Capital Gains Tax Changes: What You Need to Know

Summary

TLDRIn a recent federal budget announcement, Canada has changed its capital gains tax, increasing the inclusion rate for corporations and higher earners while leaving the first $250,000 of individual gains untouched. This shift could impact over a million Canadians and potentially reduce GDP by up to $90 billion. While primary residences remain exempt, the changes primarily affect property investors—often ordinary citizens saving for their future. The speaker emphasizes the need for clarity and confidence in Canadian investments amid these changes, urging viewers to consider how this will affect their financial decisions.

Takeaways

- 😀 Canada is changing capital gains tax exemptions, affecting how gains are taxed for individuals and corporations.

- 😀 The capital gains inclusion rate for corporations has increased from 50% to 66.67%.

- 😀 Individuals will continue to have a 50% inclusion rate on the first $250,000 of capital gains, with gains above that taxed at 66.67%.

- 😀 Primary residences remain exempt from capital gains tax, provided certain conditions are met.

- 😀 Approximately 1.26 million Canadians could be impacted by these changes in their lifetime.

- 😀 The changes may generate up to $90 billion in potential impacts on Canada’s GDP.

- 😀 Many property investors are regular individuals saving for their futures, not large corporations.

- 😀 The new rules could erode confidence in real estate investments among Canadians.

- 😀 It's crucial for individuals to consult accountants for personalized tax advice regarding these changes.

- 😀 The government aims to create a fairer tax system, but many view these changes as a cash grab against hardworking Canadians.

Q & A

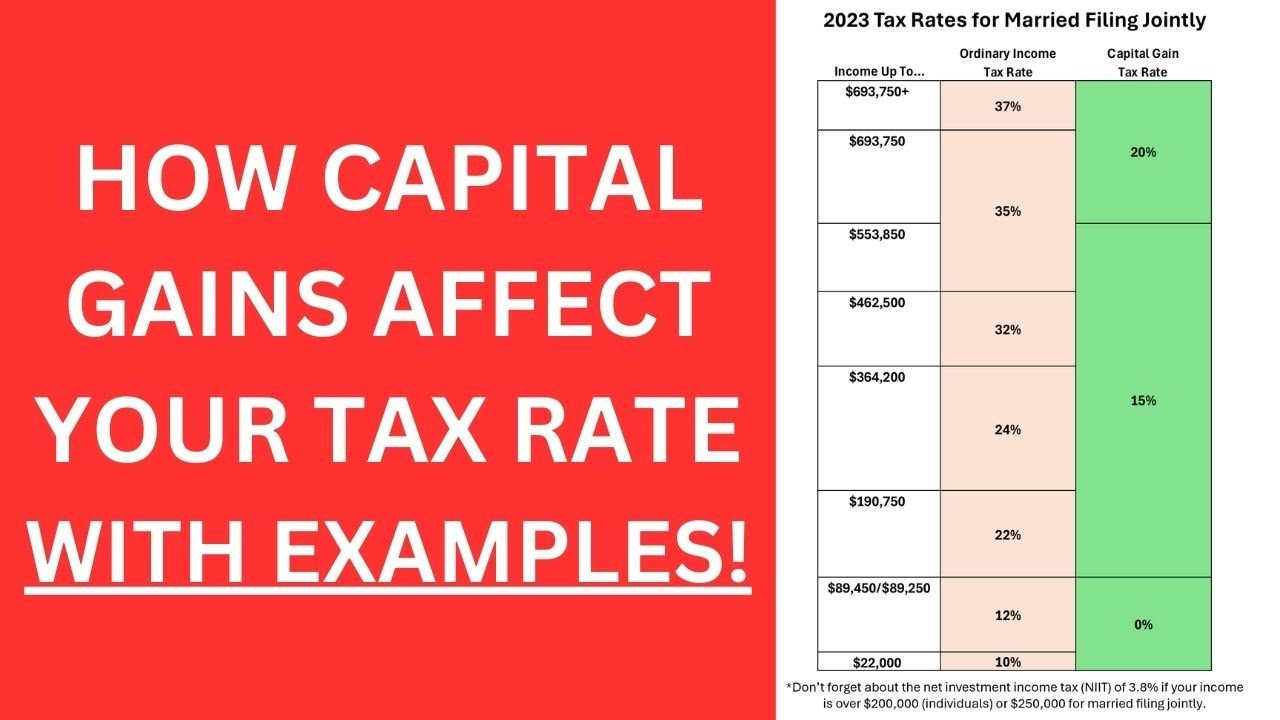

What is a capital gain?

-A capital gain is the increase in value of an asset, such as a property, when sold for more than its purchase price.

How has the capital gains inclusion rate changed for corporations in Canada?

-The inclusion rate for corporations has increased from 50% to 66.67%.

What is the new capital gains inclusion rate for individuals?

-Individuals will continue to have a 50% inclusion rate on the first $250,000 of capital gains, but any gains above that will be taxed at 66.67%.

How many Canadians are expected to be affected by these changes?

-Over a million Canadians are likely to be affected by these changes in their lifetime.

What impact could these changes have on Canada's GDP?

-The changes could potentially affect Canada's GDP by up to $90 billion.

Will homeowners living in their primary residences be affected by the new capital gains tax rules?

-No, homeowners living in their primary residences will remain exempt from capital gains tax, provided they don't rent it out or use it for business.

Who are the primary targets of these new capital gains tax changes?

-The changes primarily target property investors, who often face scrutiny regarding housing affordability.

What should Canadians with capital losses do in light of these changes?

-Canadians with capital losses should consult their accountants, as these losses can offset capital gains.

What is the potential impact on investor confidence regarding Canadian real estate?

-The changes may create uncertainty and reduce confidence among investors who might feel that rules can change unexpectedly.

What should individuals do if they have specific questions about how these changes affect their situation?

-Individuals should consult their accountants for personalized tax advice and clarification on how these changes may impact them.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

How the rich avoid paying taxes

STOP Investing in Real Estate: The Worst Asset Ever!

how long term capital gain tax rule will benefits or become curse real estate

The Truth About the UK Budget 2024

Comprehensive Analysis of Union Budget 2024 | Initiatives, Schemes and Statistics Explained

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

5.0 / 5 (0 votes)