Legal Environment of Business: Securities Law

Summary

TLDRThis video covers U.S. securities regulation, explaining the key laws that govern the issuance, sale, and trading of securities, such as stocks and bonds. It explores the Securities Act of 1933, which mandates transparency and fraud prevention in the initial offering of securities, and the Securities Exchange Act of 1934, which regulates secondary market trading. The video also discusses the Dodd-Frank Act (2010), created after the 2008 financial crisis, and the Sarbanes-Oxley Act (2002), aimed at restoring trust following corporate scandals. These laws aim to protect investors, ensure fair markets, and promote financial transparency.

Takeaways

- 😀 Securities regulation governs the issuance, sale, and trading of financial instruments like stocks, bonds, and mutual funds, with the primary goal of protecting investors and ensuring market fairness.

- 😀 The Securities Act of 1933 was the first federal law regulating securities, introduced after the 1929 stock market crash to ensure transparency and prevent fraudulent practices during initial offerings.

- 😀 A security, under the 1933 Act, includes any form of investment contract or instrument, such as stocks, bonds, and investment contracts, aiming to provide clear definitions of what constitutes a security.

- 😀 The main goal of the Securities Act of 1933 is to ensure 'full and fair disclosure,' meaning companies must provide comprehensive financial information and risk disclosures to potential investors.

- 😀 Companies must file a detailed prospectus containing audited financial statements and risk factors before issuing stock, ensuring investors make informed decisions based on accurate data.

- 😀 The Securities Exchange Act of 1934 focuses on the secondary market, regulating the buying and selling of securities after their initial offering, and ensures transparency and fairness in stock exchanges like the NYSE and NASDAQ.

- 😀 The 1934 Act created the SEC (Securities and Exchange Commission) to enforce federal securities laws, regulate markets, and protect investors from fraudulent stock trading practices, such as market manipulation and insider trading.

- 😀 The 1934 Act also requires continuous disclosure from companies, including quarterly (10-Q) and annual (10-K) reports, to keep investors informed of a company's financial health.

- 😀 The Dodd-Frank Act of 2010 was introduced in response to the 2008 financial crisis to reduce systemic risks and ensure the stability of the financial system by creating the FSOC (Financial Stability Oversight Council) and CFPB (Consumer Financial Protection Bureau).

- 😀 Sarbanes-Oxley Act of 2002 aimed to restore public trust after corporate scandals (e.g., Enron, Worldcom), focusing on accurate financial reporting, internal controls, and protecting whistleblowers who report corporate fraud.

Q & A

What is the primary purpose of securities regulation?

-The primary purpose of securities regulation is to protect investors from fraud, ensure transparency, and maintain fairness in the financial markets.

What types of investment vehicles are considered securities under the Securities Act of 1933?

-Securities include notes, stocks, bonds, treasury stock, mutual fund shares, investment contracts, voting trust certificates, certificates of deposit, and fractional interests in oil, gas, or other minerals, among others.

What was the main goal of the Securities Act of 1933, and why was it passed?

-The main goal of the Securities Act of 1933 was to ensure transparency in financial statements provided to investors before they purchase securities. It was passed in response to the stock market crash of 1929 and the widespread fraudulent activities that contributed to the crash.

What is a prospectus, and why is it important for investors?

-A prospectus is a detailed document that companies must provide when issuing securities, containing audited financial statements, management background, risk factors, and other essential information. It ensures investors have accurate data to make informed investment decisions.

What are the penalties for providing false or misleading information in a registration statement or prospectus?

-Companies that provide false or misleading information in their registration statement or prospectus can be held legally liable for securities fraud. They can face both civil and criminal penalties.

How does the Securities Exchange Act of 1934 differ from the Securities Act of 1933?

-The Securities Act of 1933 regulates the initial offering of securities, while the Securities Exchange Act of 1934 governs secondary market transactions (trading of securities after their initial issuance), ensuring transparency and fair practices in ongoing trading.

What are the requirements for companies under the Securities Exchange Act of 1934 regarding financial disclosure?

-Under the 1934 Act, companies are required to file quarterly (10-Q) and annual (10-K) reports to ensure that investors have up-to-date and accurate information about the company’s financial status.

What is insider trading, and why is it prohibited under the Securities Exchange Act of 1934?

-Insider trading occurs when individuals with access to non-public, material information about a company buy or sell securities based on that information. It is prohibited because it creates an unfair advantage for those with insider knowledge and undermines market integrity.

What is the purpose of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010?

-The Dodd-Frank Act was created in response to the 2008 financial crisis to reduce systemic risks in the financial system and prevent future economic collapses. It includes provisions like creating the Financial Stability Oversight Council (FSOC) and the Consumer Financial Protection Bureau (CFPB).

How did the Sarbanes-Oxley Act of 2002 contribute to improving corporate governance?

-The Sarbanes-Oxley Act of 2002 aimed to restore public confidence in financial markets by enhancing transparency, preventing fraud, and ensuring the accuracy of financial reporting. It introduced stricter penalties for corporate fraud, required executives to certify financial statements, and created the PCAOB to oversee public company audits.

What is the Volcker Rule, and what does it prohibit?

-The Volcker Rule, part of the Dodd-Frank Act, prohibits banks from engaging in risky trading activities with their own funds. This aims to prevent financial institutions from taking excessive risks that could jeopardize the stability of the financial system.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

Embedded Linux | Introduction To U-Boot | Beginners

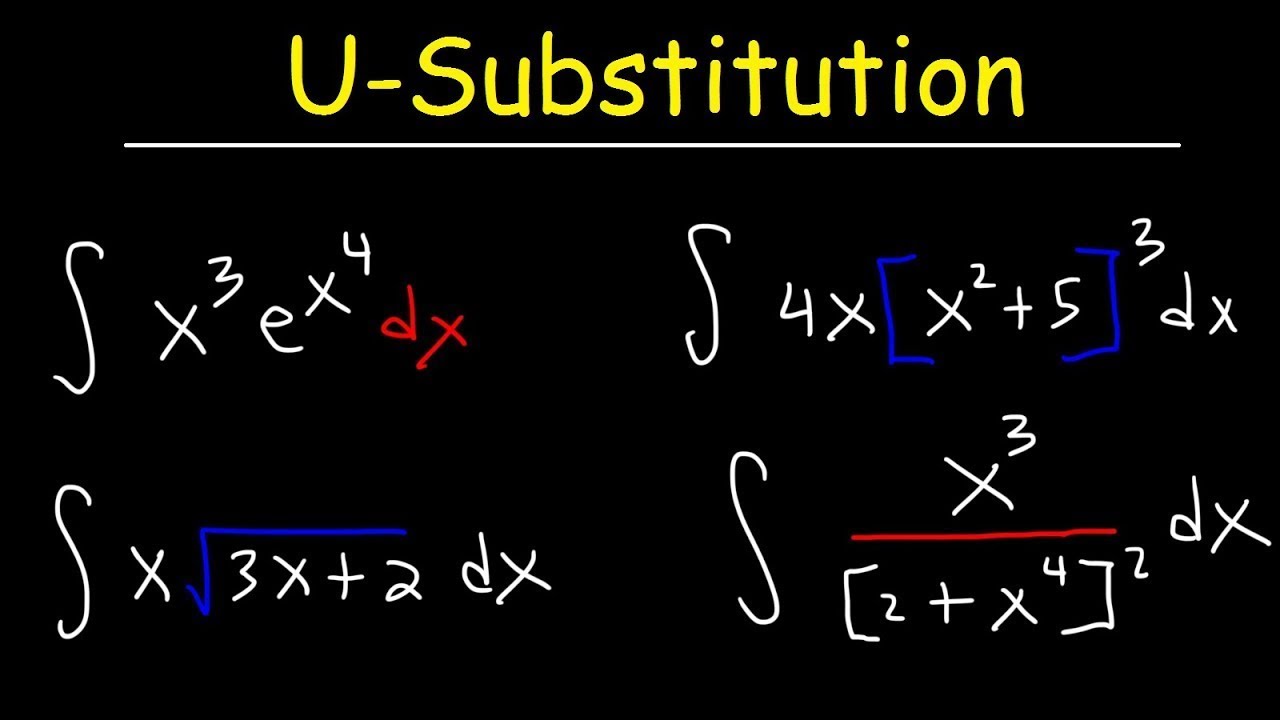

How To Integrate Using U-Substitution

Complements of Sets

DETIK DETIK TIMNAS LOLOS 16 BESAR ERICK PERPANJANG KONTRAK STY HINGGA 2027 ~ IDN VS AUSTRALIA

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

5.0 / 5 (0 votes)