Investing for Teenagers

Summary

TLDRIn this follow-up video, the hosts address teens eager to learn about investing. They highlight the significance of responsible money management and congratulate young viewers for seeking financial knowledge. While they stress they aren't financial experts, they share practical advice: set up a joint account with parents at Vanguard, opt for a Roth IRA, and invest in a Target Retirement Date fund. They also caution against investing all savings, advising viewers to keep some funds available for emergencies. The overall message promotes early financial planning for a more secure future.

Takeaways

- 😀 Managing money responsibly at a young age leads to a better financial future.

- 😀 It's essential to involve parents when setting up investment accounts as a minor.

- 😀 Vanguard is recommended for its low fees and investor-friendly practices.

- 😀 A minimum of $1,000 is needed to open an account at Vanguard.

- 😀 A Roth IRA is suggested for teenagers due to low tax implications.

- 😀 Target retirement date funds are a suitable investment option for beginners.

- 😀 Diversifying investments can be beneficial as you accumulate more funds.

- 😀 It's important to keep some money in savings for unexpected emergencies.

- 😀 Avoid investing all available funds; maintain liquidity for unforeseen expenses.

- 😀 The advice given is personal and should be tailored to individual circumstances.

Q & A

What is the main focus of the video?

-The video discusses how teenagers can start investing responsibly, particularly focusing on using a Roth IRA with Vanguard.

Why is it important for teenagers to manage their money?

-Managing money responsibly can lead to a better and easier life, setting a strong foundation for future financial health.

What type of investment account do the hosts recommend for teenagers?

-They recommend setting up a Roth IRA, as it is beneficial for those paying low taxes.

What is the minimum amount needed to set up an account at Vanguard?

-You need at least $1,000 to set up an account at Vanguard.

What should teenagers do if they don't have $1,000 yet?

-They should save their money in a bank account and continue adding to it until they reach the required amount.

What specific fund do the hosts suggest for teenagers investing in a Roth IRA?

-They suggest the Target Retirement Date 2016 fund as a suitable option.

Why is it advised not to invest all available money?

-It's important to keep some funds accessible for emergencies or unexpected expenses.

What is the analogy used to explain keeping money for emergencies?

-The analogy compares the money set aside for emergencies to a gift to your future self, which you can't access without a time machine.

What are the benefits of choosing Vanguard as an investment platform?

-Vanguard is favored for its low fees and because it is not shareholder-owned.

How should teenagers involve their parents in the investment process?

-Teenagers need their parents' assistance to set up a joint account since they cannot do it alone under the age of 18.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Potret Pendidikan di Dusun Terpencil

English Conversations in the Workplace - Phrasal Verbs for the Office

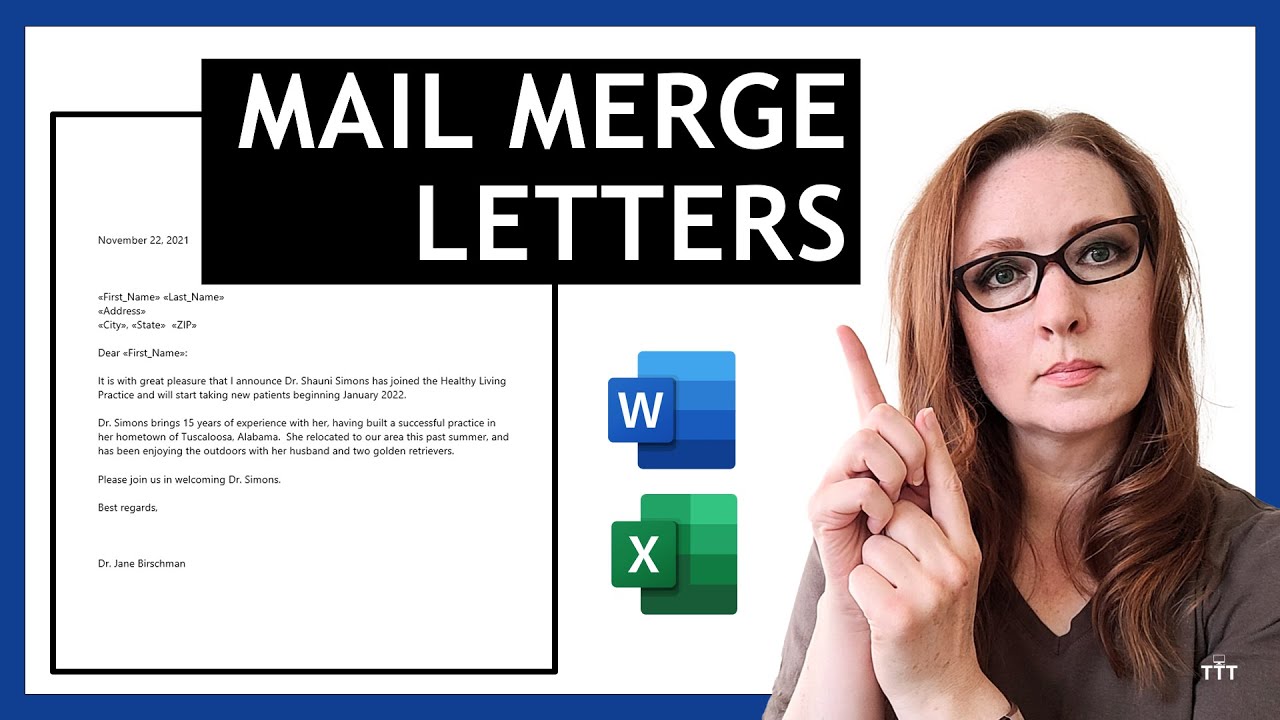

How to Create LETTERS in Microsoft Word Using Mail Merge | Use List From Microsoft Excel

The Student Volunteers Oman Scheme

McDonald's | employer brand campaign

Course Trailer: Learning How to Learn with Hutata

5.0 / 5 (0 votes)