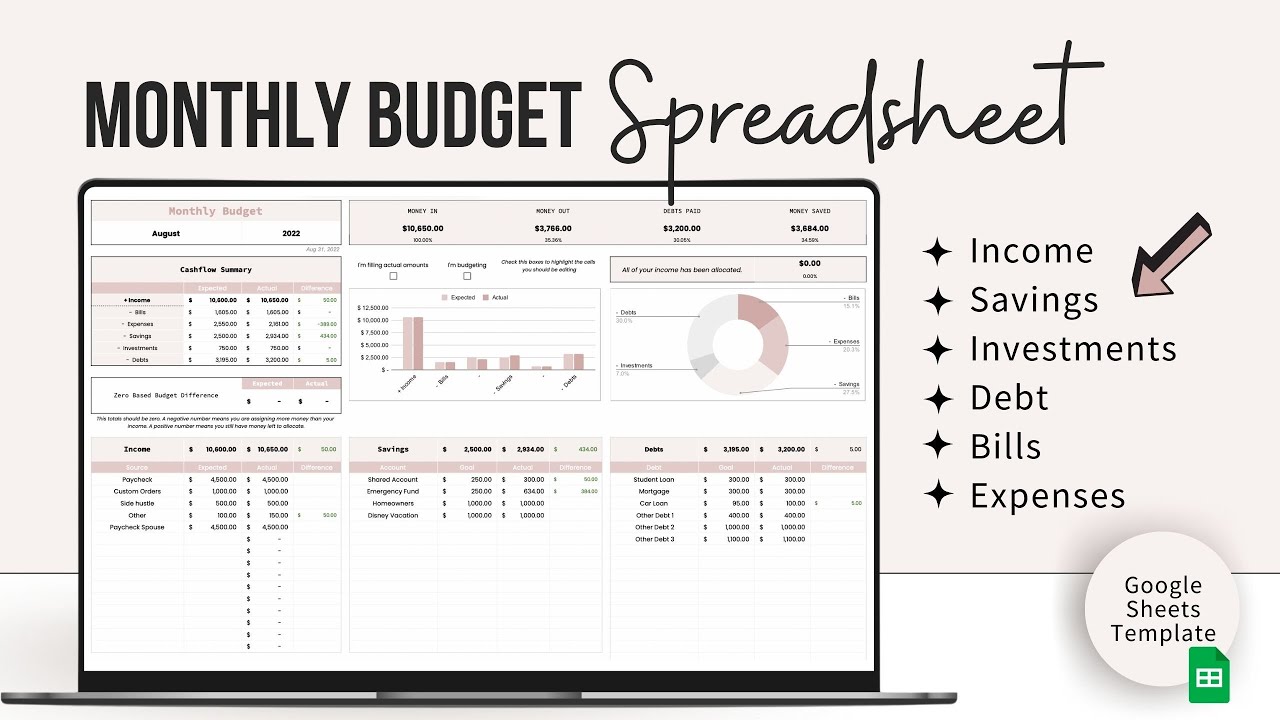

Budget Planner Spreadsheet for Google Sheets

Summary

TLDRThis demo video provides a comprehensive walkthrough of a versatile budget spreadsheet designed to help users manage their finances efficiently. It covers setting up income, savings, bills, expenses, and debts, with customizable subcategories and automatic calculations. Users can track both budgeted and actual amounts, monitor spending through an integrated expense tracker and visual graphs, and stay on top of due dates with checkboxes. The video also explains how to duplicate tabs for new periods while keeping the original template intact, making it easy to manage weekly, bi-weekly, or monthly budgets and maintain an organized, accurate overview of financial activity.

Takeaways

- 😀 The budget spreadsheet contains four tabs: Readme, Example, Budget, and Budget 2, with Budget 2 offering extra subcategories.

- 😀 Users should fill only the white fields; colored fields update automatically.

- 😀 The spreadsheet can be used for weekly, bi-weekly, monthly, or custom budgeting periods.

- 😀 Users can set start and end dates, select currency, and add a starting balance for more accurate budgeting.

- 😀 Subcategories can be added for income, savings, bills, expenses, and debts to tailor the budget to individual needs.

- 😀 Budgeted amounts for each category update automatically, showing remaining funds to allocate.

- 😀 Due dates and checkboxes help users stay on top of bills and debt payments.

- 😀 Graphs and visual breakdowns update automatically as budgeted and actual amounts are entered.

- 😀 Actual income and expenses can be tracked in real-time, with small transactions recorded in an expense tracker at the bottom.

- 😀 Users can duplicate the budget tab for new periods while keeping the original template intact to preserve formulas.

- 😀 The spreadsheet provides a clear overview of spending, helping users manage finances effectively and avoid missed payments.

Q & A

What are the main tabs included in the budget spreadsheet?

-The budget spreadsheet includes four tabs: a ReadMe tab with instructions, an Example tab, and two Budget tabs. The second Budget tab contains 10 additional subcategories for savings, bills, expenses, and debts.

Can this budget spreadsheet be used for different time frames?

-Yes, the spreadsheet can be used as a weekly, bi-weekly, monthly, or custom budget according to the user's preference.

Which fields should the user fill in when setting up the budget?

-Users should only fill in the white fields. Colored fields, such as light blue and orange, update automatically based on the inputted data.

How can users set the currency and start balance in the budget?

-Users can change the currency at the top of the budget tab, which updates throughout the tab. They can also enter a start balance to include leftover funds from previous periods, which will be added to both budgeted and actual amounts.

How are income subcategories added in the spreadsheet?

-Income subcategories can be added by typing them into empty white fields under the income section, such as paycheck, bonus, or gifts.

How does the spreadsheet help track how much money is left to budget?

-As users enter budget amounts for savings, bills, expenses, and debts, the spreadsheet automatically updates a 'left to budget' number, showing exactly how much money is available to allocate.

What feature ensures users never miss a bill or debt payment?

-The spreadsheet includes checkboxes for bills and debts, where users can mark payments as paid. It also allows users to enter due dates for each item.

How are actual transactions tracked and reflected in the budget?

-Users can enter actual income and expenses in the respective 'actual' sections. The spreadsheet automatically updates the 'left to spend' section, budget versus actual comparisons, and breakdown charts.

What is the purpose of the separate expense tracker?

-The expense tracker allows users to record small or frequent transactions, and the spreadsheet totals them automatically to show how much has been spent and what remains.

How can users create a new budget period while keeping the original template intact?

-Users can duplicate the original budget tab to create a new budget for a different period. The original template contains all formulas and can be kept as a master copy for future use.

How does the spreadsheet visually represent spending and budget data?

-The spreadsheet includes graphs that update as users enter budget amounts and actual transactions, providing a visual breakdown of spending, budget versus actual, and remaining funds.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

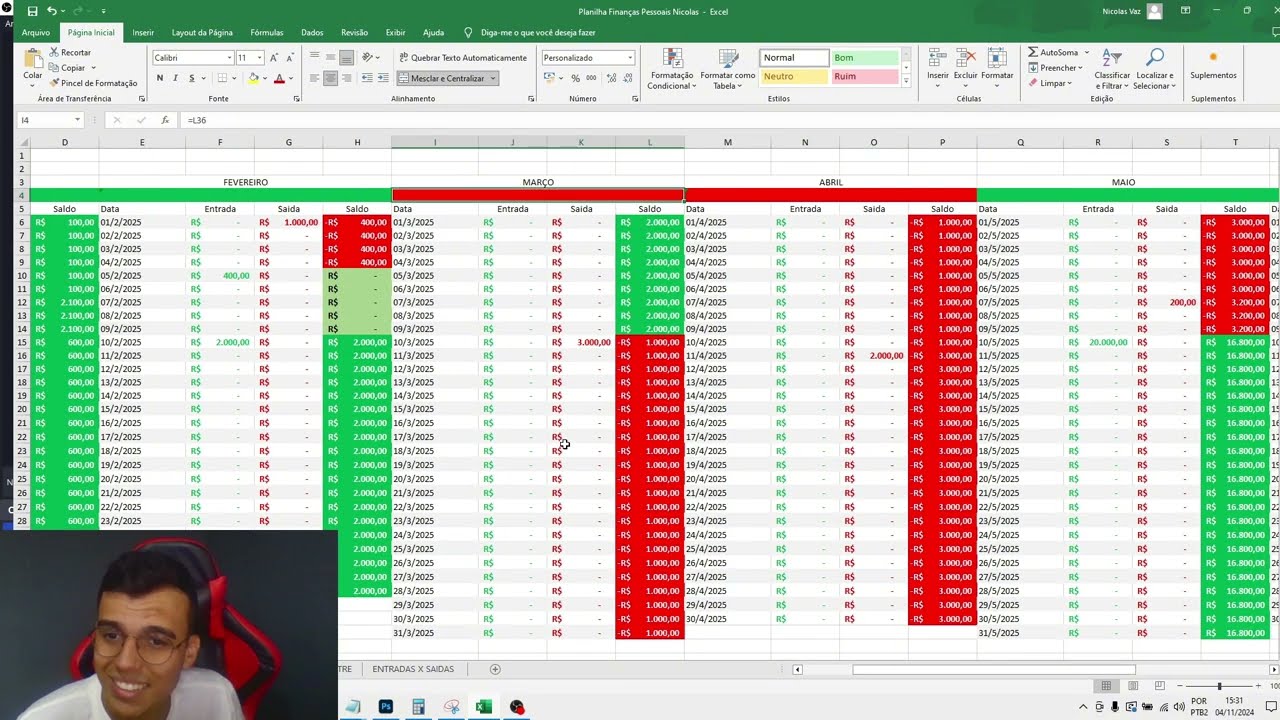

How to Track your Money - Monthly Budget Spreadsheet - Google Sheets Template, Monthly Money Tracker

Planilha de Controle Financeiro Pessoal Completa

Manage Rate library & Quotation, BOQ & Estimates

VIVER DE RENDA: QUANTO JUNTAR E QUANTO INVESTIR POR MÊS

PHP 8 MySQL Project on Online Doctor Appointment Booking System

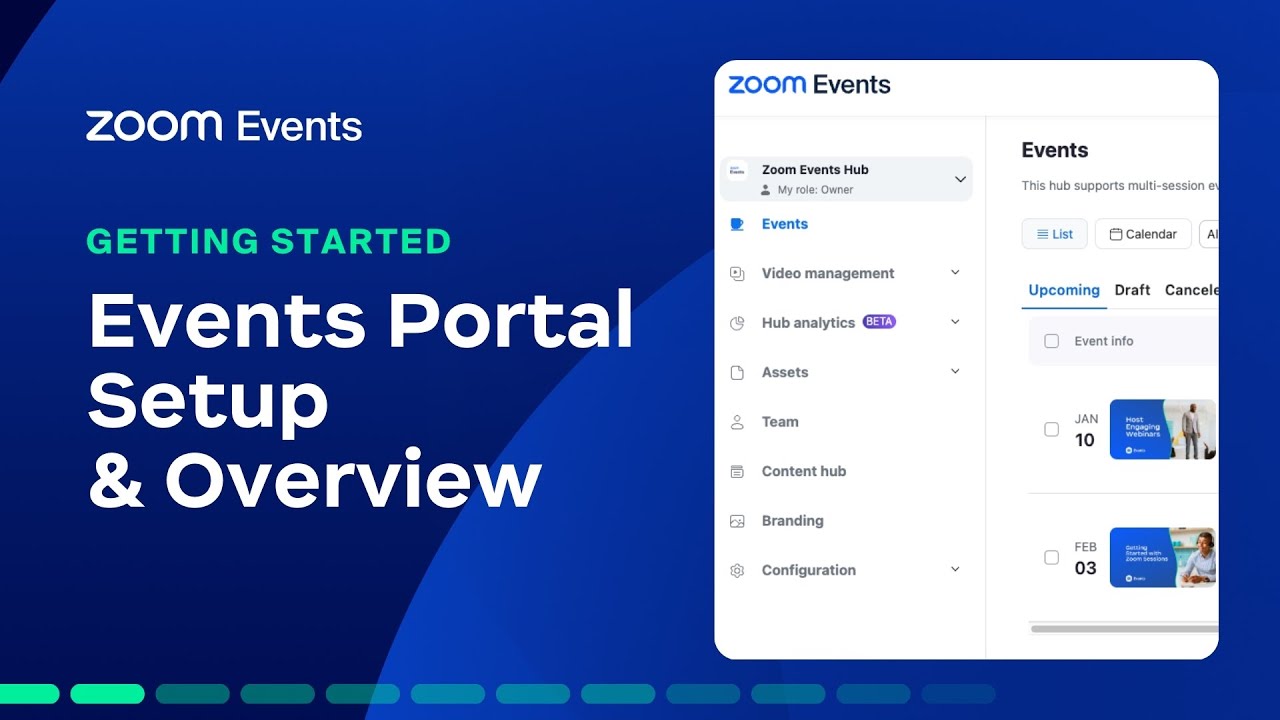

Events Portal Setup & Overview | Getting Started with Zoom Webinars & Events

5.0 / 5 (0 votes)