Bilanzen einfach erklärt (explainity® Erklärvideo)

Summary

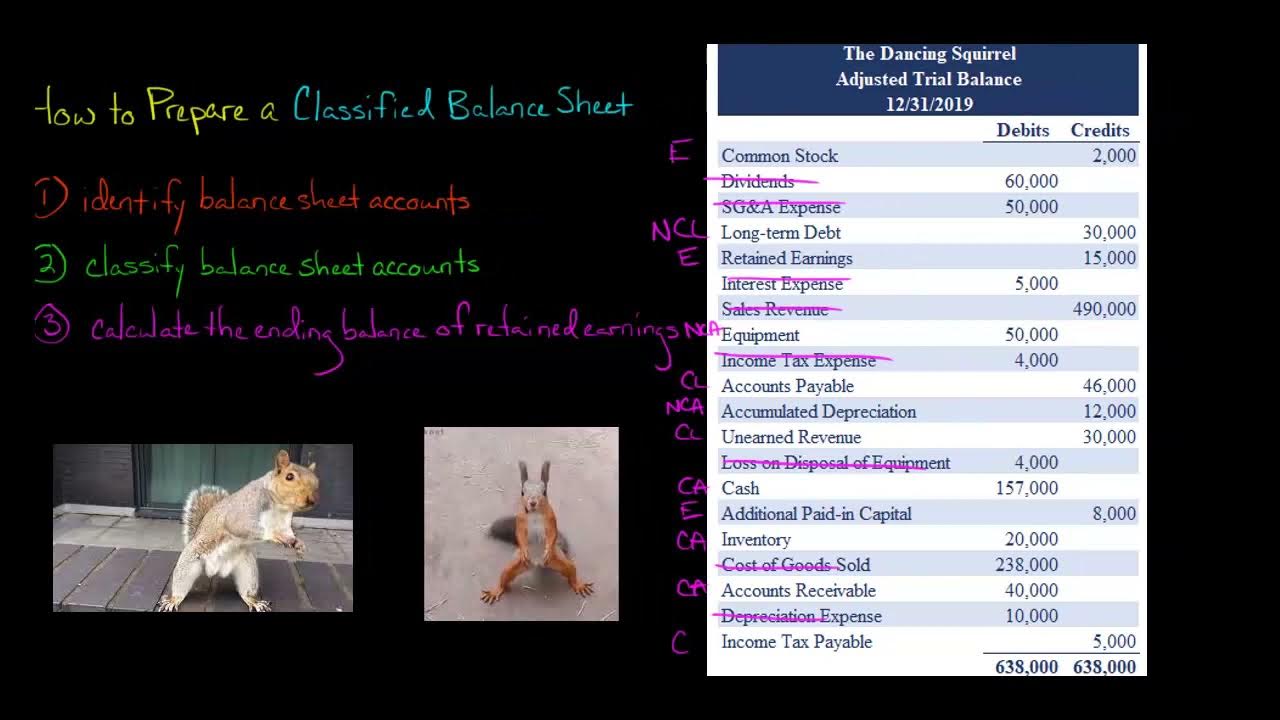

TLDRThis script explains the process of creating a balance sheet for a company, using Anna's business of manufacturing and selling rubber ducks as an example. It outlines the components of the balance sheet, including assets like machinery, office equipment, and raw materials, as well as liabilities like loans and mortgages. The balance sheet is divided into assets on the left and liabilities on the right, with the company's equity calculated as the difference. By comparing equity at the beginning and end of the year, the profit or loss for the year can be determined. This financial process is essential for businesses and their partners.

Takeaways

- 😀 A balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and equity at a specific point in time.

- 😀 Every business that operates a trade is required to prepare an annual balance sheet.

- 😀 A balance sheet is useful not only for the company itself but also for potential business partners and investors who are evaluating the company's financial health.

- 😀 Companies are required to make their balance sheets publicly accessible, especially capital companies.

- 😀 The foundation of a balance sheet is the inventory, which includes assets and liabilities.

- 😀 Assets are divided into two categories: fixed assets (Anlagevermögen) and current assets (Umlaufvermögen).

- 😀 Fixed assets (Anlagevermögen) include long-term possessions such as machinery, office equipment, or real estate.

- 😀 Current assets (Umlaufvermögen) include items that are in circulation, like raw materials, finished products, and cash in the bank.

- 😀 Liabilities (Fremdkapital) represent the company's debts, such as mortgages or loans taken to finance business activities.

- 😀 To determine equity, the value of assets is summed up, and the liabilities are subtracted from this total. This calculation helps assess whether the company has made a profit or loss over the year.

Q & A

What is the primary responsibility of Anna in the company?

-Anna is responsible for managing the finances of a company that manufactures and sells rubber ducks.

What is the purpose of creating a balance sheet at the end of the business year?

-The purpose of the balance sheet is to provide a financial overview of the company's status, including its assets, liabilities, and equity.

Which companies are required to create a balance sheet?

-Any company engaged in commercial trade (a business with a commercial enterprise) is required to create a balance sheet.

Why is a balance sheet important for both the company and potential business partners?

-A balance sheet allows stakeholders to assess the company's financial health, and it is especially important for potential partners considering doing business with the company.

What type of companies are obligated to make their balance sheets publicly available?

-Capital companies (such as public limited companies) must make their annual balance sheets publicly accessible.

What are the three main components of a balance sheet's inventory?

-The three main components are fixed assets (Anlagevermögen), current assets (Umlaufvermögen), and liabilities (Fremdkapital).

What is considered fixed assets (Anlagevermögen) in a balance sheet?

-Fixed assets are all items that are not meant for resale, such as machines used to produce rubber ducks, office equipment, and the land on which the factory stands.

What is included under current assets (Umlaufvermögen)?

-Current assets include items actively in circulation, such as raw materials for production, the finished rubber ducks, or the company's bank account balance.

What does 'Fremdkapital' (liabilities) refer to in a balance sheet?

-'Fremdkapital' refers to the debts of the company, such as a mortgage on the property or a loan taken to finance new machinery.

How do you calculate the equity (Eigenkapital) of the company?

-Equity is calculated by adding up the assets on the left side of the balance sheet and subtracting the liabilities from that sum.

How can you determine the company's profit or loss for the year using the balance sheet?

-By comparing the equity at the beginning and end of the year, you can calculate the profit or loss the company made during the year.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)