Audit Long Term Debt

Summary

TLDRThis video explores the audit process for long-term debt, emphasizing the importance of ensuring liabilities on the balance sheet are not materially misstated. It discusses the focus on substantive testing, particularly in complex debt structures like bonds with premiums or discounts. Key considerations include the verification of proper authorization, completeness through subsidiary ledgers, and accurate classification between short-term and long-term liabilities. The video also highlights the importance of using the effective interest method for amortization and the challenges posed by sophisticated financial instruments, ensuring auditors apply rigorous procedures to verify the accuracy of long-term debt reporting.

Takeaways

- 😀 Auditors aim to provide assurance that long-term debt amounts on the balance sheet are not materially misstated.

- 😀 Interest expense recognition is an essential part of the audit process for long-term debt.

- 😀 Substantive testing is typically the focus for long-term debt due to the nature of these liabilities.

- 😀 Inherent risk for long-term debt is often low to moderate because the volume of transactions is generally low.

- 😀 The complexity of long-term debt increases when there are hybrid debt-equity instruments or complex amortization schedules.

- 😀 Understanding internal controls is still important, but auditors often rely more on substantive testing for long-term debt.

- 😀 Controls ensure proper authorization for large debt commitments, with approval often required by the Board of Directors or delegated executives.

- 😀 Completeness is a key concern, ensuring that all long-term debt is recorded, including its short-term and long-term portions.

- 😀 Bonds and notes should be recorded at face value, and any unamortized discounts or premiums must be properly accounted for.

- 😀 Classification of long-term debt is crucial, particularly in ensuring that the portion due within the next year is classified as short-term liability.

- 😀 Auditors must reconcile subsidiary ledgers and the general ledger to confirm the correct classification of debt and interest payments.

Q & A

What is the primary goal of auditing long-term debt?

-The primary goal of auditing long-term debt is to ensure that the amounts reported on the balance sheet for various types of long-term debt are not materially misstated, and to provide assurance about the accuracy of interest expense recognition.

Why is interest expense a key focus when auditing long-term debt?

-Interest expense is a key focus because it is intrinsically linked to long-term debt. The auditor needs to ensure that interest is correctly recognized and reported in accordance with the terms of the debt.

Why are auditors likely to focus on substantive testing when auditing long-term debt?

-Auditors focus on substantive testing for long-term debt because the transactions are typically low in volume but can be high in value. This makes testing the details of debt more critical, even though some controls are still reviewed.

What factors contribute to higher inherent risk when auditing long-term debt?

-Higher inherent risk occurs when complex financial instruments, such as debt instruments with both debt and equity characteristics, are involved. Additionally, if the debt has intricate repayment structures or unusual terms, this adds complexity and increases the risk of misstatement.

What is the importance of understanding controls during a long-term debt audit?

-While auditors primarily focus on substantive testing, understanding controls is still important because it helps identify any potential areas of weakness in the financial reporting process. Additionally, it can lower the amount of substantive testing needed if controls are effective.

What are the key assertions that auditors examine when auditing long-term debt?

-The key assertions auditors examine include occurrence and authorization (ensuring debt is properly authorized), completeness (ensuring all debt is recorded), valuation (confirming the accurate recording of amounts, including discounts or premiums), and classification (ensuring proper distinction between short-term and long-term debt).

How does a subsidiary ledger help in auditing long-term debt?

-A subsidiary ledger provides detailed records of all long-term debt obligations, which are necessary for the auditor to verify the accuracy of the general ledger. It also helps in ensuring that short-term and long-term portions are properly classified.

Why is it essential for auditors to reconcile subsidiary ledgers to the general ledger?

-Reconciling subsidiary ledgers to the general ledger ensures that all long-term debt is accurately recorded and classified in the financial statements, helping auditors identify discrepancies and errors.

What are bond premiums and discounts, and why are they important in the audit of long-term debt?

-Bond premiums and discounts arise when bonds are sold at a price different from their face value. These amounts must be properly amortized over the life of the bond, and auditors need to ensure the correct method (such as the effective interest method) is used to amortize them.

What is the major classification issue when auditing long-term debt, and how is it addressed?

-The major classification issue is ensuring that the portion of long-term debt due within the next year is properly classified as short-term liability. This is addressed by reviewing subsidiary ledgers and amortization schedules to accurately split the short-term and long-term portions of debt.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

ISA 200 Overall Objectives of the Independent Auditor

Audit Long Term Debt Substantive Procedures

Current Liabilities Accounting (Refinancing Short Term Debt With Long Term Debt)

The Fundamentals of IFRS 16

Financial Accounting 1: 13- Sections Of A Classified Statement Of Financial Position (شرح بالعربي)

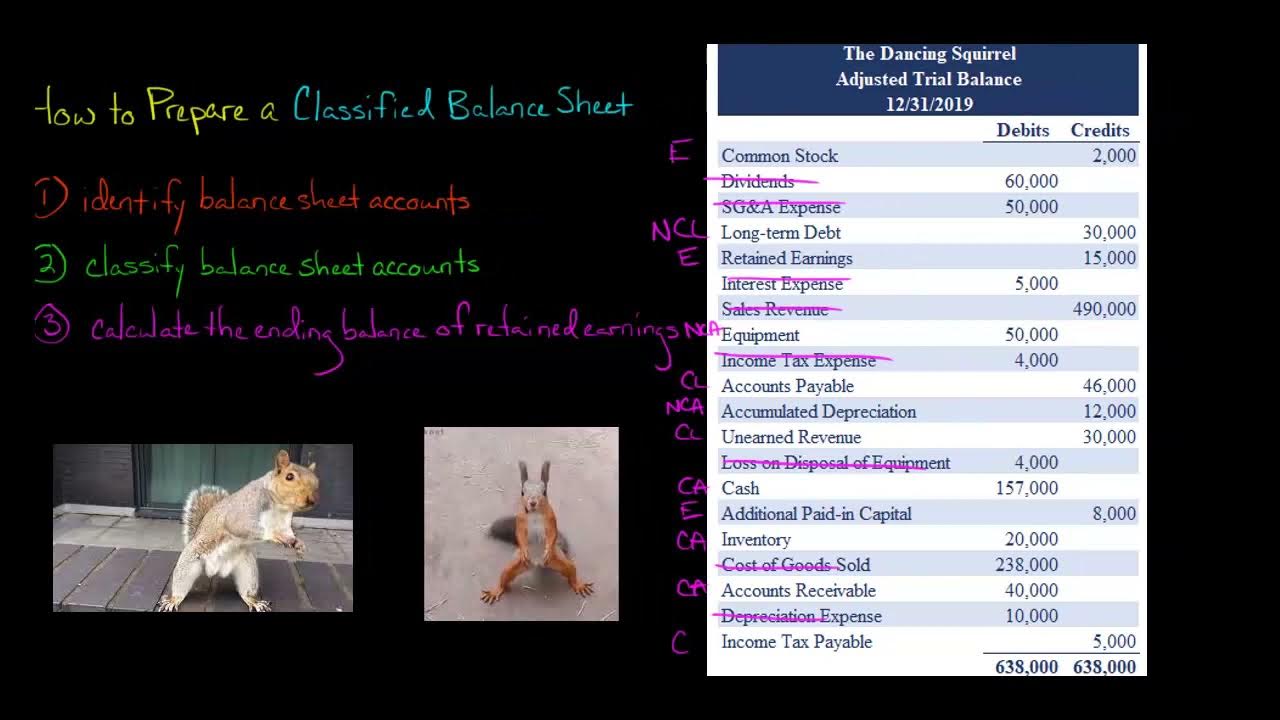

How to Prepare a Classified Balance Sheet

5.0 / 5 (0 votes)