Dana Darurat, Sepenting Itu Kah? | #TanyaBibit Eps. 6

Summary

TLDRIn this engaging discussion, Dita Amelia and Iryanto delve into the significance of emergency funds, comparing them with retirement savings and other financial instruments. They emphasize that emergency funds act as a safety net for unforeseen expenses, advocating for a balanced approach to saving and investing. The conversation highlights the importance of maintaining liquidity, choosing appropriate investment vehicles, and prioritizing financial goals. Listeners are encouraged to build financial literacy and explore smart investment strategies while ensuring they have adequate funds for emergencies. Overall, this episode aims to empower viewers to manage their finances effectively.

Takeaways

- 😀 Emergency funds are crucial as a financial safety net, akin to having substitutes in a football game.

- 😀 Emergency funds should ideally be kept in savings or money market accounts for easy access.

- 😀 There is a distinction between emergency funds and retirement funds, with each serving different financial purposes.

- 😀 Investing in low-risk options like money market mutual funds can provide better returns than traditional savings accounts.

- 😀 It's advisable to have a balanced approach, splitting funds between emergency savings and investments.

- 😀 Prioritizing emergency funds over retirement savings can be wise when immediate financial security is at stake.

- 😀 The amount set aside for an emergency fund should ideally cover three to six months of living expenses.

- 😀 Regular contributions to emergency savings are important, even while accumulating retirement funds.

- 😀 Individuals should assess their risk tolerance and financial goals when deciding where to keep their emergency funds.

- 😀 Financial literacy and proactive planning can help individuals navigate unexpected expenses and financial emergencies.

Q & A

What is an emergency fund and why is it important?

-An emergency fund is a financial safety net that helps cover unexpected expenses, such as medical emergencies or urgent repairs. It's important because it provides security and peace of mind, allowing individuals to handle financial surprises without going into debt.

How does the speaker compare an emergency fund to sports?

-The speaker likens an emergency fund to having reserve players in a sports team. Just as a coach prepares substitutes for unexpected injuries, having an emergency fund prepares you for unforeseen financial challenges.

What is the difference between savings funds and retirement funds?

-Savings funds, or emergency funds, are meant for immediate financial needs, while retirement funds are designed for long-term savings to support you after you stop working.

Is it wise to place an emergency fund in mutual funds?

-While you can invest an emergency fund in mutual funds, it is generally recommended to keep most of it in liquid accounts, like savings or money market accounts, for quick access during emergencies.

What type of mutual fund is suitable for an emergency fund?

-A money market mutual fund is typically recommended for emergency savings because it offers lower risk and high liquidity, making it easier to access your funds when needed.

How should one prioritize saving for an emergency fund versus a retirement fund?

-It's advisable to save for both simultaneously, but prioritize building your emergency fund first. This ensures you have a financial cushion for immediate needs before focusing on long-term retirement savings.

What should you consider when deciding how much money to set aside for an emergency fund?

-Consider your monthly expenses and aim to save enough to cover at least three to six months of living costs, depending on your personal financial situation and job stability.

What are the potential risks of investing an emergency fund in fluctuating assets like stocks?

-Investing an emergency fund in stocks carries the risk of losing value when you need to access it quickly, especially during market downturns. It's safer to keep this fund in stable, easily accessible accounts.

How can someone stay committed to investing while building an emergency fund?

-To maintain commitment to investing while building an emergency fund, allocate a specific amount to both savings and investments each month. This helps balance immediate financial security with long-term growth.

What is the minimum recommended amount to have in an emergency fund during uncertain financial times?

-During uncertain financial times, it’s recommended to aim for at least six months' worth of expenses in your emergency fund to ensure you can cover essential costs if your income is disrupted.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

The 4 Savings Accounts Everyone Needs | The Financial Diet

BAHAYA!! Jangan Taruh Dana Pensiun dalam Bentuk Non-Likuid Semua

Simak! Trik Makan Tabungan Tapi Anti Miskin

7 Tabungan Penting Yang Harus Dimiliki Agar Sukses dan Kaya

Retirement planning: How to avoid saving too much

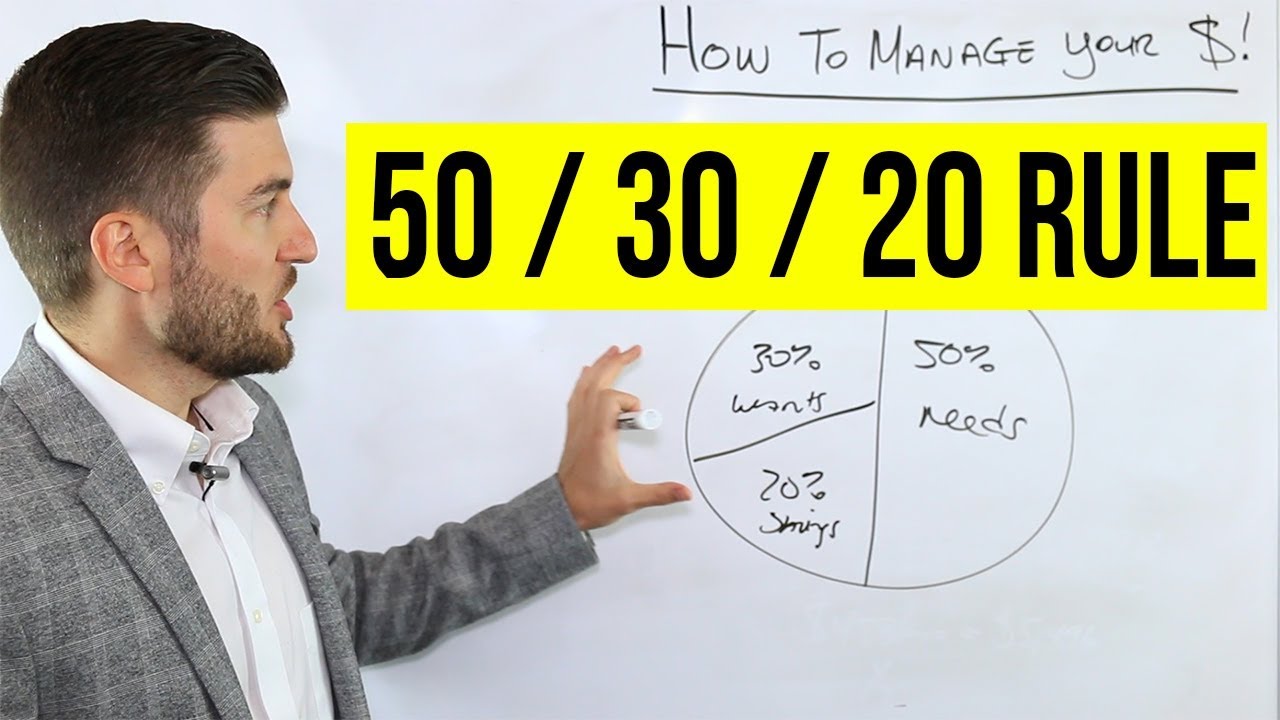

How To Manage Your Money (50/30/20 Rule)

5.0 / 5 (0 votes)