Lecture 07: Rules of Debits and Credits. [Fundamentals of Accounting]

Summary

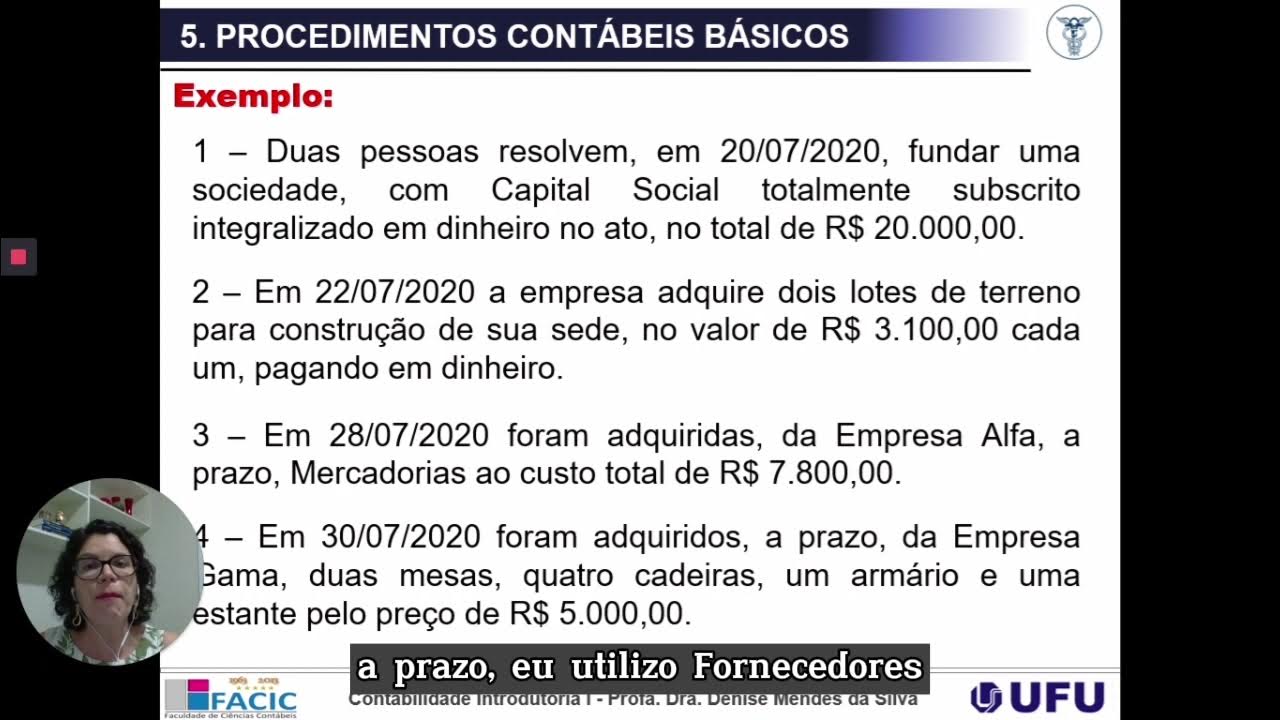

TLDRIn this online accounting lecture, the instructor introduces fundamental concepts of accounting, focusing on the definitions and effects of debits and credits. Key definitions are clarified: debits increase assets and expenses while decreasing liabilities and equity, whereas credits do the opposite. The lecture emphasizes the importance of memorization in understanding these terms, illustrating the foundational principles of accounting. Through a classroom approach, the instructor aims to make complex topics accessible, encouraging students to grasp the essential elements of accounting effectively.

Takeaways

- 😀 Accounting discussions can be effectively conducted in an online classroom setting.

- 📈 A debit increases asset accounts in accounting.

- 📉 A debit decreases liability accounts.

- 💰 A debit increases expense accounts, indicating higher costs.

- 📊 A debit decreases income accounts, reflecting lower revenue.

- 📃 A credit decreases asset accounts, impacting financial position.

- 📈 A credit increases liability accounts, suggesting more obligations.

- 💸 A credit decreases expense accounts, indicating lower costs.

- 📊 A credit increases income accounts, reflecting higher revenue.

- 📝 Memorization of the relationships between debits and credits is essential for accounting students.

Q & A

What is the primary focus of the lecture?

-The lecture primarily focuses on explaining accounting concepts, particularly the definitions and implications of debits and credits.

How is 'debit' defined in the context of accounting?

-'Debit' is defined as an increase in assets or expenses and a decrease in liabilities or equity.

What does a 'credit' represent in accounting?

-'Credit' represents an increase in liabilities or equity and a decrease in assets or expenses.

What are the implications of a debit on income?

-A debit decreases income, while a credit increases income.

What role do expenses play in the definitions provided?

-Expenses are increased with a debit and decreased with a credit, emphasizing the relationship between expenses and accounting entries.

Why is memorization important in understanding these concepts?

-Memorization is important because the definitions and functions of debits and credits are foundational to grasping accounting principles.

What is indicated by the phrase 'decrease in liability'?

-A 'decrease in liability' means that the company has reduced its obligations, which is recorded as a debit.

What does the lecturer suggest about understanding debits and credits?

-The lecturer suggests that understanding debits and credits requires memorization, as there are specific rules that govern their use.

What is the significance of 'drawings' in relation to liabilities?

-'Drawings' are treated as a reduction of equity, which affects the overall financial position of the entity.

How does the lecturer support the understanding of these terms?

-The lecturer uses a classroom approach to engage students, aiming to clarify the relationships between different accounting terms.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahora5.0 / 5 (0 votes)