

i asked @TraderTom if banks hunt my stop loss (lol)

Summary

TLDRIn an insightful interview, former institutional trader Tom Hogard shares his perspectives on trading psychology and strategy. He emphasizes the importance of mindset over technical skills, arguing that a strong mental framework helps traders navigate losses and drawdowns effectively. Hogard advocates for situational analysis to understand market behavior, rather than solely relying on traditional technical analysis. He also critiques the retail trading education landscape, highlighting the need for authenticity and resilience in teaching, particularly regarding the realities of loss. Overall, Hogard's insights encourage a balanced approach to trading that prioritizes psychological strength and genuine learning.

Takeaways

- 😀 Trading mindset is crucial: A strong mental framework is essential for enduring drawdowns and making successful trades.

- 😀 Reinventing oneself: Personal growth and self-belief can enhance trading performance, often requiring unlearning negative influences from upbringing.

- 😀 Love for trading: A genuine passion for the trading process is necessary for long-term success in the field.

- 😀 Situational analysis over technical analysis: Analyzing market behavior session by session can provide valuable insights and trading opportunities.

- 😀 Importance of scaling: While scaling into winning trades can be beneficial, traders should be cautious to avoid adding to losing positions.

- 😀 Responsibility for losses: Traders must take ownership of their mistakes rather than blaming market conditions or external factors.

- 😀 The significance of order placement: Knowing where the crowd places their stop losses can inform better trading decisions.

- 😀 Avoiding biases: Successful trading requires a flexible mindset that is open to market conditions rather than adhering strictly to personal biases.

- 😀 Education in trading: The quality of trading education is often compromised by those who prioritize wealth over genuine mentorship.

- 😀 Vulnerability in trading: Acknowledging losses and showing vulnerability is a strength that can lead to greater learning and resilience.

Q & A

What is the main focus of Tom Hogard's trading philosophy?

-Tom Hogard emphasizes the importance of mindset over technique, arguing that a strong mental foundation is essential for navigating the inevitable drawdowns in trading.

Why does Tom believe mindset is crucial for traders?

-He believes that without a strong mindset, traders are likely to abandon their strategies at the first sign of failure, regardless of how effective those strategies may be.

What does Tom Hogard mean by 'situational analysis'?

-Situational analysis involves assessing market behavior based on specific conditions and historical patterns rather than relying solely on technical indicators.

Can you provide an example of situational analysis mentioned by Tom?

-He notes that if the high of a Friday trading session is lower than that of the previous Thursday, there's a strong likelihood that the low of the Friday session will be revisited the following Monday.

How does Tom approach scaling in and out of positions?

-Tom tends to add to winning trades but acknowledges that this can be a flaw. He stresses the importance of careful evaluation to avoid losing control when adding to positions.

What is Tom's stance on the conspiracy theory regarding institutions hunting retail traders' stop losses?

-Tom refutes the idea, citing that retail traders only make up about 5% of daily trading volume, making them insignificant targets for institutions.

How does Tom view the role of algorithms in trading?

-He believes there is no single controlling algorithm and emphasizes personal accountability, stating that traders should take responsibility for their losses rather than blaming external factors.

What does Tom suggest about the importance of learning from losses?

-He stresses that handling losses is crucial for becoming a successful trader and that educators should focus more on this aspect rather than only showcasing wins.

What is Tom's perspective on retail trading education?

-Tom expresses concern over the prevalence of deceit among trading educators, noting that many prioritize showcasing their wealth over teaching effective trading strategies.

How does Tom define subjectivity in trading?

-He describes subjectivity as having a bias, emphasizing that he does not trade with a fixed bias but rather remains open to market conditions, allowing for a more flexible approach.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Turning failure into success: how to master trading psychology | Instant Funding Trader Interview

Day Trader Turns £100k to £1.5m in 8 Months w/ Tom Hougaard (Part 3)

How to Trade Like The Big Banks | Smart Money JP Morgan Trader Kathy Lien

How To Trade Forex For Beginners in 2024 | Full Tutorial

Veteran Wall Street Trader Reveals Strategies Used At Stock Exchanges

What Do Hedge Funds Think of Technical Analysis?

5.0 / 5 (0 votes)