Cash Flow vs. Profit: What’s the Difference? | Business: Explained

Summary

TLDRThis video explains the difference between two key financial metrics: cash flow and profit. Cash flow tracks the movement of money in and out of a business over a specific time, while profit measures the money left after all expenses are subtracted from revenues. The video highlights that a company can be profitable but have negative cash flow, or have positive cash flow without making a profit, as seen in startups. Both metrics offer essential insights into a company's financial health. More resources on financial metrics are available through the provided links.

Takeaways

- 💰 Cash flow and profit are two important financial metrics that are often confused by beginners.

- 📊 Cash flow refers to the net balance of cash moving in and out of a business at a specific time.

- 📈 Positive cash flow means more money is coming in than going out, while negative cash flow is the opposite.

- 📉 Profit is the remaining balance after all operating expenses are subtracted from revenues.

- 🔄 A negative profit indicates a loss, meaning the company spent more on operations than it earned.

- 💡 The main difference is that profit shows the leftover money after expenses, while cash flow represents the net cash movement during a certain period.

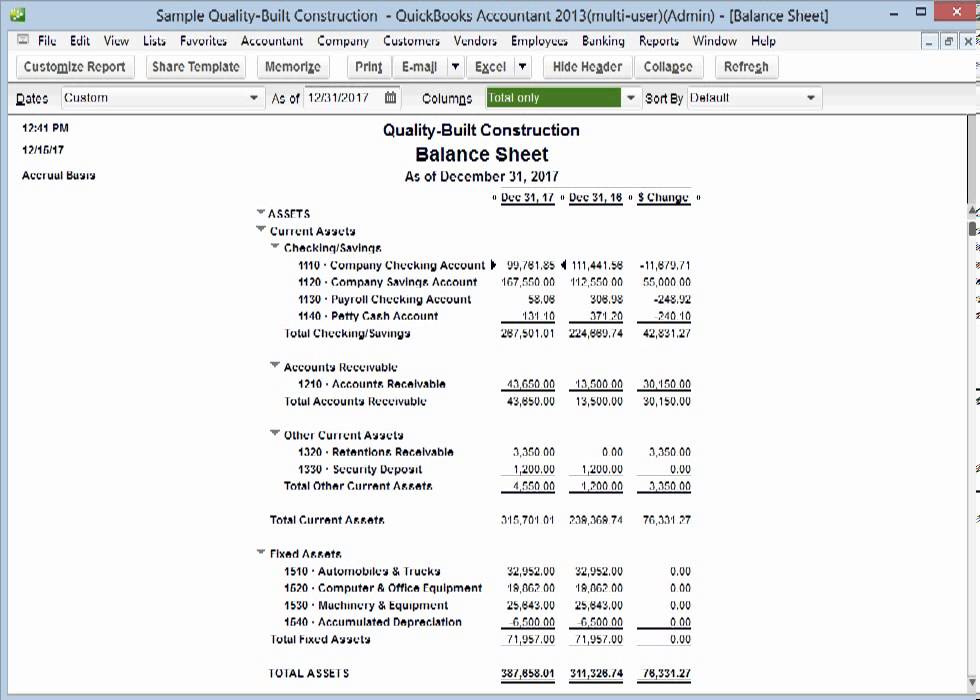

- 📝 Cash flow is reported on the cash flow statement, while profit is shown on the income statement or P&L statement.

- ⚖️ A company can be profitable but have negative cash flow, which may affect its ability to pay expenses or grow.

- 📉 Conversely, a company with positive cash flow might not make a profit, common in startups and scaling businesses.

- 🏦 Both cash flow and profit are critical metrics for evaluating a company's financial health.

Q & A

What is the key difference between cash flow and profit?

-The key difference is that profit refers to the amount of money left over after expenses are paid, while cash flow refers to the net flow of cash in and out of a business during a specific period.

What does positive cash flow indicate about a company?

-Positive cash flow indicates that a company has more money moving into the business than going out during a specific period.

What is a common misconception for those new to finance regarding cash flow and profit?

-A common misconception is confusing cash flow with profit. While both are key financial metrics, they measure different aspects of a business's financial health.

How is cash flow reported in financial statements?

-Cash flow is reported on the cash flow statement, which tracks the movement of cash in and out of a business.

How is profit typically reported in financial statements?

-Profit is reported on the income statement, also known as the profit and loss (P&L) statement.

Can a company be profitable but still have negative cash flow? Why or why not?

-Yes, a company can be profitable but still have negative cash flow if the timing of cash inflows and outflows causes more money to go out than come in, which can hinder its ability to pay expenses or grow.

What is the impact of negative cash flow on a company?

-Negative cash flow indicates that more money is going out of the business than coming in, which can hinder the company's ability to cover expenses, expand, or grow.

Why might a startup or scaling business have positive cash flow but fail to make a profit?

-A startup or scaling business might have positive cash flow due to investments or other cash inflows but fail to make a profit because their operating expenses exceed their revenue.

Which is more important: cash flow or profit?

-Neither cash flow nor profit is inherently more important. Both provide vital information about a company’s financial health and should be evaluated together.

What happens when a company's profit calculation results in a negative number?

-When a company’s profit calculation results in a negative number, it is typically called a loss, indicating that the company spent more money on operations than it earned from those operations.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

5.0 / 5 (0 votes)