Cara Pelaporan (SPT) Pajak Tahunan PNS diatas 60 juta tahun 2023

Summary

TLDRThis video tutorial guides Indonesian civil servants (PNS) earning over 60 million IDR per year through the process of filing their annual tax return (SPT) using the DJP Online portal. The steps include logging in to the portal, validating your profile, filling out tax forms with personal and income details, entering tax deductions, confirming your marital and dependent status, and reviewing tax calculations. Finally, users will receive a verification code to submit their SPT. The video offers a straightforward, step-by-step approach to ensure smooth and accurate tax filing for PNS.

Takeaways

- 😀 Ensure you visit the DJP Online website and log in using your NPWP and password to begin the e-filing process for your tax report.

- 😀 Make sure your personal information, including name, NPWP, and NIK, is accurate and validated before proceeding with the SPT submission.

- 😀 Use the correct tax form based on your income level. If your annual income exceeds 60 million IDR, select the appropriate tax form.

- 😀 Complete the steps to report your PPh (income tax) based on your income by entering details such as NPWP, payment proof number, and tax amount.

- 😀 Ensure the details for your taxable income, including deductions, exemptions, and net income, are entered correctly according to your Form A2.

- 😀 If you are reporting any dependents (e.g., spouse or children), make sure to add them accurately, including their NIK and relationship status.

- 😀 Be sure to correctly fill in information about zakat payments, marital status, dependents, and other relevant tax details from your Form A2.

- 😀 When prompted for any previous year's data, you can either use the information from the last year's report or update it as necessary for the current year.

- 😀 After entering all required information, review the tax calculation, and ensure that it matches the data on your Form A2 before continuing.

- 😀 You will receive a verification code through email to confirm the e-filing submission. Ensure the verification is completed to finalize your tax report submission.

Q & A

What is the first step to report annual tax (SPT) for government employees (PNS)?

-The first step is to visit the DJP online website by typing 'dcp online' and selecting the DJP online option. After that, you will enter your NPWP (Taxpayer Identification Number) and password, followed by the verification code.

How do you ensure your profile is valid before proceeding with the tax report?

-You need to verify that your profile information, including your name, NPWP, and NIK, is correct and valid. Once confirmed, you can proceed by clicking 'Lapor' (Report).

How do you know if you are eligible to use the 'e-filing' system for SPT submission?

-If your income for the year exceeds 60 million IDR, you should select 'Tidak' (No) when asked if your annual income is under 60 million, and proceed with 'e-filing'.

What should you do if the 'e-filing' form asks whether you have income from abroad or other specific sources?

-If you don't have foreign income or any income not subject to tax, simply click 'Tidak' (No) to proceed.

How do you report the total tax amount or deductions on the form?

-You should enter the tax deductions or payments as shown in Form A2, including details such as the NPWP of the tax collector and the tax amount, as specified in the form.

What if there is no tax deducted according to the Form A2?

-If there is no tax deducted (as indicated in Form A2), you should input '0' in the relevant field.

How do you report your dependents (children or spouse) on the tax form?

-If your dependents remain the same as the previous year, you can use the 'SPT tahun lalu' (Last Year's SPT). If there are any changes, you can manually add or modify the dependent information.

What should you do if your taxable income is not subject to tax after filling in the form?

-If the tax calculation shows that your taxable income is below the exempt threshold, you should select 'Nihil' (Zero) and proceed with the form submission.

How do you obtain the verification code for the SPT submission?

-You can obtain the verification code by either choosing email or phone number. After selecting the email option, check your email for the code and input it to verify your SPT submission.

What happens if your SPT status shows 'Penghasilan anda di bawah FTKP' (Your income is below the exempt threshold)?

-If your income is below the exempt threshold (FTKP), you can conclude the process by acknowledging the message and submitting the report.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Cara Lapor Spt Online Tahun 2025

Tutorial Pengisian SPT 1770 S Melalui e-Filing

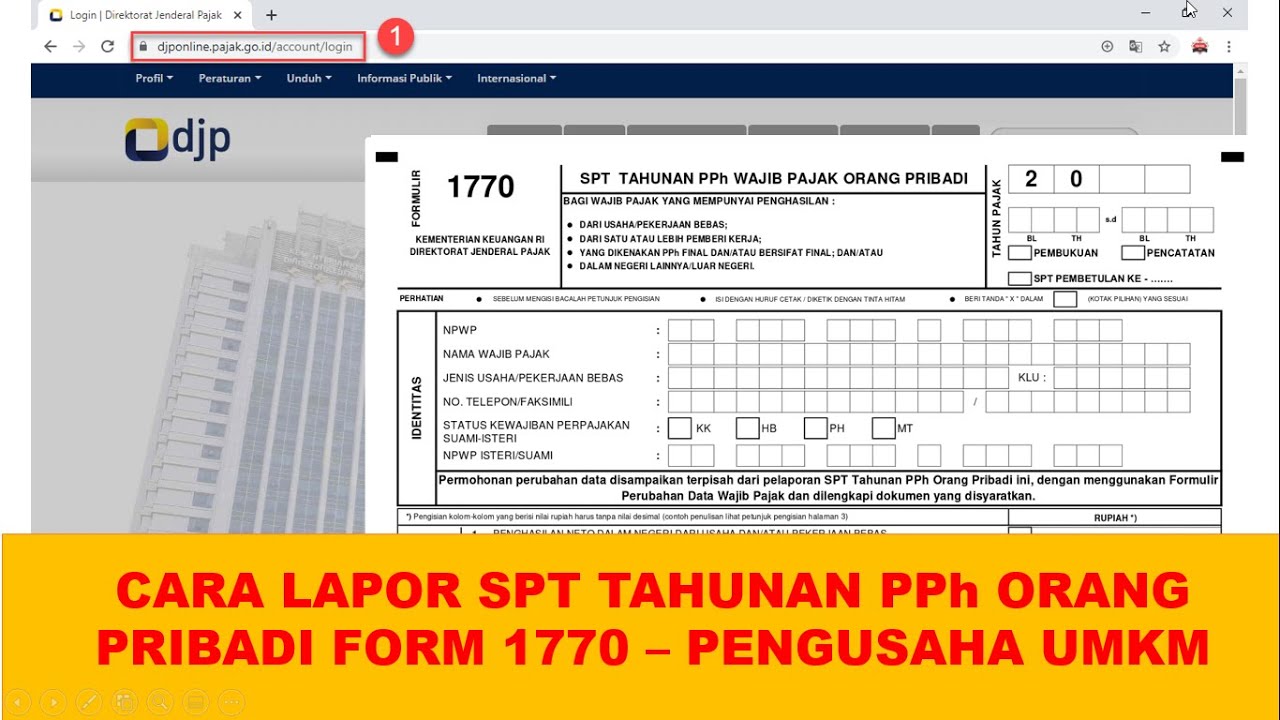

Cara lapor SPT Tahunan PPh Orang Pribadi pengusaha umkm menggunakan eform 1770

Tutorial Efiling 2022: Cara Lapor Pajak SPT Tahunan Secara Online Penghasilan Dibawah Rp 60 Juta

Tutorial Pelaporan SPT Tahunan 1770S | Bagi WP Orang Pribadi dengan e-Form

Cara Lapor eBupot Unifikasi Full Lengkap

5.0 / 5 (0 votes)