Home Loan in Nepal | Adhikari Real Estate | Cheap Loan | Ghar Jagga Kathmandu | real estate nepal

Summary

TLDRThis video explains how to apply for a housing loan from the Social Security Fund, which offers a competitive interest rate of 9.10% for amounts up to 7 lakhs. It covers various purposes for loans, including building a new home, making repairs, or purchasing apartments. Viewers are guided on the necessary documentation for the application process and the repayment terms, which can extend up to 20 years. The video also highlights the availability of educational loans and loans for social work, encouraging potential borrowers to check eligibility and apply either online or at local offices.

Takeaways

- 🏡 Social Security Fund offers home loans at an interest rate of 9.10%, which is lower compared to banks and financial institutions.

- 📋 Individuals can apply for loans up to 700,000 NPR for various purposes including home construction, renovation, and purchasing property.

- 📝 Applications for loans can be submitted online for specific types, while others must be submitted in person at designated offices.

- 📆 Borrowers must repay the loan within a maximum of 20 years, with specific conditions for early repayment.

- 🔍 The loan amount is determined based on property valuation, ensuring it does not exceed the assessed value.

- 📑 Required documents include identity proof, land ownership documents, and income verification, among others.

- 💰 Contributions to the fund are mandatory, and any lapses in contributions can affect loan eligibility.

- 👥 Different types of loans are available for educational purposes, social work, and housing construction.

- ⏳ A grace period of one year is allowed for repayment, depending on the terms of the loan.

- 👍 Viewers are encouraged to watch the video multiple times for better understanding and to like, share, and subscribe for more information.

Q & A

What is the interest rate for home loans provided by the social security fund?

-The social security fund offers home loans at an interest rate of 9.10%.

How much can one borrow from the social security fund for home loans?

-Individuals can borrow up to 7 lakh rupees from the social security fund for home loans.

What types of purposes can the home loans be used for?

-Home loans can be used for constructing new homes, renovating existing properties, and purchasing apartments or homes.

What is the maximum repayment period for these home loans?

-The maximum repayment period for the home loans is 20 years.

What documentation is required when applying for a home loan?

-Applicants must provide various documents, including citizenship proof, land ownership certificates, and income verification.

Is there a requirement for a property valuation when applying for a home loan?

-Yes, property valuation is necessary, and the loan amount cannot exceed the assessed value of the property.

How can one apply for a home loan from the social security fund?

-Applications can be submitted online for special loans or in-person at the fund's central or branch offices for other loans.

What happens if an applicant fails to make regular contributions to the fund?

-If contributions are not maintained, the fund may not provide the home loan to the individual.

Are there any fees associated with loan processing?

-Yes, there are valuation and loan processing fees, which vary based on whether the property is inside or outside the valley.

Can individuals apply for loans if the property title is in someone else's name?

-Yes, but they need to provide additional documents proving their relationship with the property owner.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Menghitung Rumus Fungsi NPER & PMT dalam Microsoft Excel

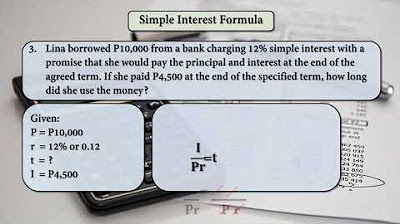

Simple interest (Mathematics)

BEKLENEN KONUT KREDİSİ KAMPANYASI DETAYLARI ve FİYATLAR ARTAR MI?

【FP3級試験対策講座】✧Day4✧ライフプランにおける資金計画

Mathematics of Investment - Simple Interest - Simple Interest Formula (Topic 1)

GCSE Maths - How to Calculate Simple Interest

5.0 / 5 (0 votes)