Guia para fazer uma Análise de Crédito COMPLETA!

Summary

TLDRThis video provides an in-depth guide to analyzing credit operations. It covers essential points such as understanding the business context, evaluating the company’s financial health, assessing risk factors, and reviewing operational strategies. The video emphasizes the importance of examining the company’s ability to repay debt through financial projections and exit strategies. Key elements include understanding the business model, management team, and assessing collateral or guarantees. The ultimate goal is to identify the company’s potential for success or failure in a credit operation and mitigate risks effectively.

Takeaways

- 😀 Understand the business: Before analyzing credit, it’s crucial to understand the business model, the players in the market, and potential risks. This includes identifying key factors that might influence the business, such as consumption patterns and competition.

- 😀 Focus on the company’s operations: Look at how the business generates revenue, what differentiates it from competitors, and its market positioning. Understanding its operational structure and key players is essential for credit analysis.

- 😀 Assess management and ownership structure: Evaluate the company’s management, its organizational structure, and potential conflicts of interest. The background of the company’s founders and their financial stability can also be a critical factor.

- 😀 Examine the financial health: Check the company’s financial statements for consistency with the management’s projections. Compare the financial performance against industry standards to gauge the company's growth and profitability.

- 😀 Rationale behind the credit request: Understand why the company is seeking credit and whether the proposed use of funds makes sense. Ensure the investment will add value or strengthen the company’s position.

- 😀 Analyze operational risk: Evaluate whether the company can successfully execute its operational plan, and determine if the financial projections align with its ability to repay debt under normal or stressful scenarios.

- 😀 Evaluate stress scenarios: Conduct a stress test on the company's financials to see if it can manage debt repayments in less favorable circumstances. Consider alternatives like asset sales or other financial strategies to ensure liquidity.

- 😀 Identify exit strategies: Look for potential exit strategies that will allow the company to repay debt, such as asset liquidation or the sale of equity. It's essential to assess the company’s ability to generate cash or sell assets if necessary.

- 😀 Consider collateral and guarantees: Analyze the types of collateral or guarantees that the company can provide. A company’s access to secured assets can mitigate the risk of lending and provide assurance in case of default.

- 😀 Take a holistic view of the credit operation: After considering the business model, financials, operational risks, and collateral, make sure the entire credit operation is viable. Look at the company’s ability to repay and the terms of the credit agreement to ensure a balanced risk-reward scenario.

Q & A

What is the first step in evaluating a credit operation?

-The first step is to understand the business behind the credit operation. This includes analyzing the company’s business model, how it generates revenue, and what differentiates it from its competitors in the market.

Why is it important to assess the industry and market when evaluating credit?

-Assessing the industry and market helps identify the key players, risks, and trends that might affect the company’s ability to repay the loan. Understanding the competitive landscape and potential market changes is crucial for accurate risk assessment.

What role does company management play in the evaluation process?

-Company management plays a critical role as their leadership and decision-making directly impact the business's performance. Evaluating the management structure, key stakeholders, and any conflicts of interest is important for understanding potential risks in the credit operation.

What should be considered when analyzing a company’s financial health?

-When analyzing a company's financial health, it is important to review financial statements like the balance sheet, income statement, and cash flow statement. You should also look for discrepancies between management’s statements and the actual financial data, as well as assess the company’s growth, profitability, and financial stability.

How should the business model and operational rationale be assessed in a credit evaluation?

-The business model should be evaluated to understand how the company makes money and whether its operations make sense. You should also examine the rationale behind investments the company is making to ensure that they align with the company's long-term goals and profitability.

What is the importance of understanding cash flow in credit evaluation?

-Understanding cash flow is essential because it reveals how well the company manages its finances. You need to determine whether the company can generate enough cash flow to meet its debt obligations and avoid financial strain.

Why is stress testing a part of the credit evaluation process?

-Stress testing helps simulate worst-case scenarios to assess whether the company can still repay its debt under adverse conditions. This helps identify potential vulnerabilities in the company's financials that could affect its ability to service debt.

What are exit strategies, and why are they important in credit evaluations?

-Exit strategies refer to plans for recovering funds if the credit operation does not go as expected. They are important because they provide options for debt recovery, such as asset sales or securing additional capital, in case the company faces financial distress.

How does the type of collateral affect a credit decision?

-The type of collateral provides security for the loan. Having strong collateral, such as valuable assets or guarantees, reduces the risk for the lender. If the borrower cannot repay, the collateral can be used to recover the debt, making it a key factor in credit decisions.

What should be considered when making projections for a company’s future performance?

-Projections should be based on the company’s past performance, industry trends, and the management’s growth plans. It’s important to compare the company’s expected results with other players in the sector and adjust projections based on realistic assumptions about the market and operations.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Pendalaman Siklus Akuntansi Perusahaan Part 2

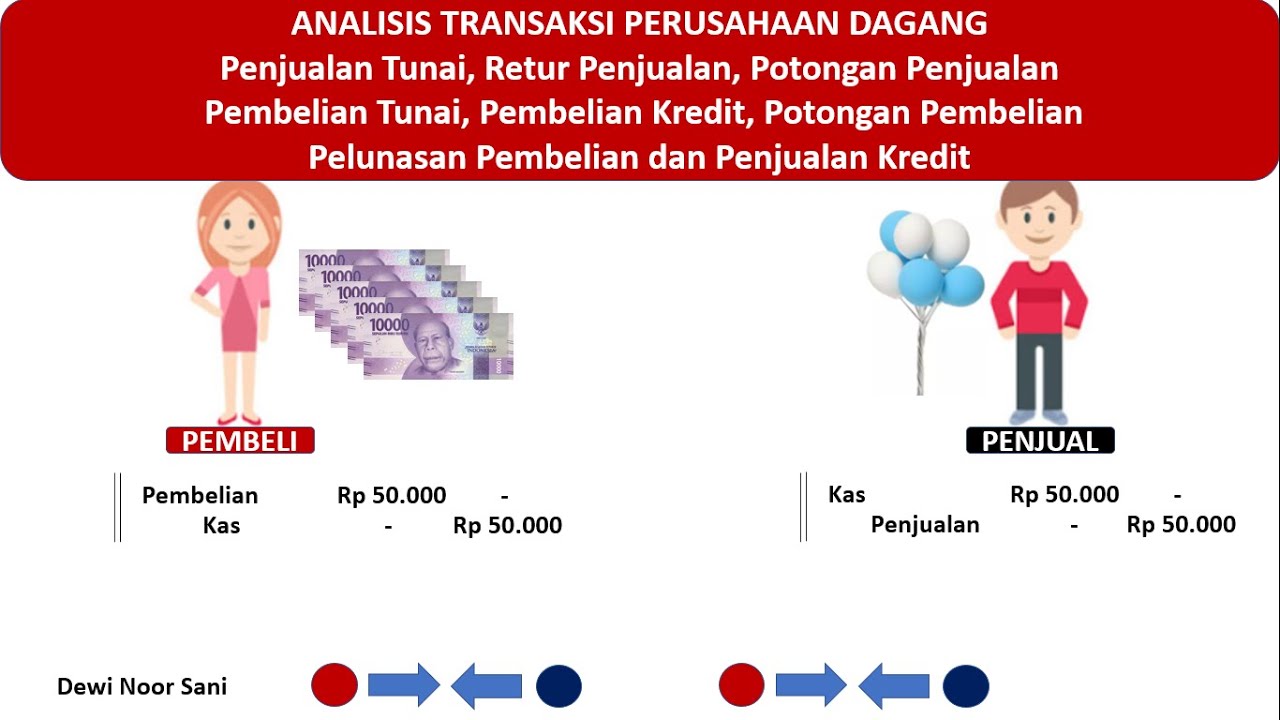

ANALISIS TRANSAKSI PERUSAHAAN DAGANG

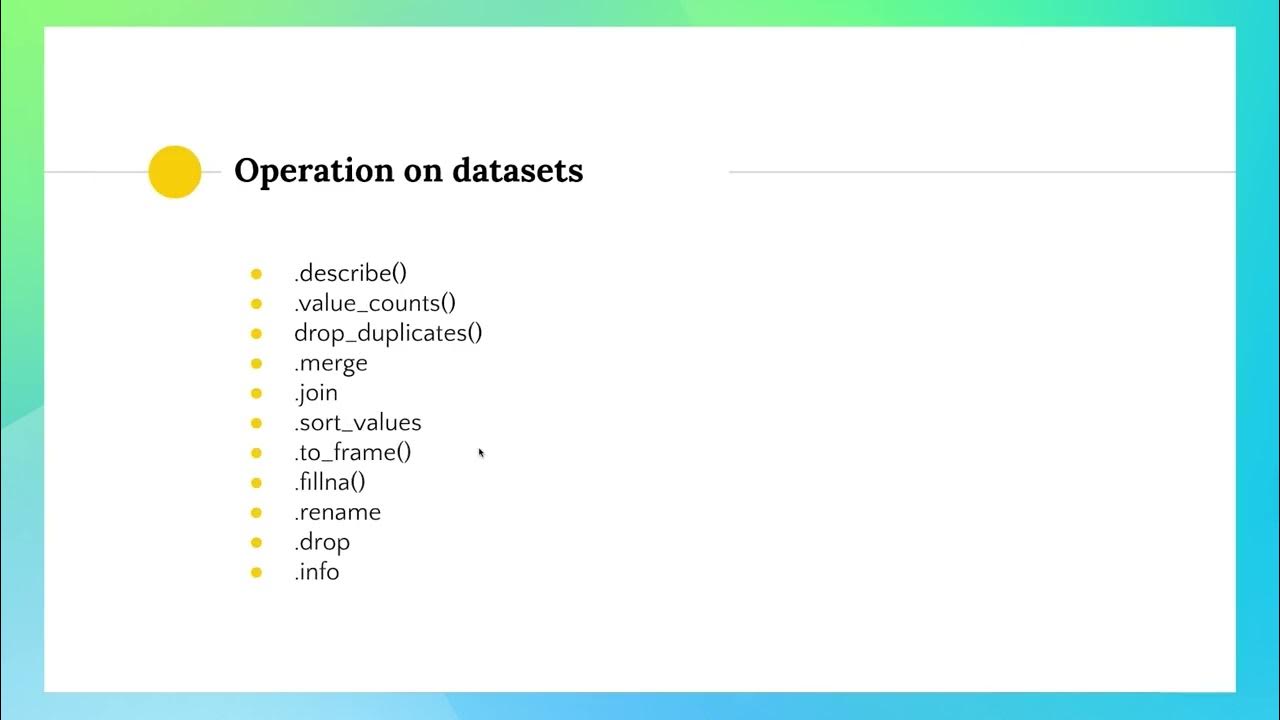

Dataframes Part 02 - 02/03

Análise de Crédito - Raio X de Cedente e Sacado

2025無腦神卡登場!LINE Pay/網購8%、街口6%、機票5%、日本刷卡5%|SHIN LI 李勛

PMP® Exam Practice questions with Explanations | Task 1.1 Manage Conflict | PMP® Exam prep questions

5.0 / 5 (0 votes)