#BITCOIN READY TO FOR A MAJOR MOVE?!?

Summary

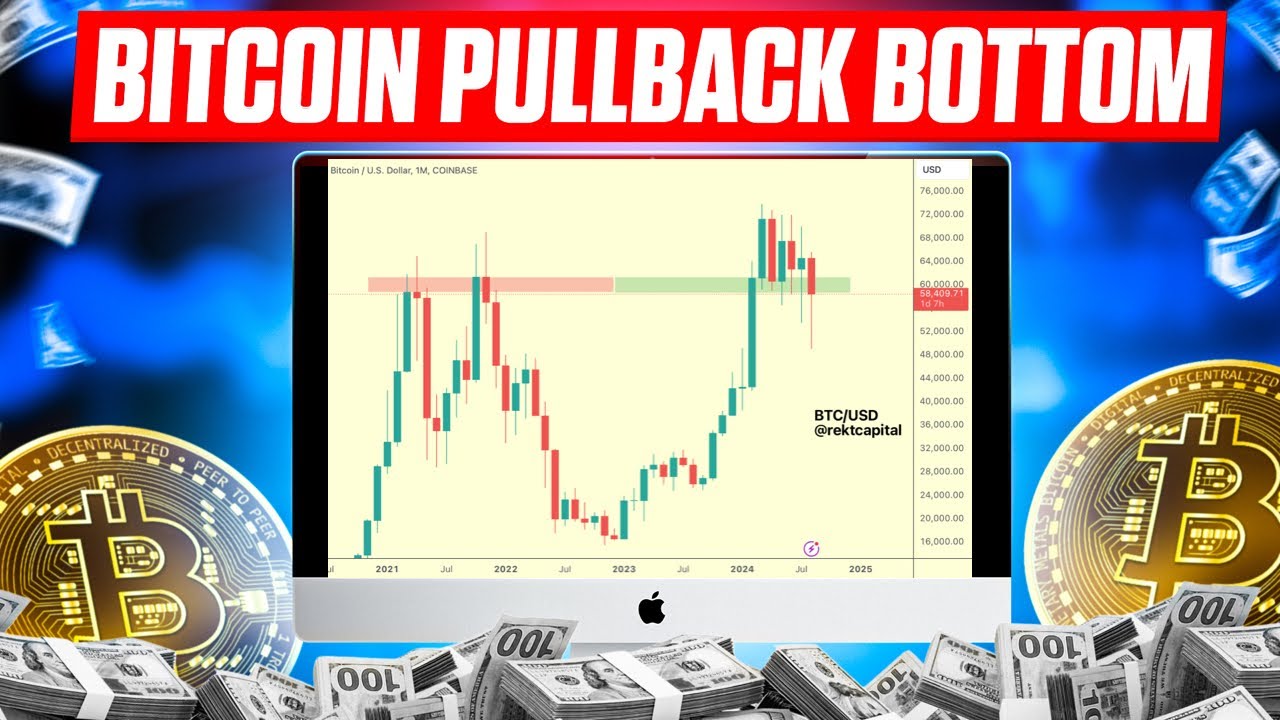

TLDRThe video discusses Bitcoin's current price action, focusing on a descending broadening wedge pattern. After a period of lower highs and lows, Bitcoin is just 16% away from an all-time high. The speaker highlights recent price resistance levels, the importance of the 128-day simple moving average (SMA), and how breaking above these could signal a major bullish trend. Despite short-term risks, long-term prospects are optimistic, with potential for Bitcoin to reach $102,000 within six months, supported by a recent breakout in the weekly RSI. The video emphasizes staying informed and engaged in the market.

Takeaways

- 📈 Bitcoin's chart recently showed a lower high around the $60,000 level, but sentiment has since improved with a breakout above resistance.

- 🚀 The video discusses a descending broadening wedge pattern in Bitcoin's chart, indicating a potential for a significant price movement.

- 📅 Bitcoin is close to achieving its first major higher high since August 25th, which could signal a bullish trend continuation.

- 📊 A breakout on the Daily RSI suggests strength in the recent uptrend, aligning with the price action.

- 🌟 The presenter is bullish on Bitcoin, predicting new all-time highs by the end of the year, likely in Q4.

- 📉 There is a mention of potential short-term downside risk with Bitcoin retesting the breakout zone before a significant move up.

- 📉 The descending broadening wedge pattern is considered difficult to trade due to the nature of lower highs and even lower lows.

- 📊 The 128-day SMA is highlighted as a significant moving average, historically playing a role in past cycles as support and resistance.

- 🌐 The presenter notes that the market is in a macro uptrend, with the Bulls in control since the beginning of 2023.

- 💹 If Bitcoin breaks above the $65,000 level, it could lead to a significant increase in confidence and a push to new all-time highs.

- 📉 The S&P 500's performance is tied to Bitcoin's, as there has never been a new Bitcoin all-time high without the S&P reaching new highs first.

Q & A

What was the situation with Bitcoin's chart just the other day?

-Just the other day, Bitcoin's chart showed another lower high around the 60,000 level, with bleak sentiment and frustrated investors.

What changed in the Bitcoin market after the FED and the Bulls stepped in?

-After the FED stepped in and the Bulls stepped in, Bitcoin broke above resistance and was very close to getting its first major higher high on the chart.

What is a descending broadening wedge pattern?

-A descending broadening wedge pattern is a chart pattern characterized by lower highs and even lower lows, making it difficult to anticipate and navigate for profit.

How close is Bitcoin to reaching an all-time high from its current price?

-From the current price, Bitcoin only needs to go up by 16% to reach a new all-time high.

What is the significance of the daily RSI breakout mentioned in the script?

-The daily RSI breakout indicates a shift in momentum, suggesting that the bullish trend might continue.

What is the current state of the market according to the script?

-As of September 25th, Bitcoin is hanging around 63,500, with the market experiencing a bit of a flat day.

What is the potential target for Bitcoin if it breaks out of the descending broadening wedge pattern?

-The potential target for Bitcoin, if it breaks out of the pattern, is $102,000 according to the textbook.

What is the role of the 128-day SMA in Bitcoin's past cycles?

-The 128-day SMA has been a significant support and resistance level in past cycles, marking key breakouts and breakdowns.

How many days has Bitcoin been above the 128-day SMA as of the script's recording?

-As of the script's recording, Bitcoin has been above the 128-day SMA for six days.

What is the correlation between the S&P 500 and Bitcoin all-time highs?

-There has never been a new Bitcoin all-time high without the S&P 500 first reaching new all-time highs.

What is the significance of breaking the weekly RSI downtrend?

-Breaking the weekly RSI downtrend suggests at least six months to a year of upside in the market.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

This Signal = 2025 Silver Boom (Silver Price Pullback Won't Last Long)

This Patterns Suggests A Major Failure Coming For Bitcoin

WARNING: BITCOIN JUST PRINTED CRYPTIC CANDLE – DO THIS NOW

BITCOIN $2 BILLION SHORT SQUEEZE NOW!!!! Bitcoin News Today & Ethereum Price Prediction!

Bitcoin Crashes Again - Where Is the Bottom?

TESLA Stock - Big Move Coming Next?

5.0 / 5 (0 votes)