Using Market Corrections to Strengthen Portfolios

Summary

TLDRThe video provides insights on the current state of the stock market, focusing on the Nifty 500's six-week decline and potential recovery. The speaker emphasizes the importance of managing risk, long-term investing, and understanding market cycles, citing past corrections. They highlight sectors like capital markets, defense, and healthcare as potential opportunities. The message encourages investors to use strategies like rupee cost averaging, stay emotionally strong, and remain patient. The speaker remains confident in the market's future growth despite short-term volatility, particularly in 2025, with expectations of a significant rally by 2026.

Takeaways

- 😀 The market is currently experiencing a 6-week decline, but this is normal in the stock market cycle and could represent a consolidation phase.

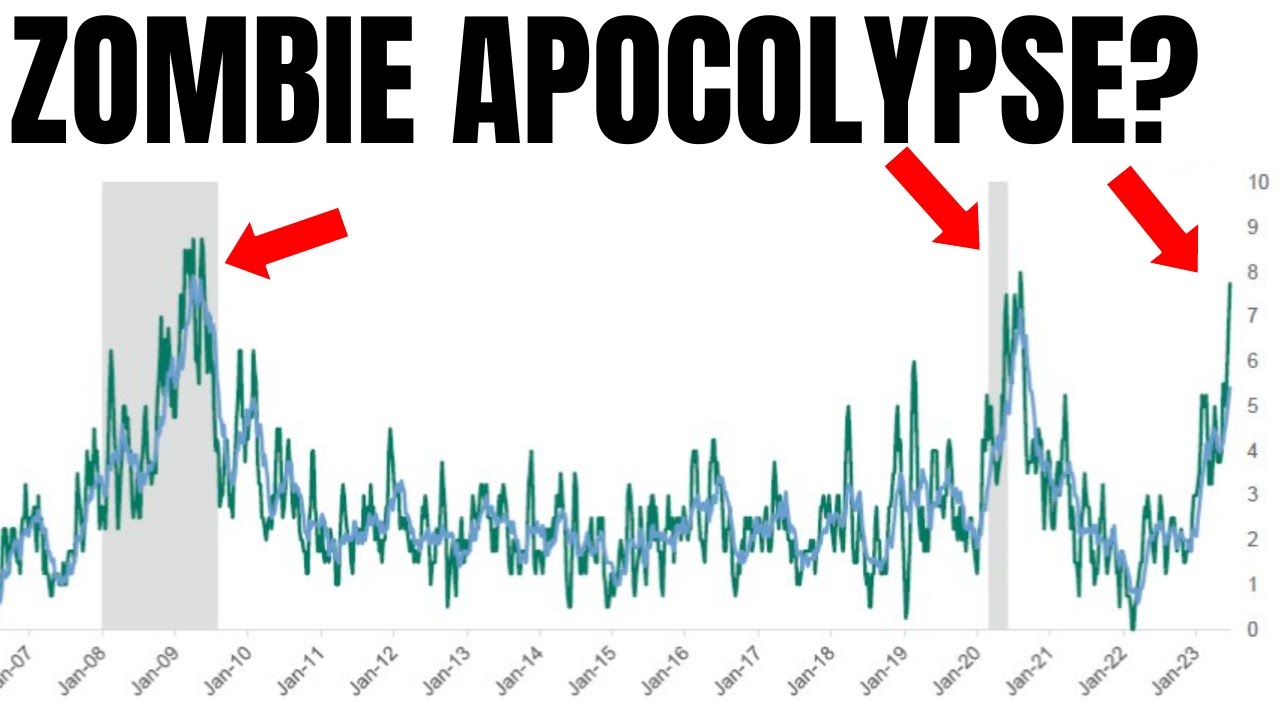

- 📉 A simple Fibonacci retracement shows the market has not yet reached the 38.2% level, which could be a key support zone for a potential reversal.

- 📊 The Nifty 500 index performance is being compared against the Nifty 50 to gauge the broader market performance and benchmark its strength.

- 💡 Human psychology often leads to recency bias during market declines, where investors fear further drops, even when the broader market shows signs of stability.

- 🔍 The current pullback is part of a larger trend where long-term investors should be patient and manage risk, while traders should focus on risk management during volatility.

- ⏳ Long-term market behavior shows that corrections between 15% to 30% are common, but over time, the market tends to rebound and head higher.

- 🏦 Investors in ETFs, particularly Nifty and Bank Nifty, should take advantage of the current dip to make strategic purchases, considering long-term growth.

- 💰 Risk management is key in the market, and proactive traders should cut their losses and retain winning positions, keeping a cash reserve for better opportunities.

- 📉 The market's current weakness is likely a digestion phase after a 24% rally, and a 5.3% pullback cannot be termed a crash or major correction.

- 📅 2025 is expected to be a year of market digestion, with limited gains, but it will provide long-term opportunities for investors who follow a disciplined approach to position building.

- 📈 Stock market success requires emotional discipline, as corrections test an investor's conviction. Following a process and focusing on long-term goals is critical.

Q & A

What is the significance of the 30-weekly moving average in the analysis?

-The 30-weekly moving average is used to track long-term trends in the market. It follows the teachings of William O'Neill and Stan Weinstein, helping to identify whether the market is in a bullish or bearish phase. It is a critical tool for analyzing trends over a multi-week period.

Why is the speaker not overly concerned about the market's current pullback?

-The speaker views the current market pullback as a normal consolidation phase, rather than a major correction or crash. Since the market has risen by 24% prior to this pullback, a 5.3% drop is not significant in the broader context. The speaker emphasizes that corrections are opportunities, not reasons to panic.

What does the speaker believe about the market’s future in 2026?

-The speaker is confident that 2026 will be the year for a major upward trend. They view 2025 as a year for digestion, where markets will consolidate and test investors' patience before a sustained rally begins in 2026.

How does the speaker suggest long-term investors should approach the current market conditions?

-Long-term investors should focus on managing risk by holding onto their winning positions while cutting losses on underperforming ones. They are advised to be patient, use the market dip to their advantage, and consider investing through ETFs, such as Nifty ETF, Capital Market ETF, or Healthcare ETF, among others.

What is the role of Fibonacci retracement in the analysis?

-Fibonacci retracement is used to identify key levels of support and resistance in the market. The speaker points out that the current market has not yet reached the 38.2% retracement zone, indicating that the market may still have room to pull back before it finds support.

What advice does the speaker give for managing risk in the current volatile market?

-The speaker stresses the importance of risk management, advising investors to set stop losses if their portfolio drops by 5%, and to actively monitor positions. Traders should be proactive, constantly reassessing their positions as new data comes in, and not hesitate to cut losses when needed.

What is the speaker's take on short-term trading in 2025?

-The speaker believes that short-term trading will be particularly challenging in 2025 due to volatility and unpredictable market movements. They warn that short-term traders could face significant losses due to sudden market gaps and reversals.

Why does the speaker emphasize emotional strength in investing?

-Emotional strength is crucial because market corrections can trigger emotional responses, leading to impulsive decisions. The speaker advises investors to stay emotionally grounded, avoid reacting to sensational news on social media, and stick to a disciplined investing process.

What strategy does the speaker recommend for long-term investors during a market pullback?

-During a market pullback, the speaker recommends a strategy of rebalancing portfolios by selling weaker stocks and reallocating funds into existing winners. Investors should also use rupee cost averaging, gradually buying into sectors they believe in, as the market continues to decline.

How does the speaker view the performance of specific sectors in the market?

-The speaker identifies several sectors that are currently on their radar for long-term investment, including Capital Markets, Metals, Defense, Financial Services (excluding banks), PSU Banks, Hotels, Insurance, and Healthcare. They suggest that these sectors will perform well once the market stabilizes.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)