Master SMC/ ICT Market Structure The Correct Way (very easy)

Summary

TLDRThis video provides a comprehensive guide to understanding market structure in trading, emphasizing the importance of identifying trends through highs and lows. The script covers the basics of market structure, such as uptrends, downtrends, and break of structure. It introduces key concepts like swing, internal, and fractal structures, as well as techniques to determine entry and exit points using support and resistance areas, liquidity grabs, and fair value gaps. The video also offers practical advice for using the 4-hour chart and Fibonacci levels to optimize trade entries, helping traders improve their trading strategies.

Takeaways

- 😀 Market structure is essential for understanding the market's direction and predicting price movements.

- 📈 A market structure shift occurs when the market moves from a downtrend (lower highs, lower lows) to an uptrend (higher highs, higher lows) and vice versa.

- 🔑 Identifying swing highs and swing lows is crucial in understanding the trend and determining potential entry points.

- 🛑 A break of structure signals a potential pullback, and it’s essential to anticipate this move rather than expecting immediate continuation.

- 💡 There are three types of market structure: swing structure (big trends), internal structure (price movements within the trend), and fractal structure (smaller price pullbacks).

- ⚡ Internal structure refers to price movements between significant swing highs and lows before they are broken.

- 📉 In a downtrend, swing lows are weak, and swing highs are strong; the goal is to sell near strong swing highs and buy near strong swing lows.

- 🔄 The fractal structure deals with smaller pullbacks that happen before a significant price movement and helps refine entries.

- 🏁 Point of Interest (POI) areas such as fair value gaps or order blocks can indicate optimal entry points in the market.

- ⏳ To improve trade entries, use Fibonacci retracement levels (e.g., 61.8%) and apply the concept of imbalance and order blocks to locate high-probability setups.

Q & A

What is the most important factor in trading according to the video?

-Market structure is considered the most important factor in trading, as it provides the direction of the market and helps identify trends.

How can traders easily identify the market trend?

-Traders can easily identify the market trend by observing the pattern of higher highs and higher lows for an uptrend, or lower highs and lower lows for a downtrend.

What happens when the market shifts from a downtrend to an uptrend?

-When the market breaks the previous high and starts forming higher highs and higher lows, it indicates a market structure shift from a downtrend to an uptrend.

What is a 'break of structure' in trading?

-A 'break of structure' occurs when the market breaks the previous low or high, indicating a potential change in the trend. After a break of structure, a pullback is often expected.

What are the three types of market structure discussed in the video?

-The three types of market structure are swing structure (big picture trends), internal structure (price movements within a swing), and fractal structure (small pullbacks before larger moves).

What is the role of swing highs and swing lows in identifying strong or weak market levels?

-Swing highs and swing lows help identify strong or weak levels. A swing high is strong if it creates a new low, while a swing low is strong if it creates a new high. Conversely, levels that get broken repeatedly are considered weak.

How does the concept of 'point of interest' areas affect trading decisions?

-Point of interest areas, such as order blocks, fair value gaps, or previous highs and lows, are critical for identifying entry and exit points. These areas are where price is likely to react and reverse.

What is an 'order block' in market structure analysis?

-An order block is defined as two opposite candles or the one opposite candle color before a price collapse happens. It is used to identify areas of market imbalance where price may reverse.

How does Fibonacci play a role in identifying optimal entry points?

-Fibonacci retracement, especially the 61.8% level, is used to identify optimal entry points by highlighting the 'discount area' in the market. It helps in choosing entry levels that align with key market zones.

What should a trader do after identifying a 'change of character' on a lower time frame?

-After identifying a 'change of character' (when market structure shifts from higher highs and lows to lower highs and lows), traders should look for order blocks or fair value gaps to base their entry on, and place stops above recent highs for confirmation.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Simplifying Advanced Market Structure in 20 Minutes | Forex Trading Tutorial

Do yourself a favor; learn Order Flow.

ICT/SMC Market Structure Full Guide Simplified | CHoCH & BOS Secrets

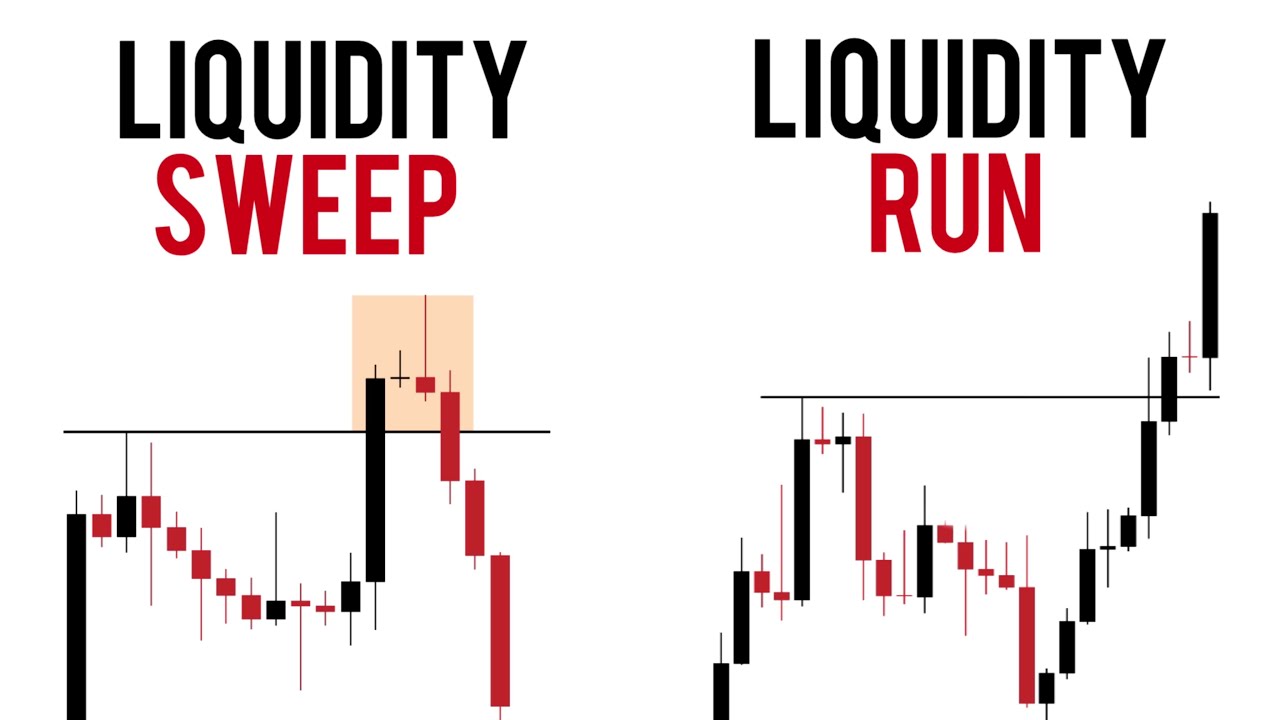

Liquidity Run Or Liquidity Sweep ( Purge Or Bos )

Trading Transformation Day 6: Highs, Lows, and Trends

The Only Trading Strategy You'll Ever Need

5.0 / 5 (0 votes)