How the rich avoid paying taxes

Summary

TLDRThe video script explores the disparity in the U.S. tax system, highlighting Warren Buffett's lower tax rate compared to his secretary despite his wealth from Berkshire Hathaway and investments. It delves into capital gains tax advantages for the wealthy, such as 'stepped-up basis' and the potential for untaxed wealth through stock holdings. The script also discusses President Biden's proposal to increase capital gains tax rates for high earners and the debate around its impact on investment and tax fairness.

Takeaways

- 💼 Warren Buffett, the CEO of Berkshire Hathaway, has amassed his wealth through the company's ownership of various businesses and investments.

- 📈 Berkshire Hathaway's stock value has increased significantly since Buffett took over, with a single share worth nearly half a million dollars today.

- 🤑 Buffett owns a large number of Berkshire Hathaway shares, which form the basis of his wealth.

- 💰 Despite his wealth, Buffett pays a lower tax rate than his secretary due to the difference in the types of taxes levied on their income.

- 📊 The disparity in after-tax income between the richest Americans and the middle class has been growing, with the rich seeing a much higher increase in income over the past 40 years.

- 🏦 Morris, a retired Wall Street worker, represents the one percent who advocate for higher taxes on the wealthy to support a robust middle class.

- 📈 Investments, such as stocks and real estate, are taxed as capital gains at a lower rate than income tax, benefiting the wealthy.

- 💼 The tax system allows for significant wealth accumulation without taxation until assets are sold, as illustrated by Jeff Bezos' situation with Amazon stock.

- 💡 Some billionaires, like Elon Musk, leverage loans against their stocks to avoid selling and incurring taxes, further minimizing their tax obligations.

- 🔄 The 'stepped-up basis' loophole allows the wealthy to pass on investments to heirs without paying taxes on the original gains, perpetuating wealth accumulation without taxation.

- 🏛️ President Biden has proposed changes to capital gains tax, including closing the 'stepped-up basis' loophole and increasing tax rates for high-income earners, to address tax inequality.

- 💡 Advocates suggest that changing capital gains taxes is a starting point for a fairer tax system, although it is not a comprehensive solution to wealth inequality.

Q & A

Who is Warren Buffett and what is his connection to Berkshire Hathaway?

-Warren Buffett is one of the richest people in the world, known for running Berkshire Hathaway, a holding company that owns various businesses including Geico, Dairy Queen, and a significant railroad. His wealth is largely tied to the performance of these companies and the stock he owns.

What was the value of a single share of Berkshire Hathaway when Buffett took over in 1965, and what is it worth today?

-When Warren Buffett took over Berkshire Hathaway in 1965, a single share was worth $19. As of the script's date, it's worth nearly half a million dollars.

How many shares of Berkshire Hathaway does Warren Buffett own, and what does this signify about his wealth?

-Warren Buffett owns nearly 240,000 shares of Berkshire Hathaway. This signifies a substantial portion of his wealth, as the value of these shares is tied to the success of the companies Berkshire Hathaway holds.

Why does Warren Buffett pay a lower tax rate than his secretary?

-Warren Buffett pays a lower tax rate than his secretary because of the difference in the types of taxes they pay. His secretary pays income taxes on her salary, while Buffett primarily pays capital gains taxes on his sold stock, which are taxed at a lower rate.

What is the disparity in after-tax income growth between the richest Americans and the middle class over the last 40 years?

-In the last 40 years, the after-tax income of the richest Americans has risen more than 400%, while the middle class income has only risen by 50%, indicating a significant disparity.

How does the tax system treat income from investments differently from income from a regular job?

-Income from investments, such as stocks and real estate, is taxed as capital gains, which often have a lower tax rate compared to income taxes paid on a regular job, which can range from 10 to 37 percent.

What is the 'stepped-up basis' loophole in capital gains taxes, and how does it benefit the wealthy?

-The 'stepped-up basis' loophole allows the cost basis of an inherited asset to be 'stepped up' to its market value at the time of inheritance. This means that when the inheritor sells the asset, they only pay taxes on the gain since the inheritance, not the original gain made by the decedent, effectively avoiding taxes on the initial appreciation.

What is President Biden's proposal regarding capital gains taxes for high-income earners?

-President Biden has proposed closing the 'stepped-up basis' loophole and increasing the maximum capital gains tax rate from 20% to 39.6%, but only for people making more than a million dollars a year.

What are some potential criticisms of changing the capital gains tax rate for the wealthy?

-Critics argue that changing the capital gains tax rate might discourage investment in the stock market or lead to current millionaires selling less stock, potentially impacting market dynamics.

How could changing capital gains taxes potentially impact tax revenue?

-Changing capital gains taxes could bring in more tax revenue, with estimates ranging from $200 billion over ten years to possibly double that amount, depending on the specifics of the policy change.

What alternative tax measures are suggested to make the tax system fairer for the wealthy?

-Some suggested measures to make the tax system fairer include implementing wealth taxes and taxes on gains in the stock market, which could help address the issue of wealth concentration.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Can India Fix Its Rural Poverty Problem?

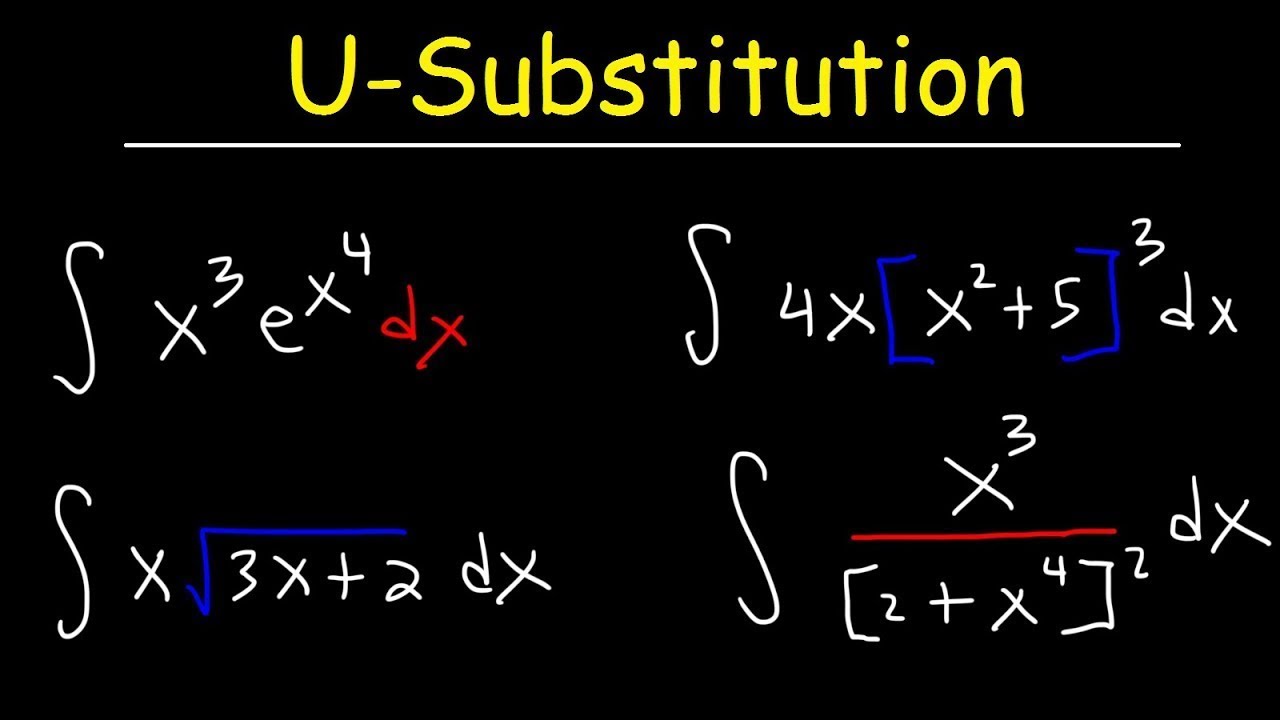

How To Integrate Using U-Substitution

For Oom Piet - Poem Analysis

Insight: Ship Pollution

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Unit Step Signal: Basics, Function, Graph, Properties, and Examples in Signals & Systems

5.0 / 5 (0 votes)