Elements of Financial Statement - Part 1

Summary

TLDRThis video lesson introduces the five key elements of financial statements: assets, liabilities, equity, income, and expenses. It emphasizes their foundational role in bookkeeping and accounting, illustrating how all business transactions can be classified under these categories. The video explains the importance of understanding these elements for maintaining balanced accounts through the accounting equation. Definitions and classifications of assets and liabilities are provided, along with practical examples, highlighting their significance in financial reporting and decision-making within a business context.

Takeaways

- 😀 Financial statements include income statements, statements of changes in equity, and balance sheets, which are essential for understanding a business's financial position.

- 😀 The five elements of financial statements are assets, liabilities, equity, income, and expenses, and all transactions are categorized under these elements.

- 😀 Assets are defined as resources controlled by a business that provide future economic benefits, resulting from past transactions.

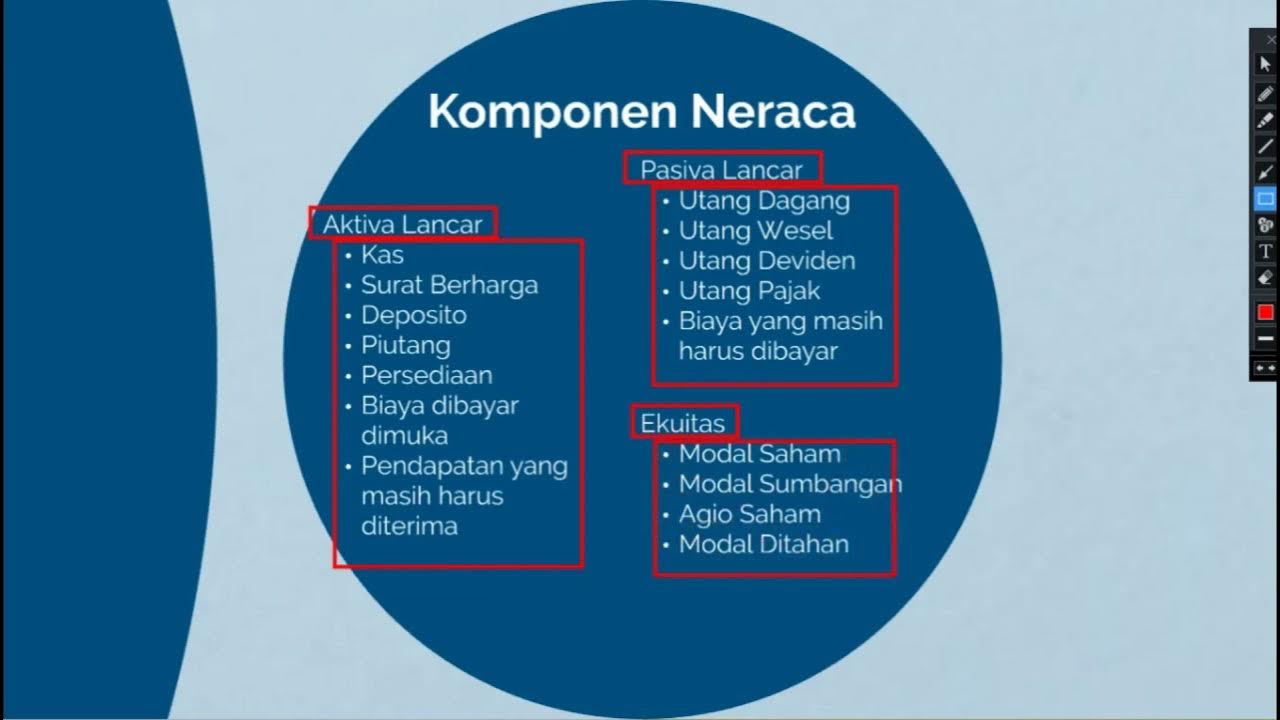

- 😀 Assets are classified into current assets, expected to be realized or consumed within one year, and non-current assets, which are used for more than one year.

- 😀 Liabilities are present obligations arising from past transactions that require an outflow of resources from the business.

- 😀 Similar to assets, liabilities are categorized into current liabilities, due within one year, and non-current liabilities, due beyond one year.

- 😀 Equity represents the residual interest in a company's assets after liabilities are deducted, indicating ownership value.

- 😀 Understanding these financial elements is crucial for accurate bookkeeping and accounting, ensuring all transactions are correctly recorded.

- 😀 The accounting equation (Assets = Liabilities + Equity) must always hold true to maintain balanced financial statements.

- 😀 Notes to the financial statements are important for explaining accounting policies and providing details that enhance the understanding of financial reports.

Q & A

What are the five main elements of financial statements?

-The five main elements of financial statements are assets, liabilities, equity, income, and expense.

Why is it important to understand the elements of financial statements?

-Understanding these elements is crucial because they are the foundations of bookkeeping and accounting, and all transactions will be captured under these elements in financial statements.

What is the accounting equation mentioned in the transcript?

-The accounting equation is that assets must always equal liabilities plus equity.

How are assets classified?

-Assets are classified into current assets and non-current assets. Current assets are expected to be realized in cash or consumed within a year, while non-current assets are used for longer periods, typically more than one year.

What defines an asset?

-An asset is defined as a resource controlled by the business, resulting from a past event, and expected to provide future economic benefits.

Can you give an example of an asset?

-An example of an asset is a delivery van owned by a business, as it is controlled by the business and provides economic benefits through delivery services.

What are the three keywords that define a liability?

-The three keywords that define a liability are: present obligation, arising from a past transaction, and resulting in an outflow of resources.

How are liabilities classified?

-Liabilities are classified into current liabilities, which are due within the next 12 months, and non-current liabilities, which are due in more than 12 months.

What is the role of notes to the accounts in financial reporting?

-Notes to the accounts provide crucial information about accounting policies and detailed explanations of figures presented in financial statements, helping users understand the context behind the numbers.

What is the difference between tangible and intangible assets?

-Tangible assets have a physical form, like machinery or buildings, while intangible assets lack physical form and include legal rights such as patents, copyrights, and trademarks.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)