"PENGKOLAN" Cara kalian melihat Market Structure langsung berubah!

Summary

TLDRThis video focuses on the basics of price action trading, especially market structure, support and resistance (SR) levels, and key concepts like major and minor trends, flag patterns, and supply/demand zones. The speaker emphasizes the importance of understanding the structure of the market, using time frames effectively, and being patient when analyzing charts. With a focus on practical tips and clear explanations, the video aims to help beginners simplify their trading approach by identifying critical areas on the chart and avoiding the confusion of overanalyzing. The key takeaway is to focus on structure and context for successful trading.

Takeaways

- 😀 Understand the importance of market structure in trading, especially when analyzing price action.

- 😀 Trading without indicators can be challenging for beginners, but focusing on price action and market structure simplifies analysis.

- 😀 Recognize that market structure can appear random, but once you understand the core concepts, it becomes easier to interpret.

- 😀 There are four key principles of price action: Major, Minor, Flag, and structure and time frame.

- 😀 Support and Resistance (SR) are key elements of price action, but they are clearer when you analyze larger time frames.

- 😀 Major and minor structures refer to large and small market movements, with major structures being more significant for overall analysis.

- 😀 Time frames play an essential role in analyzing market context; start with larger time frames to grasp the bigger picture.

- 😀 Price can often appear erratic, but understanding structure and SR zones helps to make sense of market movements.

- 😀 The crossing of SR levels can indicate important price actions; zones that cross SR are critical for trading decisions.

- 😀 Hidden supply and demand zones are crucial; even if not visible on the chart, they influence price movements significantly.

- 😀 Focus on major structure points and areas where SR levels intersect for optimal entry and exit points in price action trading.

Q & A

What is price action trading and why is it emphasized in the video?

-Price action trading refers to analyzing charts without the use of indicators. The video emphasizes this approach to help traders focus on the core movement of price, relying on the structure of the market and key support and resistance levels instead of external indicators.

What is market structure and how does it affect trading decisions?

-Market structure refers to the way price moves within a chart, including the formation of highs and lows that define support and resistance levels. Understanding market structure helps traders identify potential price movements, trend reversals, and key entry points.

What is the difference between major and minor structures in trading?

-Major structures represent significant price movements and trends in the market, often defined by larger support and resistance levels. Minor structures are smaller, less significant trends that can still influence price action but are secondary to the major structures.

Why is it important to analyze higher time frames when trading price action?

-Analyzing higher time frames (such as daily or weekly charts) gives traders a clearer view of the broader market structure, highlighting significant support and resistance zones. These levels are more reliable for predicting price direction compared to those found in smaller time frames.

How do support and resistance (SR) levels help in price action trading?

-Support and resistance levels are key price zones where the market tends to reverse or consolidate. By marking these levels on a chart, traders can identify potential entry points and areas where price may react, helping to make more informed decisions.

What does it mean when price crosses an SR level?

-When price crosses an SR level, it indicates a potential change in market direction or momentum. A crossing suggests that the market has moved past a previously established boundary, and this can signal either a continuation or reversal in the trend.

What is the significance of rejections at SR levels?

-Rejections at SR levels indicate that price is struggling to break through these zones. This often signals strong buying or selling pressure, and such rejections can be used as confirmation for potential trade entries, either in the direction of the trend or as a reversal signal.

What are hidden supply and demand zones in price action trading?

-Hidden supply and demand zones are price areas that are not immediately visible but become significant when identified through structure analysis. These zones are important because they represent areas where price might reverse or consolidate, even if not immediately apparent.

How can lower time frames aid in identifying market structure?

-Lower time frames provide a more granular view of market movements, helping traders spot smaller structures and refine their entries. By analyzing smaller time frames, traders can pinpoint specific levels and price action signals that may not be visible in higher time frames.

What is the 'first crossing' rule in trading, and why is it important?

-The 'first crossing' rule refers to identifying the first instance when price crosses an important support or resistance level. This is important because the first crossing often signals the most significant price move, and it helps traders identify key turning points in the market for potential entries.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

The Secrets of Market Logic | Smart Money Concept, Supply & Demand, Beginner | Market Maker Logic

Memahami Logika Chart Seperti Profssional Lewat Pola Candle + Price Action || Seni Membaca Market

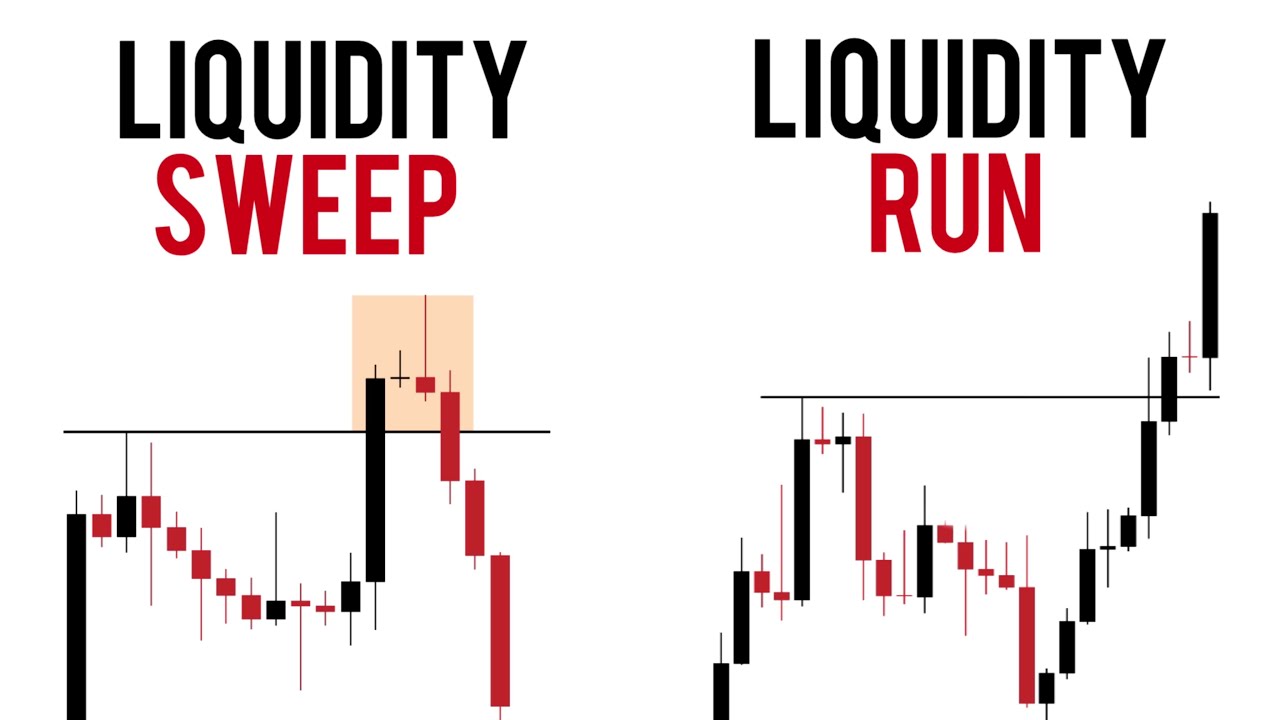

Liquidity Run Or Liquidity Sweep ( Purge Or Bos )

5-S&D Structure Zones Theory Pt1

ICT - Trading Plan Development 6

$435 Profit -Simple Price action setup even a beginner can make $$ Money $$ - Trusted spots

5.0 / 5 (0 votes)