How to Make 100k+ In The Next 90 Days (EXCLUSIVE LIVE)

Summary

TLDRIn this live session, Rob Moore shares his blueprint for building a $300M+ information business, combining practical business strategies, investment insights, and personal wealth-building advice. He introduces his depublished book, *Money Matrix*, and offers an exclusive opportunity to attend the Money Maker Summit with VIP perks, including private lunches, masterclasses, and a 90-day £100K challenge. Rob also provides his 11-point investment checklist, covering passion, experience, risk, diversification, decentralization, cash flow, and market cycles. Throughout, he emphasizes over-delivering value, leveraging content for sales, and strategically investing to create recurring income, generational wealth, and financial freedom.

Takeaways

- 📚 The Money Matrix book is a limited, depublished resource offering 313 pages on building generational wealth and beating the financial system, available for £30 plus exclusive bonuses.

- 🎟️ First 60 buyers of Money Matrix receive upgraded VIP tickets to the 3-day Money Maker Summit, including private lunches, dinners, and direct access to multi-millionaire and billionaire mentors.

- 💡 Rob Moore’s Five Ps for business success: Passion → Product, Plan & Position, Price & Pre-launch, Promote & Persist, and Produce & Please.

- 🚀 Passion should guide the business/product creation process; choose niches you enjoy and have expertise in to increase your chances of success.

- 💸 Pre-launch and pricing strategy should focus on perceived value, not cost, using compelling offers and urgency to drive first sales.

- 📈 Persistence in promotion is essential; multiple launches and consistent marketing efforts are necessary to reach revenue goals.

- 📊 Rob’s 11-point investing checklist covers passion, experience, age, risk appetite, diversification, decentralization, capital vs income focus, investment horizon, and market cycle awareness.

- 🪙 Diversifying into physical, decentralized, or alternative assets like gold, silver, crypto, and watches can protect wealth from systemic risks.

- 💬 Engaging directly with the audience through live streams, WhatsApp groups, and Telegram builds trust, urgency, and loyalty, amplifying sales and retention.

- 🏆 High-value bonuses such as the 90-day cash flow challenge and direct mentorship help over-deliver on promises, creating gratitude, referrals, and long-term brand credibility.

- ⏳ Long-term compounding and strategic investment timing are emphasized; buy low, hold forever, and align risk with age and net worth to maximize wealth growth.

Q & A

What are the 'Five P's' Rob Moore uses to build a successful information business?

-The 'Five P's' are: 1) Passion → Product – turn what you know into a product; 2) Plan & Position – plan your launch and position it for your ideal client; 3) Price & Pre-Launch – create a compelling offer and pre-launch content; 4) Promote & Persist – actively market and persist until you hit your goal; 5) Produce & Please – deliver a high-quality product and overdeliver with bonuses.

What is the main strategy behind the Money Matrix offer?

-The strategy combines scarcity, value, and bonuses: a depublished book priced at £30, limited to the first 120 buyers, plus upgraded golden VIP tickets to Moneymaker Summit, private lunches/dinners, a 15-hour masterclass, and a 90-day 100K cash flow challenge, creating urgency and perceived high value.

How does Rob Moore suggest setting a 90-day financial goal?

-He advises reverse-engineering your revenue target. For example, to make £100K in 90 days: sell 1 course/day at £1K, 2 courses/day at £500, or 1 mentorship every 10 days at £10K. The idea is to break the goal into achievable, consistent actions.

What are the key factors in Rob Moore's 11-point investing checklist?

-Key factors include: 1) Passion for the asset; 2) Experience in the asset; 3) Age & risk appetite; 4) Aggressive vs defensive approach; 5) Percentage of net worth invested; 6) Diversification; 7) Desire for decentralization; 8) Wealth vs cash flow focus; 9) Short-term vs long-term goals; 10) Stage of the market cycle; 11) Cycle awareness to buy low and hold.

Why does Rob emphasize overdelivering to his audience?

-Overdelivering builds trust, gratitude, and referrals. By providing unexpected bonuses, high-quality content, and personal interaction, customers feel valued and are more likely to promote the business themselves.

How does Rob Moore differentiate between capital assets and income assets?

-Capital assets, such as gold, silver, and Bitcoin, primarily grow wealth over time. Income assets, like real estate, stocks, or businesses, generate ongoing cash flow. Investors should decide which type aligns with their financial goals.

What role does scarcity play in Rob Moore's sales strategy?

-Scarcity creates urgency and increases perceived value. Examples include limiting Money Matrix books to 120 copies, restricting private lunch/dinner spots, and first-come, first-served VIP ticket upgrades.

How does Rob suggest using social media and content to sell products?

-He recommends a content bridge strategy: provide valuable content first (like teaching skills or sharing insights), then naturally link to your product. This builds trust and positions the product as a solution rather than a hard sell.

What are some of the bonuses included with the Money Matrix purchase?

-Bonuses include: upgraded golden VIP tickets to Moneymaker Summit, private lunch and dinner with Rob and other high-net-worth individuals, a 15-hour 'how to raise money online' masterclass, a 90-day 100K cash flow challenge via WhatsApp, and access to a private Telegram group.

What mindset advice does Rob give regarding risk and investing?

-He emphasizes that taking no risks is the greatest risk. Investors should assess their age, risk appetite, and financial goals to determine appropriate risk levels. Long-term compounding is key, but short-term hustling is needed for immediate cash flow goals.

How does Rob Moore suggest determining diversification in investing?

-He suggests balancing risk and potential returns: more diversified portfolios reduce risk but may grow slower, whereas focused investments can generate higher returns but carry greater risk. The choice depends on individual goals, risk tolerance, and stage in the market cycle.

What does Rob consider essential for producing and delivering a successful product?

-Rob stresses that quality content, thorough research, clear guidance, and overdelivering on promises are essential. For example, the Money Matrix book is comprehensive (313 pages) and includes practical advice, while the Summit and bonuses amplify the perceived value.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Watch This To Become Crorepati FAST, Real Estate Secrets of Ultra-Rich | Ep 30

O NICHO DA MAROMBA

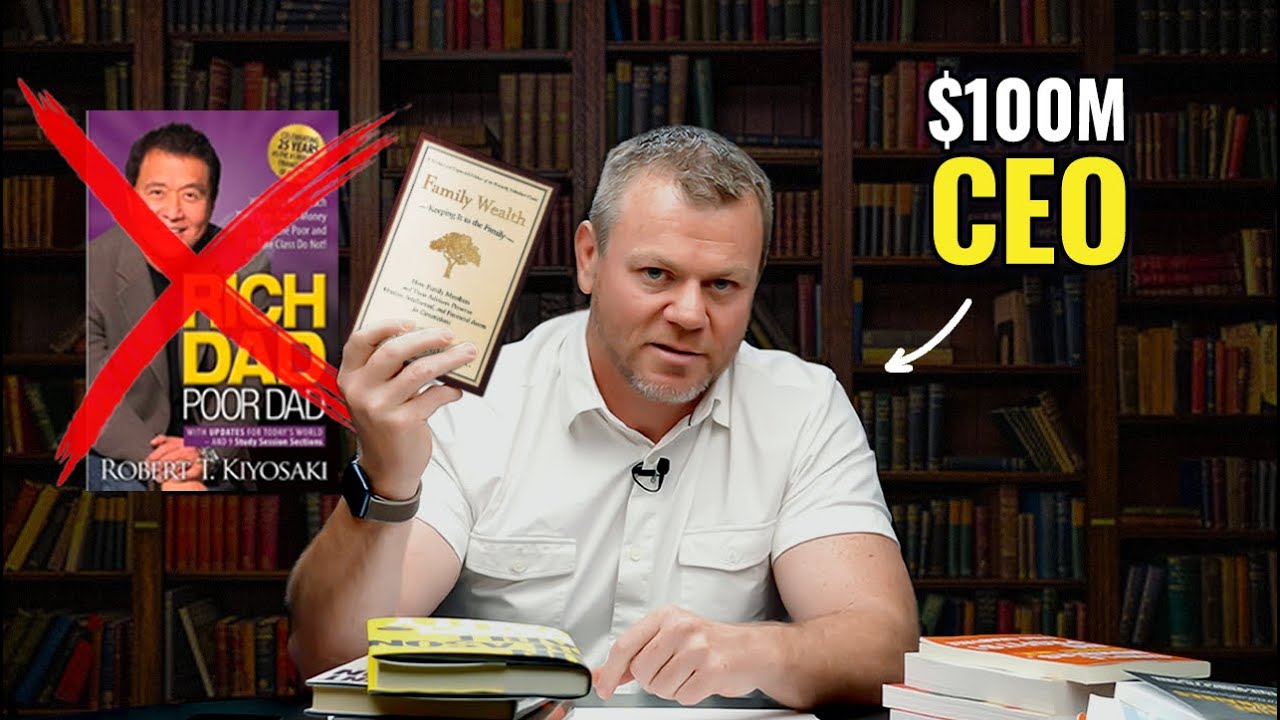

Founder CEO shares all the books that helped build a $100M enterprise | Daniel Ramsey

I Was on Food Stamps... Now I Make $100M/Year

前Banker真心話🙅🏻♀️成為有錢人不能靠投資, 不要再浪費時間了🫡[中文ENG]

Como fazer Milhões COMEÇANDO do ZERO em 2024

5.0 / 5 (0 votes)