HOW TO CONVERT A LIABILITY INTO AN ASSET - ROBERT KIYOSAKI, Rich Dad Poor Dad

Summary

TLDRIn this engaging discussion, Robert Kiyosaki and Alexa explore the fundamentals of financial literacy, emphasizing the critical distinction between assets and liabilities. Kiyosaki argues that a personal residence is not an asset since it incurs ongoing costs, and he shares insights on managing cash flow effectively. They discuss the financial implications of family members as potential liabilities and the necessity of understanding how to control cash flow. The conversation highlights the importance of mastering key financial terms—income, expense, asset, liability, and cash flow—to achieve financial intelligence, especially for millennials navigating today's economic landscape.

Takeaways

- 😀 Understanding that a personal residence is not always an asset; it can often be a liability due to ongoing costs.

- 💰 The key to financial intelligence lies in controlling cash flow, not just earning a high salary.

- 📊 Familiarity with six essential financial terms: income, expense, asset, liability, and cash flow is crucial for financial literacy.

- 🏠 Middle-class cash flow patterns often involve buying bigger houses that can lead to financial strain.

- 📉 Many people, regardless of education level, struggle with managing cash flow, which contributes to financial instability.

- 🧑🤝🧑 Relationships can also be liabilities, especially when considering the financial impact of family obligations as they age.

- 💡 Financial education is not typically taught in schools, leaving many young people unprepared for real-world financial challenges.

- 🧾 Understanding the true nature of financial products like 401(k)s and IRAs is important, as they can often act as liabilities.

- 👶 Children are considered financial liabilities due to their ongoing costs, which increase over time.

- 🔍 High financial IQ is about identifying and managing potential liabilities in both personal relationships and financial decisions.

Q & A

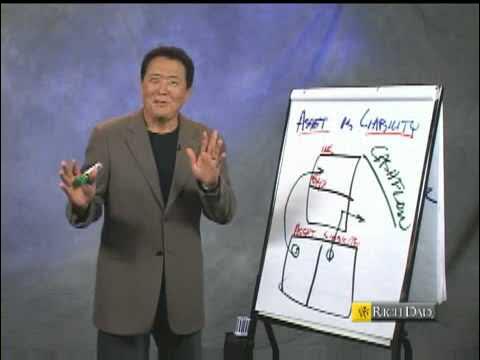

What is the fundamental difference between assets and liabilities according to Robert Kiyosaki?

-Assets put money into your pocket, while liabilities take money out of your pocket.

Why does Kiyosaki claim a personal residence is not an asset?

-He argues that a personal residence incurs expenses like mortgage payments and taxes, which result in cash flowing out.

What are the six basic words Kiyosaki associates with financial literacy?

-Income, expense, asset, liability, and cash flow.

How does Kiyosaki define cash flow?

-Cash flow is the movement of money in and out of a person's finances, which is crucial for financial intelligence.

What does Kiyosaki suggest about college education in relation to wealth?

-He emphasizes that controlling cash flow is more important than having a college degree for achieving wealth.

How can family members be considered liabilities according to Kiyosaki?

-As people age, they may require financial support for healthcare, which can become a significant expense.

What does Kiyosaki say about financial advisors?

-He warns that a bad financial advisor can be a liability, potentially leading to significant financial loss.

How does Kiyosaki view the traditional advice of living below one's means?

-He believes this approach does not address the root problem of controlling cash flow, which is essential for financial health.

What example does Kiyosaki give about unexpected expenses in life?

-He mentions that many people are unprepared for the medical expenses associated with aging parents, which can deplete savings.

What key advice does Kiyosaki give to millennials regarding purchasing homes?

-He advises them to assess whether a home will put money in their pocket or take money out, emphasizing the importance of cash flow.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

PADRE RICCO PADRE POVERO - Robert Kiyosaki - AUDIOLIBRO in ITALIANO Riassunto - Crescita personale

Why the Rich are Getting Richer | Robert Kiyosaki | TEDxUCSD

11 Mei 2025

Robert Kiyosaki - Assets vs Liabilities

3 Kunci Membangun Kekayaan! - Maudy Ayunda's Booklist

rich Dad Poor Dad - in Just 11 Minutes(All 7 chapters)

5.0 / 5 (0 votes)