The Keys To Weekly Bias | $NQ Trade Breakdown

Summary

TLDRIn this educational trading video, the presenter demystifies the concept of weekly buys by detailing their process for generating a weekly outlook and creating a trade idea. They use the NASDAQ, S&P 500, and Dow Jones weekly charts to identify bullish and bearish fair value gaps, suggesting a market inclination towards lower prices. The video guides viewers on refining this bias with daily charts, highlighting significant market divergences and protected highs. The climax is a precise trade execution strategy using a 1-hour chart, aiming for a 1 to 2 risk-to-reward ratio, which resulted in over a 100-point return. The presenter also shares this strategy with their Discord community, offering a link for interested viewers.

Takeaways

- 📈 **Weekly Outlook Creation**: The speaker outlines their process for creating a weekly outlook and trade idea based on market analysis.

- 🔍 **Market Analysis**: They start with a blank chart analysis of NASDAQ, S&P 500, and Dow Jones on a weekly scale, looking for annotations and patterns.

- 📉 **Violation of Bullish Fair Value Gap**: A key observation is the violation of a weekly bullish fair value gap on NASDAQ, indicating a potential bearish trend.

- 🔄 **Correlated Asset Behavior**: The speaker discusses how the behavior of correlated assets can signal market direction, especially when they trade through internal range liquidity pools.

- 📊 **Daily Chart Refinement**: The process continues with daily charts to refine the weekly bias and identify potential entry points for trades.

- 🚫 **SMT Divergence**: 'SMT' (Small Minuette) divergence is used as a signal for potential reversals, with the speaker identifying it at key price points.

- ⏰ **Time Frame Alignment**: The speaker emphasizes aligning timeframes from daily to hourly to identify key levels for trading decisions.

- 📌 **Internal Range Liquidity Pool Tag**: Identification of internal range liquidity pools and divergence at these tags is crucial for trade setup.

- 🔔 **Trade Execution**: The speaker details how to set up a sell limit order based on the opening price of an hourly up-close candle, aiming for a 1:2 risk-to-reward ratio.

- 💡 **Discord Community**: The speaker shares their trade ideas and narrative building process with a Discord community, inviting viewers to join for more insights.

- 📚 **Educational Content**: The video serves as an educational resource, teaching viewers how to frame a weekly narrative and execute trades based on market analysis.

Q & A

What is the main focus of the video?

-The main focus of the video is to explain the process of generating a weekly outlook and creating a trade idea based on market analysis, specifically for a short trade on the NASDAQ.

What is a 'weekly buys' concept mentioned in the video?

-The 'weekly buys' concept refers to the process of analyzing weekly charts to determine potential buying opportunities or, in this case, short selling opportunities in the market.

What did the speaker generate from their weekly outlook?

-The speaker generated a narrative and a trade idea for a short position on the NASDAQ that resulted in over a 100-point return.

What is the significance of the 'weekly bullish fair value gap' mentioned in the video?

-A 'weekly bullish fair value gap' is a technical analysis term that indicates a price level where the market is expected to find support and potentially reverse to the upside. However, in this context, the violation of such a gap suggests a bearish sentiment.

Why did the speaker anticipate lower prices despite the S&P 500 and Dow Jones being in a bullish fair value gap?

-The speaker anticipated lower prices because the NASDAQ, a correlated asset, traded through an internal range liquidity pool, suggesting that the market might be signaling lower prices.

What is meant by 'smt' in the context of the video?

-In the video, 'smt' stands for 'significant market testing', which refers to the repeated testing of a price level that could indicate a potential reversal or continuation of a trend.

How does the speaker refine the weekly bias to a daily bias?

-The speaker refines the weekly bias to a daily bias by analyzing daily charts to identify potential entry points and using the inverse fair value gap as a short interest for a sell position.

What is the '1 hour chart' used for in the speaker's analysis?

-The '1 hour chart' is used to identify key levels and short-term high/low points for setting up trades, specifically to set a sell limit based on the opening price of an up-close candle.

What is the 'forever model' referred to in the video?

-The 'forever model' is a trading strategy that involves identifying a tag of an internal range liquidity pool, significant market testing at that tag, and then waiting for price to create a change and save delivery off of that higher time frame key level tag.

What is the speaker's approach to trading at the start of a new week?

-The speaker's approach to trading at the start of a new week is to build a narrative based on the weekly candle formation, identify potential price points for trades, and then frame execution based on daily charts and market order flow.

How does the speaker use the term 'protected High' in their analysis?

-The term 'protected High' is used when a high point in the market has significant market testing, indicating that it is less likely to be breached and could act as a resistance level for future price movements.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

Trading the Weekly Range: Full Breakdown

THIS Weekly Profile Will Change The Way You See Price, Forever

Using Weekly Profiles for Daily Bias (Simplified)

Weekly Forecast - January 4th, 2026

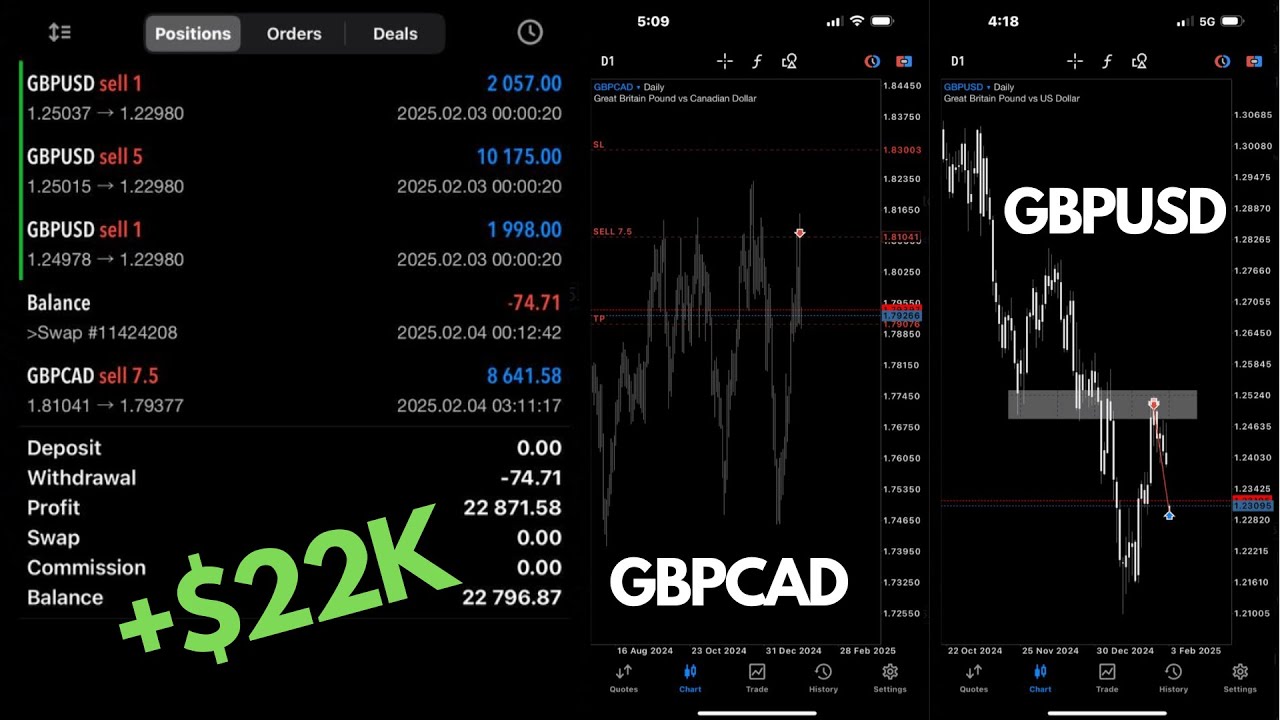

+$22,000 This Week Trading Forex (My Simple Analysis)

ICT 4 Phases of Price Delivery, Find Daily Bias with Phases of Price Delivery,

5.0 / 5 (0 votes)