How to Start Bookkeeping for Free (Easy Google Sheets Tutorial)

Summary

TLDRThis tutorial walks through the process of creating a Profit and Loss (P&L) statement using Google Sheets. It covers everything from categorizing transactions based on your chart of accounts to using formulas like `SUMIF` for automatic calculations. The guide also highlights common pitfalls such as double-counting transfers and inconsistent bank statement formats. For those who need more advanced features, the video suggests options like pre-built templates or QuickBooks. Aimed at small business owners, it offers a clear, hands-on approach to tracking and analyzing financial data with ease.

Takeaways

- 😀 Understand the importance of creating a Profit & Loss (P&L) report to manage business finances and track expenses effectively.

- 😀 Don't rely solely on the categories provided by your credit card company or bank; customize them to align with your business's chart of accounts for accurate accounting.

- 😀 Use Google Sheets to manually import, categorize, and analyze transactions for a straightforward financial overview.

- 😀 Categorizing transactions correctly helps ensure that income and expenses are properly tracked without duplication or confusion.

- 😀 For credit card payments and transfers between accounts, use a specific account to avoid miscategorizing these as income or expenses.

- 😀 Double-check how your bank or credit card provider formats incoming and outgoing transactions (positive/negative) to avoid errors in your P&L report.

- 😀 Learn the `SUMIF` formula in Google Sheets to automate the calculation of totals for different categories (e.g., sales income, expenses).

- 😀 Lock ranges in your formulas with dollar signs (e.g., `$E$5`) to ensure your `SUMIF` formulas reference the correct cells as you drag them down.

- 😀 Regularly update your spreadsheet with new transactions to keep your P&L report accurate and up to date, ideally on a monthly or quarterly basis.

- 😀 If you prefer a more advanced solution, consider using a pre-built template or accounting software like QuickBooks for greater complexity and automation.

- 😀 Watch out for common mistakes like forgetting to lock formula ranges or miscategorizing account transfers, which can lead to inaccurate financial reports.

Q & A

What is the purpose of categorizing expenses in the video tutorial?

-Categorizing expenses helps organize financial data according to a chart of accounts, allowing for better tracking and analysis of business finances. It ensures that transactions are classified correctly for the Profit and Loss (P&L) statement.

Why should you ignore the categories provided by your bank or credit card company?

-Bank or credit card companies create categories that may not align with your business needs or chart of accounts. These automated categories can be inaccurate or too broad, so it's better to manually categorize transactions based on your specific accounting needs.

What is the main benefit of using a 'SUMIF' formula in Google Sheets?

-The 'SUMIF' formula helps sum up specific financial data based on predefined criteria. In the tutorial, it is used to calculate totals for categories like sales income, making it easier to track revenue and expenses without manually adding values.

What are account transfers, and why do they need to be handled carefully?

-Account transfers refer to moving money between accounts, such as paying a credit card bill from a bank account. These should be categorized correctly to prevent them from being counted as income or expenses, as they are simply shifts of funds between accounts.

How do you lock a range in a Google Sheets formula, and why is it important?

-To lock a range in Google Sheets, you add dollar signs before the column letter and row number (e.g., $E$5). This ensures the range stays fixed when you drag the formula down across rows, preventing errors and ensuring consistent data reference.

What should you do if the bank categorizes transactions incorrectly in your financial data?

-If your bank categorizes transactions incorrectly, you should manually adjust the categorization to match your chart of accounts. This ensures that expenses are properly tracked and don't disrupt your financial analysis.

How can you ensure your Profit and Loss statement automatically updates when new transactions are added?

-By using dynamic formulas like 'SUMIF' in Google Sheets, the P&L statement will update automatically whenever new transactions are entered. As long as the formulas are set up correctly, any new data added will be included in the totals.

What should you do if a transaction between accounts doesn't net to zero?

-If a transaction between accounts doesn't net to zero, it means that one side of the transfer is missing or categorized incorrectly. To fix this, check both accounts for any missing or misclassified transactions and adjust accordingly.

What does the tutorial recommend if a simple Google Sheets solution isn't enough for your business?

-If a simple Google Sheets solution doesn't meet your needs, the tutorial suggests exploring more advanced tools like QuickBooks, which offer additional features for tracking complex business finances and automating accounting tasks.

What is the purpose of the P&L dashboard template offered in the tutorial?

-The P&L dashboard template provides a more advanced, ready-to-use solution for businesses. It includes a customizable chart of accounts, automatic formulas, and visual metrics such as graphs and charts to help users easily analyze their financial data.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Profit and Loss secrets explained

Aktivitas Belajar 7.4

Cara Buat Laporan Laba Rugi, Neraca, dan Perubahan Modal - Siklus Akuntansi 4

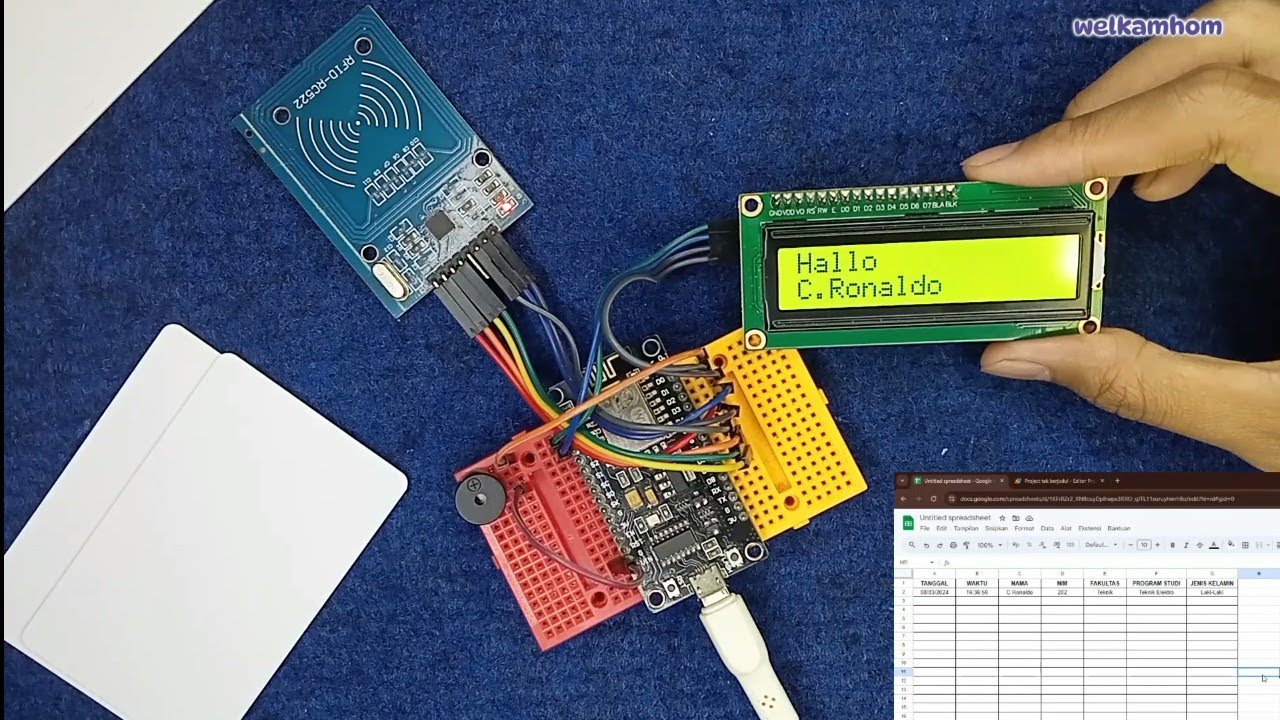

Sistem Absensi Online Menggunakan kartu RFID

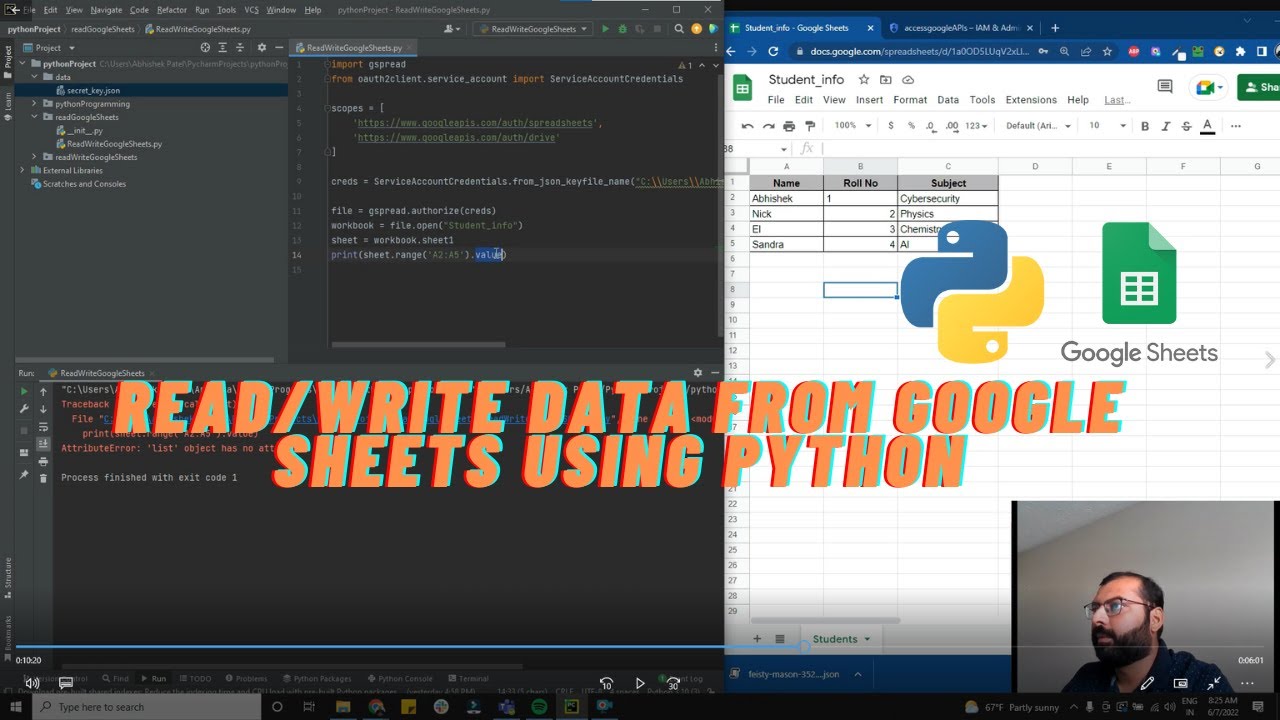

Read and Write data from google sheets using Python

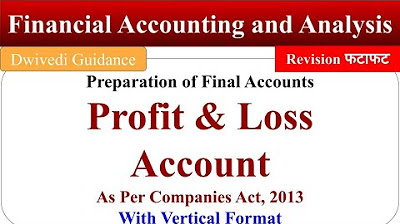

Profit & Loss Account, Preparation of Final Accounts, Format of Profit and Loss Account, Accounting

5.0 / 5 (0 votes)