12 Marketing-Tricks der Finanzindustrie, auf die du nicht reinfallen solltest!

Summary

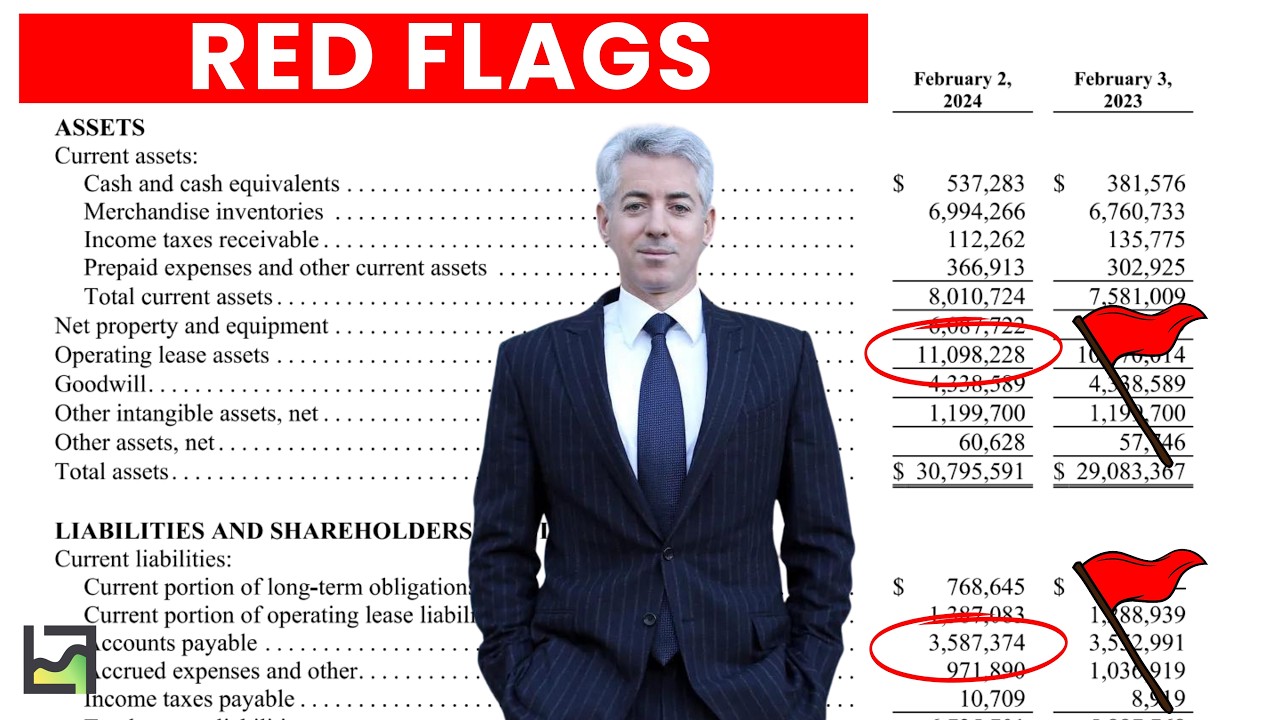

TLDRIn this informative video, Thomas from Finanzfuss warns viewers about common red flags in the financial market. He advises skepticism towards products promising tax advantages, democratization of access, and investment opportunities 'like the pros.' He also cautions against financial advisors who disparage existing investments and overpromise financial freedom. Thomas debunks myths around high guaranteed returns, exclusive tips, and the fear of market crashes, advocating for a diversified portfolio and long-term investment strategy.

Takeaways

- 🚩 Beware of financial products marketed for their tax advantages; what matters is the net return after taxes, not just the tax savings.

- 🏦 'Democratization' of finance often means access to markets or investments not previously available, but it can also be a marketing ploy to sell less attractive deals to retail investors.

- 🔒 When promised access to 'invest like the pros', be cautious as professional investment strategies may not be suitable or as profitable for individual investors.

- ❌ Dismiss any financial advisor who badmouths all your current investments to push you into new ones, as this could trigger unnecessary costs or penalties.

- 💰 Be skeptical of promises of financial freedom through financial products, coaching, or consulting services; achieving financial independence is complex and not guaranteed by a single purchase or course.

- 🤫 Avoid falling for 'secret tips' or 'exclusive offers'; true market inefficiencies that could be exploited for profit are rare and professionals wouldn't share them widely.

- 📉 Don't be swayed by promises of high returns with no risk; in finance, return and risk are usually intertwined, and 'risk-free' high returns are often too good to be true.

- 📈 Past performance is not indicative of future results; be wary of financial products that are sold based on their historical success.

- 🆓 Question how 'free' financial products or services are financed; they may come with hidden costs or conflicts of interest.

- 💡 Don't let fear of a market crash drive your investment decisions; diversification and a long-term perspective are better safeguards against market volatility.

- ⚠️ Be cautious of copycats and scammers misusing established financial brands to sell fraudulent products or services.

Q & A

What is the main message of the video script about financial markets?

-The main message of the video script is to be skeptical of various 'red flags' in the financial market, such as overpromised tax benefits, democratization claims, and guaranteed high returns with no risks, which are often misleading or deceptive.

Why should one be cautious about financial products that emphasize tax advantages?

-One should be cautious because while these products may offer tax benefits, they may not necessarily provide better returns than regular products. It's essential to consider the net return after all costs, not just the tax savings.

What is the issue with the term 'democratization' in the context of financial products?

-The term 'democratization' can be misused as a marketing tool to make people believe they are gaining access to exclusive financial opportunities. However, this can lead to investing in products that may not be financially beneficial, as professional investors might avoid them due to unfavorable risk-reward ratios.

What does the script suggest about the claim of 'investing like the pros'?

-The script suggests that the claim of 'investing like the pros' can be misleading. For instance, actively managed funds often perform worse than the average passive ETF, and even ETFs, originally designed for institutional investors, are now marketed to everyone without acknowledging their professional origins.

How can financial advisors' criticism of existing financial products be problematic?

-This criticism can be problematic as it may encourage people to terminate existing contracts and switch to new ones, potentially incurring costs, triggering taxes, or losing government subsidies without proper consideration of the implications.

What is the script's stance on promises of financial freedom through financial products, coaching, or consulting services?

-The script is critical of such promises, stating that they are often exaggerated and misleading. It suggests that the person offering the product or service is the one likely to achieve financial freedom, not the consumer.

Why should one be skeptical of 'secret tips' or 'exclusive offers' in the financial market?

-One should be skeptical because true inefficiencies in the market that allow for risk-free profit, such as arbitrage opportunities, are rare and would not be widely shared. Those who claim to have such secrets are likely trying to sell their coaching or services, not genuinely sharing profitable strategies.

What is the issue with promises of 'guaranteed high returns with no risk'?

-Such promises are typically associated with scams. High returns and low or no risk are generally incompatible, and anyone offering such deals should raise immediate concerns.

Why should past performance not be the sole basis for investment decisions?

-Past performance is not a reliable indicator of future results due to the 'survivorship bias' and 'hindsight bias'. These biases can lead to an overestimation of the likelihood of past successes being repeated in the future.

What is the concern with 'free' financial products and services?

-The concern is how these 'free' offerings are financed. They may involve hidden costs, such as high spreads in trading platforms or commissions from product providers, which can create conflicts of interest.

How can fear be used as a marketing strategy in the financial sector?

-Fear can be used to promote financial products by suggesting imminent market crashes and offering 'protection' through specific investments. However, crashes are relatively rare, and diversification and a long-term investment horizon are more reliable strategies for managing risk.

What should one consider when encountering claims of financial market 'secrets'?

-One should consider the credibility of the source and the likelihood of such secrets being genuinely shared. Be wary of exclusive groups or services that claim to offer high returns with little to no risk, as these are often deceptive.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

5.0 / 5 (0 votes)