Islamic Finance Show EP2: Ethics

Summary

TLDRIn this episode of *The Islamic Finance Show*, experts discuss the ethical foundations of Islamic finance, its growth since the 2008 financial crisis, and the challenges it faces in a rapidly evolving financial landscape. Emphasizing shared risk, integrity, and social justice, they explore how Islamic finance can offer an alternative to conventional banking. The discussion also covers the role of technology, crowdfunding, and the need for innovation to align financial products with Islamic principles. The future of Islamic finance hinges on staying true to its ethics while embracing modern financial models for greater social impact.

Takeaways

- 😀 Islamic finance is built on ethical principles that prioritize social good, fairness, and integrity in financial transactions.

- 😀 There are two forms of ethics in Islamic finance: one focused on duties regardless of consequences, and another considering the outcomes of actions.

- 😀 Risk sharing is a core principle in Islamic finance, where both financial institutions and consumers share risks fairly, especially in retail banking.

- 😀 The ethical foundation of Islamic finance emphasizes the fair distribution of wealth, aiming to reduce poverty and ensure financial independence.

- 😀 The 2008 subprime mortgage crisis significantly eroded public trust in the financial sector, a trust that is still being rebuilt over a decade later.

- 😀 Despite efforts to restore trust, many financial institutions, including Islamic banks, continue to face challenges in fully implementing ethical principles in their operations.

- 😀 The increasing role of technology in finance necessitates the adaptation of ethical principles to a more tech-savvy world, aligning with new entrepreneurial solutions.

- 😀 There's growing consumer demand for businesses to consider ethical factors such as workers' rights, environmental impact, and transparency in their supply chains.

- 😀 A key challenge for both conventional and Islamic financial institutions is the disconnect between ethical knowledge and actual implementation of these principles.

- 😀 Islamic finance must innovate and move beyond mimicking conventional finance models, focusing on long-term ethical business practices rather than short-term profits.

- 😀 The Islamic finance sector must better align with its foundational values by emphasizing the human, environmental, and social impacts of business practices.

Q & A

What are the core ethics behind Islamic finance?

-The ethics of Islamic finance are built on two main principles: normative ethics, which addresses the right duties to complete regardless of consequences, and consequential ethics, which focuses on the outcomes of actions. Islamic finance integrates both aspects under the spirit of the Mikasa del Sharia, emphasizing shared risk, fairness, integrity, and accountability.

How does Islamic finance ensure fairness in financial transactions?

-Islamic finance ensures fairness by emphasizing shared risk between financial institutions and consumers. Unlike conventional finance, where risks are often shifted entirely to the consumer, Islamic finance promotes a model where both parties share in the profits and risks, creating a more equitable approach.

What role does poverty alleviation play in Islamic business ethics?

-Islamic business ethics prioritize the fair distribution of wealth, ensuring that poverty is addressed within the financial system. The model aims to support those at the lower end of the economic spectrum, empowering individuals to become financially independent and run their own businesses.

How did the 2008 financial crisis affect trust in the financial sector, and how is it being rebuilt?

-The 2008 subprime mortgage crisis led to a significant loss of trust in the financial sector. Despite efforts from both governmental and private entities to rebuild trust, it's clear that trust is still being restored, with ongoing efforts to create stronger frameworks and ensure ethical compliance in financial operations.

Has Islamic finance benefited from the ethical vacuum created by the 2008 financial crisis?

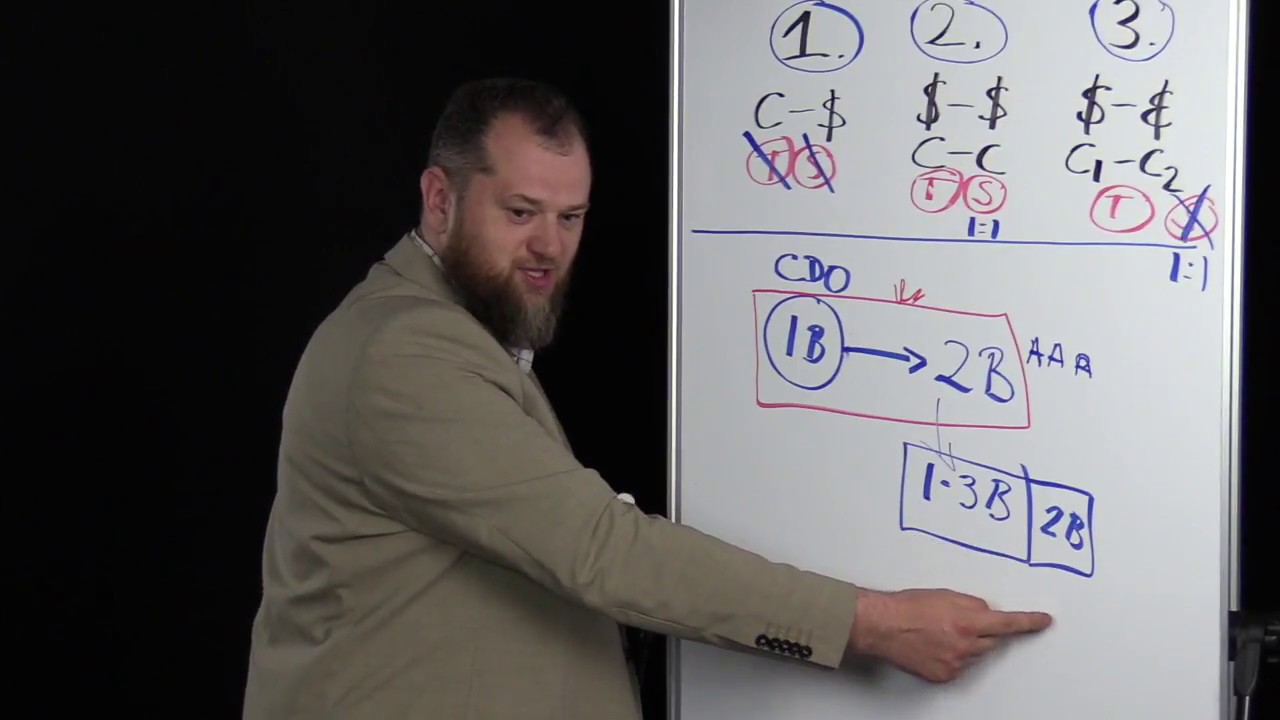

-While Islamic finance was positioned to fill the ethical vacuum created by the 2008 crisis, it was not immune to the structural issues that affected all financial systems, including conventional banks. Both Islamic and conventional banks shared common structural issues that led to the crisis, which limited the potential for Islamic finance to capitalize on this gap.

What is the difference between short-term and long-term profit-making in Islamic finance?

-In Islamic finance, long-term profits that align with social good and fairness are prioritized, whereas conventional finance often focuses on short-term profit maximization for shareholders. Islamic finance encourages sustainable and ethical profit-making that benefits society as a whole.

How does crowdfunding fit into the Islamic finance model?

-Crowdfunding in Islamic finance is seen as a tool for empowering entrepreneurs to raise capital without falling into debt or paying high-interest rates. This model encourages financial independence and community-driven investments, aligning with Islamic principles of social responsibility and fairness.

Why are Islamic financial products sometimes criticized for mimicking conventional financial products?

-Islamic financial products are often criticized for structurally resembling conventional finance products. Critics argue that Islamic finance should innovate rather than replicate, ensuring that products adhere to the ethical principles of Islamic finance rather than merely providing a 'Sharia-compliant' label.

What is the challenge of implementing Islamic finance ethics in the face of modern technological advances?

-As the world becomes more technologically driven, Islamic finance ethics must adapt to new challenges, including ensuring that technological innovations prioritize social good and environmental responsibility. Without a strong ethical foundation, even the most innovative solutions may fail to align with the principles of Islamic finance.

How can Islamic finance address the issues of profit at the expense of society?

-Islamic finance promotes profits that are aligned with the welfare of society, ensuring that businesses do not exploit workers or harm the environment. The system emphasizes socially responsible investing and prioritizes long-term prosperity, with profits that do not come at the cost of societal or environmental well-being.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

(Kelompok 5) AKAD MUDHARABAH

Pengertian Lembaga Keuangan dalam Islam

Diskusi dengan Pak Irfan Syauqi Beik (Wakaf Core Principle)

Wisdom behind Prohibition of Riba (interest) - Case study GFC | Almir Colan

RI Negara Muslim Terbesar Tapi Literasi Keuangan Syariah Rendah, Kenapa?

Introduction to Islamic Finance (1 of 4): The basics you should know.

5.0 / 5 (0 votes)