Introduction to Auditing | Auditing and Attestation . CPA Exam AUD

Summary

TLDRThis video provides an introductory overview of auditing, highlighting key concepts such as evidence collection, established criteria, and the auditor's role. It emphasizes the importance of impartiality and competence for auditors, explaining that they must be independent and skilled to provide trustworthy reports. The criteria for auditing vary, depending on the type of audit, whether for financial statements or other operational areas. The video also discusses the significance of evaluating evidence and ensuring it aligns with predetermined standards, offering a solid foundation for students beginning their auditing studies.

Takeaways

- 😀 Auditing involves collecting evidence to evaluate how well information aligns with predetermined criteria.

- 😀 The criteria for evaluating information in an audit can vary depending on the type of audit (e.g., GAAP for financial statements).

- 😀 Evidence in auditing comes in various forms, including transaction data, communication records, observations, and oral statements.

- 😀 The auditor must be competent, impartial, and independent to ensure the reliability of the audit results.

- 😀 Independence is crucial for auditors to maintain the trust of users in their findings and reports.

- 😀 Evidence used in auditing must be verifiable and appropriate to the type of audit being conducted.

- 😀 Different types of audits (e.g., financial, operational, or internal) require different criteria for evaluation.

- 😀 Auditors issue a report that informs users about the findings, explaining the criteria used and how the evidence aligns with them.

- 😀 Auditors must understand both the complexity of evidence and the established criteria to draw accurate conclusions.

- 😀 A clean audit opinion is issued when the evidence aligns with the established criteria, while a non-clean opinion indicates discrepancies.

- 😀 Both internal and external auditors need to maintain independence, with internal auditors reporting to the board rather than management.

Q & A

What is the main goal of auditing?

-The main goal of auditing is to collect evidence and assess how well the information aligns with predetermined standards or established criteria.

What is meant by 'evidence' in the context of auditing?

-Evidence in auditing refers to the data collected to verify whether the audited information matches the criteria set for evaluation. This evidence can come in various forms, such as transaction data, communication records, observations, and oral statements.

Why is impartiality important for an auditor?

-Impartiality, or independence, is crucial for an auditor because it ensures that their report can be trusted by the users. Without independence, an auditor's findings may be biased and unreliable.

What are the two key qualities an auditor must possess?

-An auditor must be both competent and impartial. Competence ensures they understand the evidence and criteria, while impartiality ensures that the audit is unbiased and independent.

What is the significance of 'established criteria' in auditing?

-Established criteria provide a benchmark or standard against which the auditor measures the evidence they collect. The criteria may vary depending on the type of audit, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

What role does an auditor’s independence play in the audit process?

-An auditor's independence ensures that the audit is conducted without bias or external influence, thus ensuring the reliability of the audit's findings. It is vital for maintaining the trust of the users of the audit report.

What types of reports are typically produced in an audit?

-Audits can result in various types of reports, including those for financial statements, internal controls, and operational effectiveness. The format and complexity of the report depend on the scope and nature of the audit.

How does an auditor ensure that evidence is appropriate?

-An auditor ensures that evidence is appropriate by evaluating its relevance and reliability. The evidence must be sufficient, meaning there is enough data to form a reasonable conclusion, and appropriate, meaning it aligns with the criteria being measured.

What happens if an auditor is not independent?

-If an auditor is not independent, the audit results may be biased, and users of the audit report will not be able to trust the conclusions. This compromises the entire purpose of the audit, making it worthless.

What is the role of the auditor when auditing financial statements in the U.S.?

-When auditing financial statements in the U.S., the auditor follows Generally Accepted Auditing Standards (GAAS) and evaluates the financial statements against Generally Accepted Accounting Principles (GAAP).

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

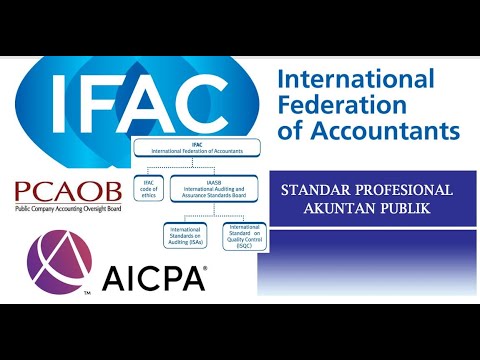

STANDAR AUDIT DAN SA 200

Ruang Lingkup Akuntansi | Pengantar Akuntansi | Bahan Ajar Akuntansi Politeknik Negeri Medan

4.2 Audit Procedures

Tanggungjawab auditor, asersi dan tujuan audit

STATISTIKA PENDIDIKAN PERTEMUAN 1-PENGANTAR STATISTIKA DAN STATISTIK

Delving into Key Audit Matters: auditor responsibilities under ASA/ISA701

5.0 / 5 (0 votes)