9. Learn To Prepare "Ledger Accounts" In 20 Minutes

Summary

TLDRThis video provides a comprehensive guide on accounting fundamentals, focusing on the creation and posting of journal entries, managing debits and credits, and understanding transaction classifications. It walks through real-world examples and offers practical insights for students, helping them grasp key accounting principles such as posting to ledgers and managing account balances. The video encourages active learning with repeated references to accurate transaction entries, ensuring a clear understanding of accounting practices.

Takeaways

- 😀 Journal entries are fundamental in accounting, and they involve both a debit and a credit for each transaction.

- 😀 Every transaction must balance, meaning the total debits and credits must be equal.

- 😀 In accounting, debits are recorded on the left side of the ledger and credits on the right.

- 😀 A basic example of a journal entry for cash receipt would be: Debit Cash Account, Credit Sales Account.

- 😀 Bank transfers involve moving funds between accounts, recorded as Debit Bank Account (Receiving) and Credit Bank Account (Sending).

- 😀 When cash is withdrawn from an account, the journal entry should reflect: Debit Cash Withdrawal, Credit Bank Account.

- 😀 Purchases are recorded as: Debit Purchases Account, Credit Cash or Bank Account.

- 😀 It's essential to track opening and closing balances to ensure accurate financial records and prevent discrepancies.

- 😀 Posting journal entries to the ledger accounts is necessary to maintain a clear financial record for a business.

- 😀 Remember, journal entries impact both short-term cash flow and long-term financial stability, so accurate tracking is vital.

Q & A

What is the importance of journal entries in accounting?

-Journal entries are fundamental in accounting because they help track and record every financial transaction. They provide a chronological record of all transactions that affect the financial position of an entity, ensuring accuracy in financial statements.

How do you determine whether to debit or credit an account?

-To determine whether to debit or credit an account, remember the basic rule: Debit increases assets and expenses, and decreases liabilities and equity. Credit increases liabilities, equity, and income, and decreases assets and expenses.

What is the process for recording a bank transfer in a journal entry?

-In the case of a bank transfer, if cash is transferred from one account to another, you debit the receiving account (e.g., bank account) and credit the sending account (e.g., cash account) to reflect the movement of funds.

What are some examples of personal account transactions?

-Personal account transactions include those involving individuals, where one party owes or receives money from another. For example, if Deepak receives money, you would debit Deepak's account and credit the giver's account.

How do you record purchases made on credit?

-When a purchase is made on credit, you debit the purchase account to reflect the increase in inventory or assets, and credit accounts payable to indicate that the amount is owed to the vendor.

What happens when cash is received in accounting?

-When cash is received, the cash account is debited to show an increase in the asset, and the corresponding account, such as accounts receivable or sales revenue, is credited.

Why is it important to balance debit and credit entries?

-Balancing debit and credit entries ensures the accounting equation (Assets = Liabilities + Equity) remains in balance. It also prevents errors in the financial statements and ensures accurate reporting of the company’s financial position.

What should you do if a transaction involves both a debit and a credit?

-If a transaction involves both a debit and a credit, you must record both sides in the journal. For instance, when goods are purchased on credit, you debit the purchase account and credit accounts payable, ensuring the total debits equal the total credits.

How do you record a deposit made into a bank account?

-To record a deposit into a bank account, you debit the bank account to reflect the increase in cash and credit the source of the deposit, which could be a cash account, customer accounts, or others.

What are common mistakes in journal entries, and how can they be avoided?

-Common mistakes in journal entries include incorrect debit or credit application, misclassification of accounts, and errors in amounts. These can be avoided by following the basic rules of accounting, double-checking entries, and ensuring both sides of the transaction balance.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

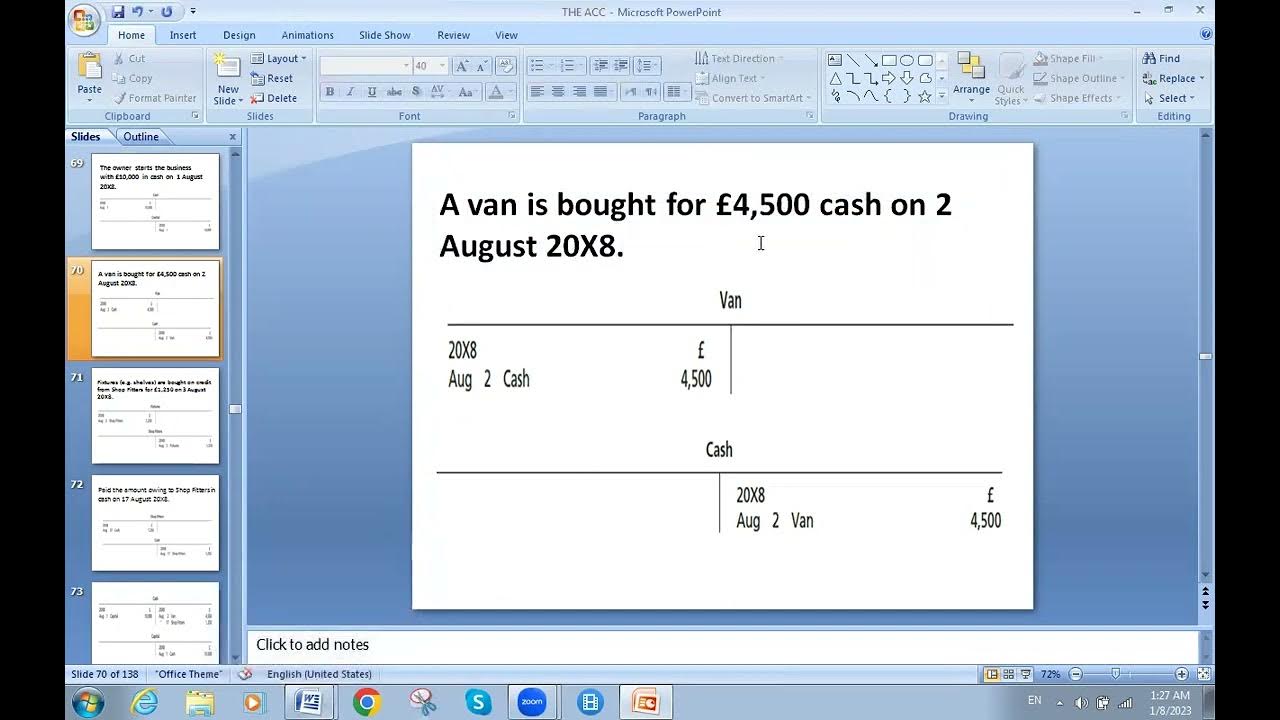

8 ACC JOURNA STARTING AND BUYING

Cara Membuat Jurnal Umum Perusahaan Jasa untuk Pemula

Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

How JOURNAL ENTRIES Work (in Accounting)

Ekonomi Kelas XII Bab 3: Siklus Akuntansi Perusahaan Jasa Tahap Pencatatan (Part 1)

The Accounting Cycle Part 1(Journal entry, posting, unadjusted trial balance)

5.0 / 5 (0 votes)