Top 3 Options Trading Strategies for Small Accounts

Summary

TLDRThis video dispels the myth that small account traders can't successfully engage in options trading. It presents three effective strategies for accounts as small as $1,000: the Iron Condor, which generates income by selling and protecting against options; the Debit Spread, which limits upfront costs while maintaining a bullish position; and LEAP options, which offer long-term exposure to stock movements with minimal capital. Each strategy is illustrated with practical examples, showcasing how options trading can yield substantial returns while minimizing risk, making it accessible and beneficial for traders with limited funds.

Takeaways

- 😀 Many traders believe they can't trade options due to limited capital, but it's possible with small accounts starting as low as $1,000.

- 📈 Options trading strategies are capital-efficient, making it feasible for traders with small accounts to participate in the market.

- 💡 The first strategy introduced is the Iron Condor, which allows traders to generate income by selling calls and puts while buying protective options.

- 💰 In the Iron Condor example with SPY, the trader can realize a profit of $300 with only a $700 margin requirement.

- 📅 The second strategy discussed is the Debit Spread, which involves buying a call option and selling another call at a higher strike price to reduce costs.

- 🚀 In the Microsoft example, a debit spread allows the trader to invest less than $1,000 and achieve significant returns if the stock rallies.

- 🗓️ The third strategy is using LEAP options, which are long-term options expiring at least a year in the future, enabling traders to leverage their capital.

- 📊 The H&R Block example illustrates how buying a deep in-the-money call option can lead to substantial profits with limited risk.

- 🔄 Options can provide better returns than directly buying stocks, with less capital needed, appealing especially to small account holders.

- 🔑 Overall, options trading strategies empower traders to take advantage of large stock movements with reduced risk and capital outlay.

Q & A

What is the main purpose of the video?

-The video aims to educate traders with small accounts on how they can effectively trade options with as little as a thousand dollars in their trading accounts.

What is an Iron Condor strategy?

-An Iron Condor is an options trading strategy that involves selling calls and puts at different strike prices while simultaneously buying further out-of-the-money calls and puts for protection. This strategy is capital-efficient and can be executed even with a small account.

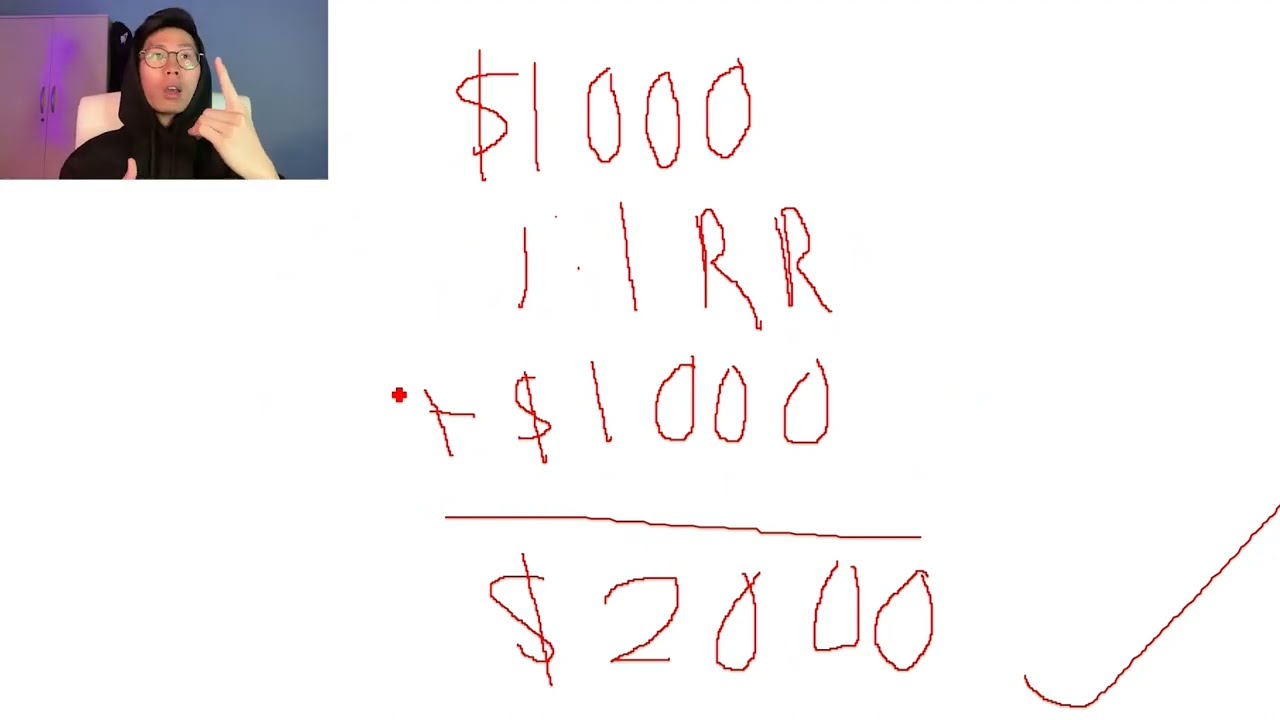

How does an Iron Condor work with a $1,000 account?

-For example, a trader could sell 10 calls and puts while buying protective options, resulting in an overall positive cash flow. If the options expire worthless, the trader retains the premium, potentially increasing their account by 30% in a single day.

What is a debit spread?

-A debit spread involves buying a call option and simultaneously selling another call option at a higher strike price, reducing the overall cost of the trade. This strategy allows traders to participate in stock movements without needing significant capital.

Can you give an example of a debit spread using Microsoft?

-If a trader believes Microsoft will rise, they could buy a 295 call and sell a 320 call. This would cost about $956 instead of the full price of $27,420 to buy 100 shares, allowing them to profit if the stock increases.

What are leap options?

-Leap options are long-term options that expire at least 12 months in the future. They allow traders to speculate on stock movements over a longer time frame with less capital compared to buying shares outright.

How did the example with H&R Block demonstrate the use of leap options?

-The video explains that instead of buying 100 shares of H&R Block for $2,158, a trader could buy a deep in-the-money call option for $690, allowing for significant profit potential with less capital risk.

What advantages do options offer to traders with small accounts?

-Options allow traders to capitalize on significant stock movements while requiring less capital and risk compared to outright stock purchases, making trading accessible for those with limited funds.

Why are options considered capital-efficient?

-Options strategies, like the Iron Condor and debit spreads, enable traders to manage risk and generate profits without needing large amounts of capital, which is particularly beneficial for small account traders.

What key takeaway should viewers have after watching the video?

-Traders with small accounts can effectively trade options to participate in significant market movements with less risk and lower capital requirements, making options trading a viable strategy for growing small accounts.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

MON PROCESSUS DE PRISE DE TRADE FOREX DE A à Z

How to Grow SMALL Forex Account with little money (No Bullsh*t Guide)

ThinkorSwim vs Robinhood 13 Things You Need to Know

Small Account Options Income Strategy (Easy)

Forex: What Are The Best Pairs To Trade With A SMALL Account?

Robinhood Trader Commits Suicide: What Actually Happened

5.0 / 5 (0 votes)