How These Companies Are Taking Over Car Dealerships

Summary

TLDRThe U.S. auto dealership landscape is undergoing dramatic change, with over 16,000 dealerships, primarily small businesses, facing challenges from online competition and rising vehicle prices. Larger groups like Lithia Motors and AutoNation are rapidly acquiring smaller dealers, leading to record profits despite customer dissatisfaction with dealer markups. While franchise laws protect traditional dealerships, their relevance may be tested as direct-selling manufacturers like Tesla gain traction. With only 2% market share in new vehicle sales, major players have ample room for growth, potentially signaling the slow decline of family-owned dealerships in favor of larger corporate entities.

Takeaways

- 😀 The U.S. auto dealership market comprises over 16,000 dealerships, primarily small businesses.

- 📈 Large dealership groups are rapidly consolidating smaller shops, especially after the pandemic-induced price surge.

- 💰 Major publicly traded dealership groups like AutoNation and Lithia Motors have seen significant profit growth, with net incomes skyrocketing during the pandemic.

- 🚗 The average profit margin for dealerships has improved from 1% during the financial crisis to approximately 2.2% in recent years, aided by low inventory and high demand.

- 🔄 The pace of dealership acquisitions has accelerated, with major groups completing hundreds of acquisitions annually to expand their market presence.

- 🛒 Direct sales models from companies like Tesla are challenging traditional dealership practices, prompting discussions about the future of franchise laws.

- 😡 Consumers are increasingly frustrated with dealer markups, which could lead to legislative changes impacting dealership operations.

- 🔧 Parts and service revenue is critical for dealerships, contributing significantly to overall profit margins.

- 🌐 The shift towards online car sales is transforming the dealership landscape, with companies investing in technology to improve customer experiences.

- 🔍 Despite the success of large dealership groups, the market remains fragmented, with substantial opportunities for growth and acquisition in the future.

Q & A

What is the current state of auto dealerships in the U.S.?

-There are over 16,000 auto dealerships in the U.S., primarily consisting of small businesses, but larger dealership groups are acquiring smaller ones, indicating a trend toward consolidation.

How has the COVID-19 pandemic affected the auto dealership market?

-The pandemic led to soaring new car prices and a frenzy of acquisitions as demand surged while inventory remained tight due to production shutdowns and supply chain issues.

Which companies are the major publicly traded auto dealership groups?

-The six publicly traded auto dealership companies mentioned include AutoNation, Lithia Motors, and Penske, with Lithia recently surpassing AutoNation in sales.

What were the sales figures for AutoNation and Lithia Motors between 2020 and 2021?

-Between 2020 and 2021, AutoNation's net income rose from $382 million to $1.4 billion, while Lithia Motors saw its sales nearly double, with net income increasing from $470 million to nearly $1.1 billion.

What challenges do auto dealerships face in the current market?

-Auto dealerships face challenges from changing consumer preferences for online buying, high vehicle prices, and criticism over dealer markups, as well as competition from manufacturers like Tesla that sell directly to consumers.

How do franchise laws impact auto dealerships?

-Franchise laws were designed to protect dealers from competition and unfair treatment from automakers, requiring new cars to be sold through dealers, which benefits dealerships but may be challenged by direct-to-consumer models.

What strategies are major dealership groups using to maintain profitability?

-Major dealership groups are focusing on acquisitions, investing in technology, and enhancing online sales capabilities to improve efficiency and drive profitability.

How is the profitability of dealerships changing in light of current market conditions?

-Dealerships are experiencing higher profitability per unit sold due to lower inventory and reduced discounting, resulting in significant increases in both sales and net income compared to pre-pandemic periods.

What impact do dealer markups have on consumer perceptions?

-High dealer markups have generated consumer dissatisfaction, leading to concerns that could influence legislation and affect the reputation of dealerships.

What future trends are anticipated in the auto dealership industry?

-The auto dealership industry is expected to continue consolidating, with major players aiming to increase their market share and expand their online presence, while remaining aware of competition from other dealerships and direct sales models.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Embedded Linux | Introduction To U-Boot | Beginners

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

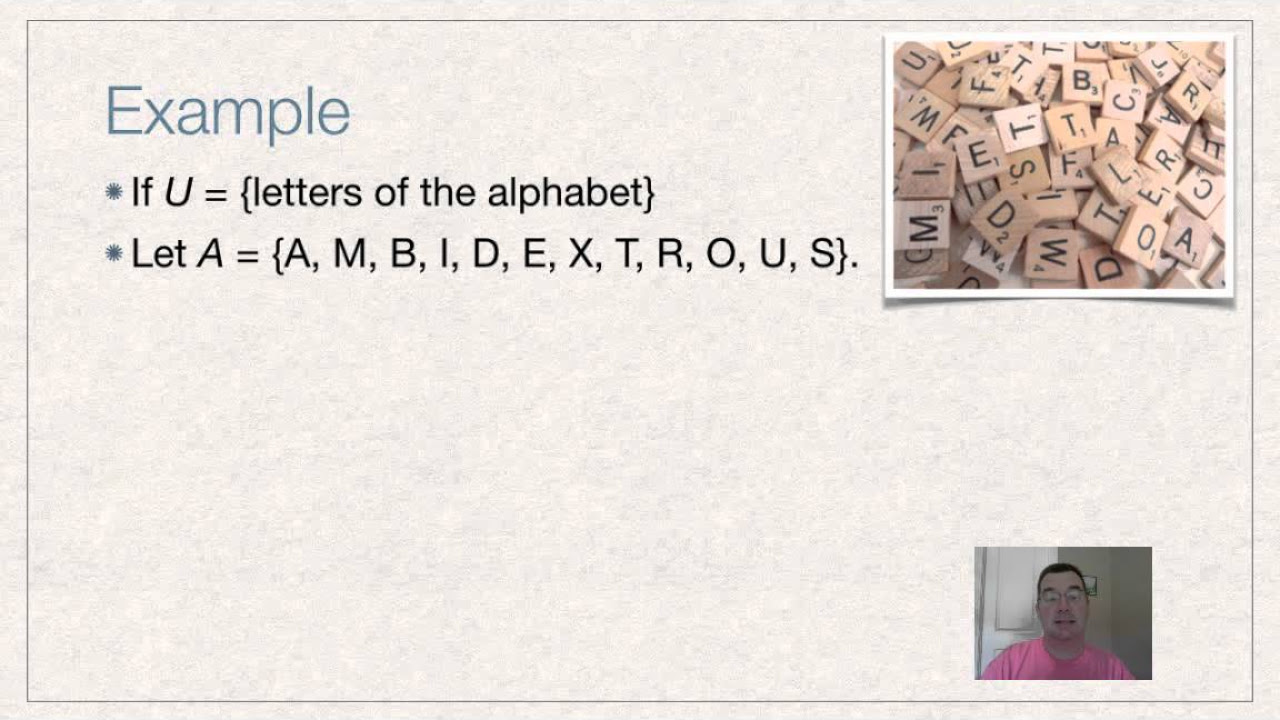

Complements of Sets

Kalah 6-0 dari Korea Utara, Timnas Indonesia U17 Gagal ke Semifinal Piala Asia

TIMNAS INDONESIA U17 KALAH SEGALANYA DARI KORUT DAN TERSINGKIR DARI PIALA ASIA!

5.0 / 5 (0 votes)