Holding Period Return vs TIR: Comprendere le Differenze per Investire Meglio

Summary

TLDRThe video script delves into the strategic financial decision of reinvesting the coupon ('cedola' in Italian) from a bond or state title investment. It emphasizes the importance of considering the convexity concept, often overlooked in long-term interest rate speculations. The speaker introduces an improved, more automated model to compare the benefits of buying a bond index fund versus holding onto individual titles and reinvesting the coupons. The script discusses the impact of reinvestment on returns, the challenges of matching investment opportunities with the exact amount of coupons received, and the potential of investing coupons in stocks for potentially higher returns. It also touches on tax implications, the role of market tools in managing reinvestment, and the evergreen strategy of diversifying within the bond market to improve overall investment performance.

Takeaways

- 📈 The speaker discusses the importance of reinvesting the coupon of a bond, highlighting the impact it can have on long-term returns.

- 💡 The concept of convexity is mentioned, suggesting that it's often overlooked when considering long-term bond investments.

- 🤔 The speaker emphasizes that the choice between buying a bond index, a bond fund, or holding onto individual bonds depends on personal investment goals and time horizon.

- 💼 The role of bonds in an investment portfolio is highlighted, noting that they can range from low to high risk and duration.

- 💰 The speaker explains that reinvesting the coupon can significantly increase returns compared to simply collecting the coupon and not reinvesting it.

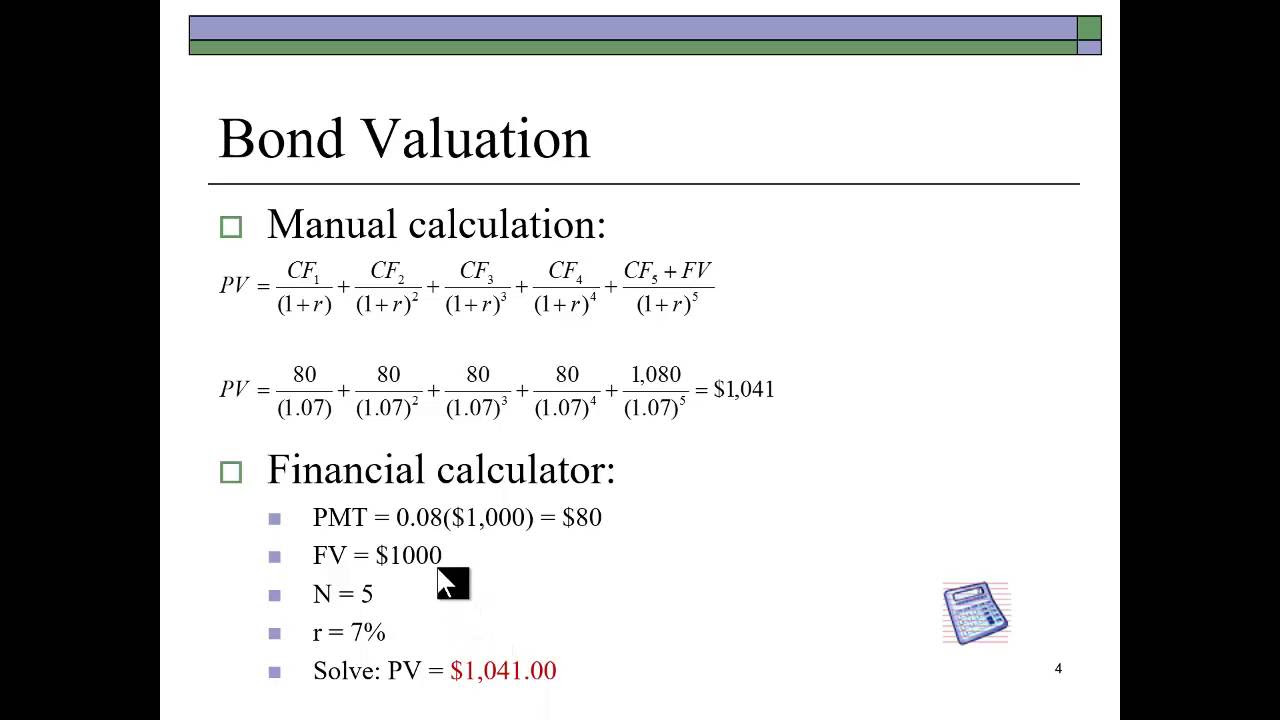

- 📚 The theoretical internal rate of return (IRR) is contrasted with the actual returns that can be achieved through reinvestment, showing the potential discrepancy.

- 🔍 The speaker suggests considering alternative investments for the coupon, such as stocks, to potentially achieve higher returns.

- 🌐 The impact of tax on bond returns is discussed, noting that the tax rate can affect the decision to reinvest coupons.

- 💡 The idea of investing in bonds with lower coupons to reduce tax impact is proposed, suggesting that this strategy could be beneficial in certain market conditions.

- 🏦 The speaker recommends diversifying within the bond market, considering the benefits of reinvestment and the potential for higher returns.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the importance of reinvesting the coupon (cedola) of a government bond or a bond investment, and the impact it can have on the overall return of the investment.

What does 'convessità' refer to in the context of the script?

-'Convessità' refers to the concept of convexity in bond investments, which is a measure of the sensitivity of a bond's price to changes in interest rates, and it was a focus in one of the speaker's previous videos.

Why is reinvesting the coupon of a bond important according to the script?

-Reinvesting the coupon is important because it can significantly increase the overall return on investment due to the compounding effect of reinvested earnings, as opposed to simply collecting the coupon and potentially forgetting about it in a current account.

What is the 'holding period return' mentioned in the script?

-The 'holding period return' is the total return of a bond if held for a certain period, including all coupon payments received and the change in the bond's price, which is relevant when the coupon is not reinvested.

What is the difference between investing in a bond index fund and holding individual bonds?

-Investing in a bond index fund offers diversification and the benefit of reinvesting the coupons automatically, whereas holding individual bonds requires a decision on whether to reinvest the coupons and potentially deal with the complexities of reinvestment.

How does the script suggest reinvesting the coupon could be more beneficial than not reinvesting?

-The script suggests that reinvesting the coupon at a consistent rate can lead to a higher overall return due to the power of compound interest, as opposed to not reinvesting and potentially earning a lower holding period return.

What is the 'tir' formula mentioned in the script?

-The 'tir' formula, which stands for 'tasso di interesse riflessato' or 'internal rate of return', is a theoretical formula used to calculate the yield of a bond, but the script points out that it is an approximation and may not reflect the actual reinvestment scenarios.

Why might an investor choose to invest in stocks with the reinvested coupons instead of buying more bonds?

-An investor might choose to invest in stocks to potentially achieve a higher return than the bond's coupon rate, diversify their portfolio, and benefit from the long-term growth potential of equities.

What is the impact of taxation on the reinvestment strategy discussed in the script?

-Taxation impacts the reinvestment strategy by reducing the net amount available for reinvestment after receiving the coupon, with different tax rates applying to different types of investments, such as corporate bonds versus government bonds.

What are some challenges mentioned in the script regarding the reinvestment of coupons?

-Some challenges mentioned include the difficulty of reinvesting small amounts of coupons, the minimum investment requirements for certain bonds, and the timing of reinvestment opportunities which may not align with when coupons are received.

How does the script suggest investors should consider their investment horizon when deciding on reinvestment strategies?

-The script suggests that investors should consider their investment horizon and objectives when deciding on reinvestment strategies, as the need for capital preservation may lead to different choices compared to seeking long-term growth through reinvestment.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5.0 / 5 (0 votes)