GE-McKinsey matrix

Summary

TLDRThe GE McKinsey Matrix, developed by General Electric and McKinsey in 1971, is a strategic tool for analyzing a company's business portfolio by assessing industry attractiveness and business unit strength. Unlike the BCG Matrix, which uses a 2x2 structure, the GE McKinsey Matrix employs a 3x3 grid, dividing it into nine distinct areas that inform specific growth, investment, and divestment strategies. This detailed analysis helps organizations effectively determine which business divisions or products to prioritize, guiding them towards informed decisions for optimal resource allocation and competitive positioning.

Takeaways

- 😀 The GE McKinsey Matrix is a strategic tool for analyzing a company's business portfolio, developed by General Electric and McKinsey in 1971.

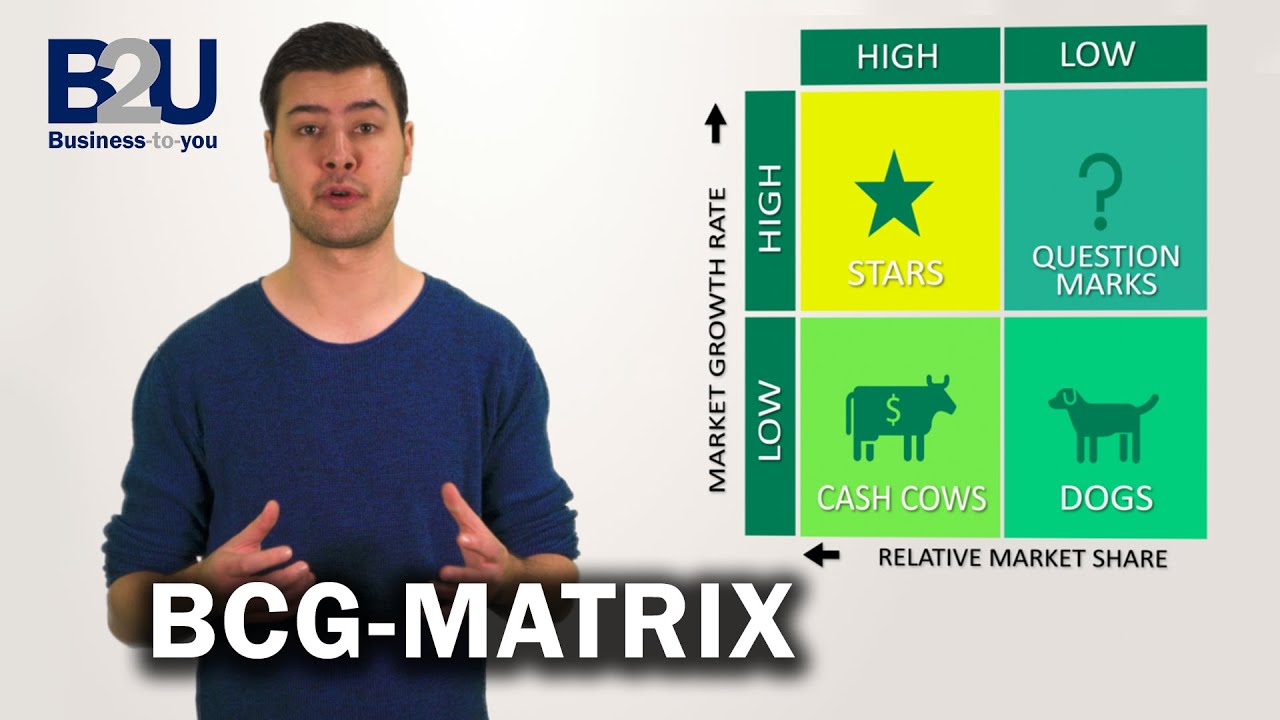

- 📊 Unlike the BCG Matrix, which focuses on market growth rate and market share, the GE McKinsey Matrix evaluates industry attractiveness and business unit strength.

- 🔍 The GE McKinsey Matrix consists of a 3x3 grid, categorizing Strategic Business Units (SBUs) into nine distinct areas based on high, medium, and low evaluations.

- 📈 The vertical axis represents industry attractiveness, analyzing external factors such as market size, growth rate, and competition intensity.

- 💪 The horizontal axis assesses business unit strength, evaluating internal factors like market share, revenue growth, and product quality.

- 🌱 Zone 1 (Premium Area) indicates high industry attractiveness and strength, requiring investment for growth strategies.

- 💼 Zone 4 (Selective Invest or Divest Area) is characterized by high attractiveness but low strength, necessitating selective investment in niche markets.

- 💸 Zone 9 (Harvest or Divest Area) reflects low attractiveness and strength, suggesting an exit from the market while maximizing cash generation.

- 🔄 The matrix helps companies develop specific portfolio strategies based on the competitive positioning of their SBUs.

- 📝 Creating the GE McKinsey Matrix involves evaluating each SBU's attractiveness and strength, represented as circles, with their size indicating total industry revenue.

Q & A

What is the purpose of the GE McKinsey Matrix?

-The GE McKinsey Matrix is a strategic tool used to analyze corporate-level competitiveness and provides insights into a company's business portfolio by evaluating which business divisions or products to promote.

How does the GE McKinsey Matrix differ from the BCG Matrix?

-While the BCG Matrix focuses on market growth rate and market share, the GE McKinsey Matrix evaluates industry attractiveness and business unit strength, offering a more nuanced approach with a three-by-three matrix structure.

What are the two main factors analyzed in the GE McKinsey Matrix?

-The two main factors analyzed in the GE McKinsey Matrix are industry attractiveness and business unit strength.

How is the GE McKinsey Matrix structured?

-The GE McKinsey Matrix is structured as a three-by-three grid, where the vertical axis represents industry attractiveness (high, medium, low) and the horizontal axis represents business unit strength (high, medium, low), resulting in nine distinct areas.

What strategy is suggested for Zone 1 of the GE McKinsey Matrix?

-Zone 1, known as the Premium Area, suggests a growth strategy that actively invests to protect the current market leader position and to enter new markets.

What does Zone 4 of the GE McKinsey Matrix represent?

-Zone 4 is called the Selective Invest or Divest Area, representing high industry attractiveness but low business unit strength, where a selective invest or divest strategy is needed to find niche markets or promising business units.

Which area of the GE McKinsey Matrix is categorized as requiring a harvest or divest strategy?

-Zone 9, the Harvest or Divest Area, is categorized as requiring a strategy to exit the market quickly while maximizing cash generation, as both industry attractiveness and business unit strength are low.

What factors are evaluated to determine industry attractiveness in the GE McKinsey Matrix?

-Industry attractiveness is evaluated based on external factors such as market size, market growth rate, past profit trends, competition intensity, and market sensitivity to economic changes.

How does the GE McKinsey Matrix categorize business units?

-Business units are categorized based on their strength into three levels: high, medium, and low, considering factors like market share, revenue growth rate, pricing, cost advantage, product quality, financial strength, and technological level.

What is the significance of circle sizes in the GE McKinsey Matrix?

-In the GE McKinsey Matrix, the circle sizes represent the total revenue of the industry for the company's product, with the size of the arc indicating the company's market share within that industry.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

GE Matrix

Strategic Business unit - Meaning, Role, Characteristics, Structure, Models & Examples

SBL in Real Life : BCG Matrix at Unilever

SPACE Analysis or the SPACE Matrix with an example - Simplest Explanation Ever

BCG Matrix (With Real World Examples) | From A Business Professor

BCG Matrix (Growth-Share Matrix) EXPLAINED | B2U | Business To You

5.0 / 5 (0 votes)